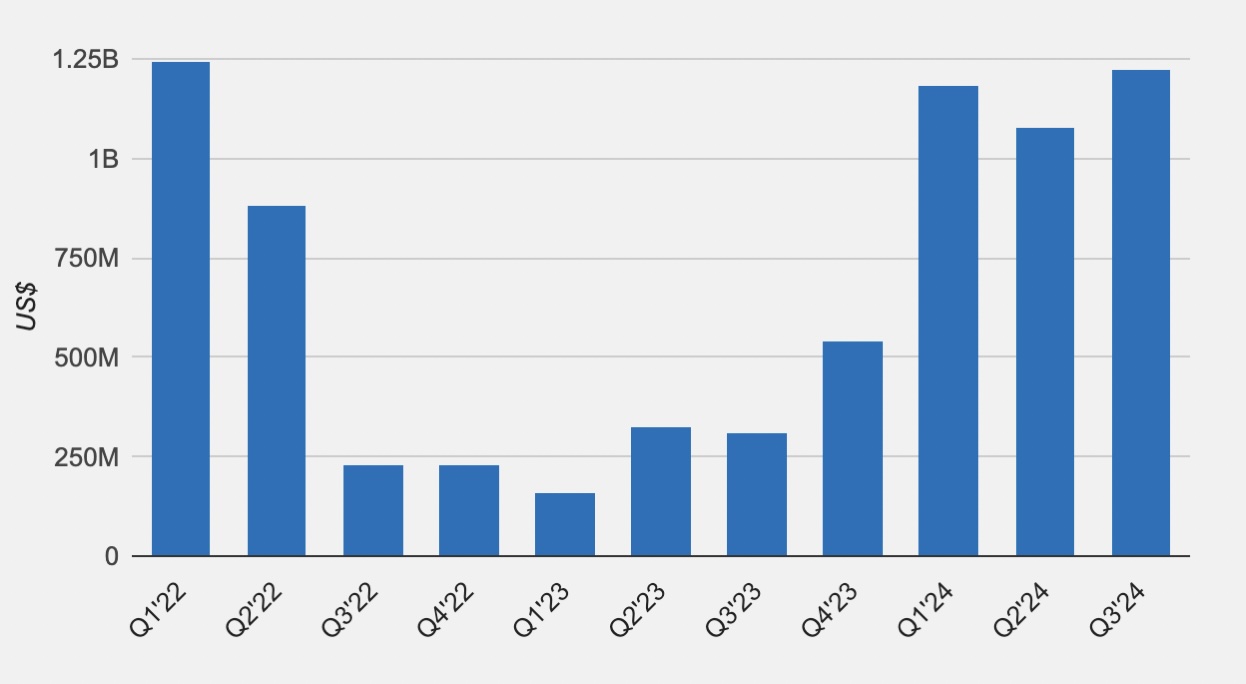

The year 2024 marked a record level of investment for publicly traded Bitcoin  $97,278 mining companies in terms of facilities and equipment. According to TheMinerMag, these companies spent a total of $3.6 billion since the beginning of the year. The third quarter revealed the highest expenditure figures since the first quarter of 2022, with hardware upgrades accounting for a significant portion of total spending.

$97,278 mining companies in terms of facilities and equipment. According to TheMinerMag, these companies spent a total of $3.6 billion since the beginning of the year. The third quarter revealed the highest expenditure figures since the first quarter of 2022, with hardware upgrades accounting for a significant portion of total spending.

Mining Companies Shift Toward Debt Financing

Bitcoin mining firms have changed their financing strategies, emphasizing debt. As of 2024, 16 companies have raised over $5 billion in total funds. Mara issued zero-interest convertible bonds to purchase 6,474 BTC, thereby strengthening its corporate treasury.

Bitfarms plans to host 10,000 new mining devices at its Pennsylvania facility through an agreement with Stronghold. CleanSpark announced that it will establish a new mining infrastructure of 400 megawatts after acquiring GRIID. Hive Digital purchased 6,500 ASIC devices for use at its new facility in Paraguay.

Customs Crisis Between Bitmain and the U.S.

Meanwhile, ASIC manufacturer Bitmain is at the center of a customs crisis with the U.S. Authorities have begun investigating allegations that Bitmain uses chips from Huawei, which is under sanctions. Despite Bitmain and Xiamen Sophgo denying these allegations, Antminer mining devices sent by Bitmain have been detained at customs, with a fee of $200,000 imposed. This situation has raised concerns about supply chain disruptions and potential future shortages, as geopolitical tensions between the U.S. and China continue to create uncertainty in the Bitcoin and cryptocurrency mining sector.