Following Bitcoin’s (BTC) rise above the $100,000 mark, the cryptocurrency market has become more dynamic. Although this gain may not be sustained, prominent analyst Michael van de Poppe suggests that this is merely the beginning. He predicts a significant rotation within the altcoin market, resembling the cryptocurrency cycle of 2017. Poppe emphasizes that new players entering the market should closely monitor this process.

Bitcoin Moves, Altcoins Await

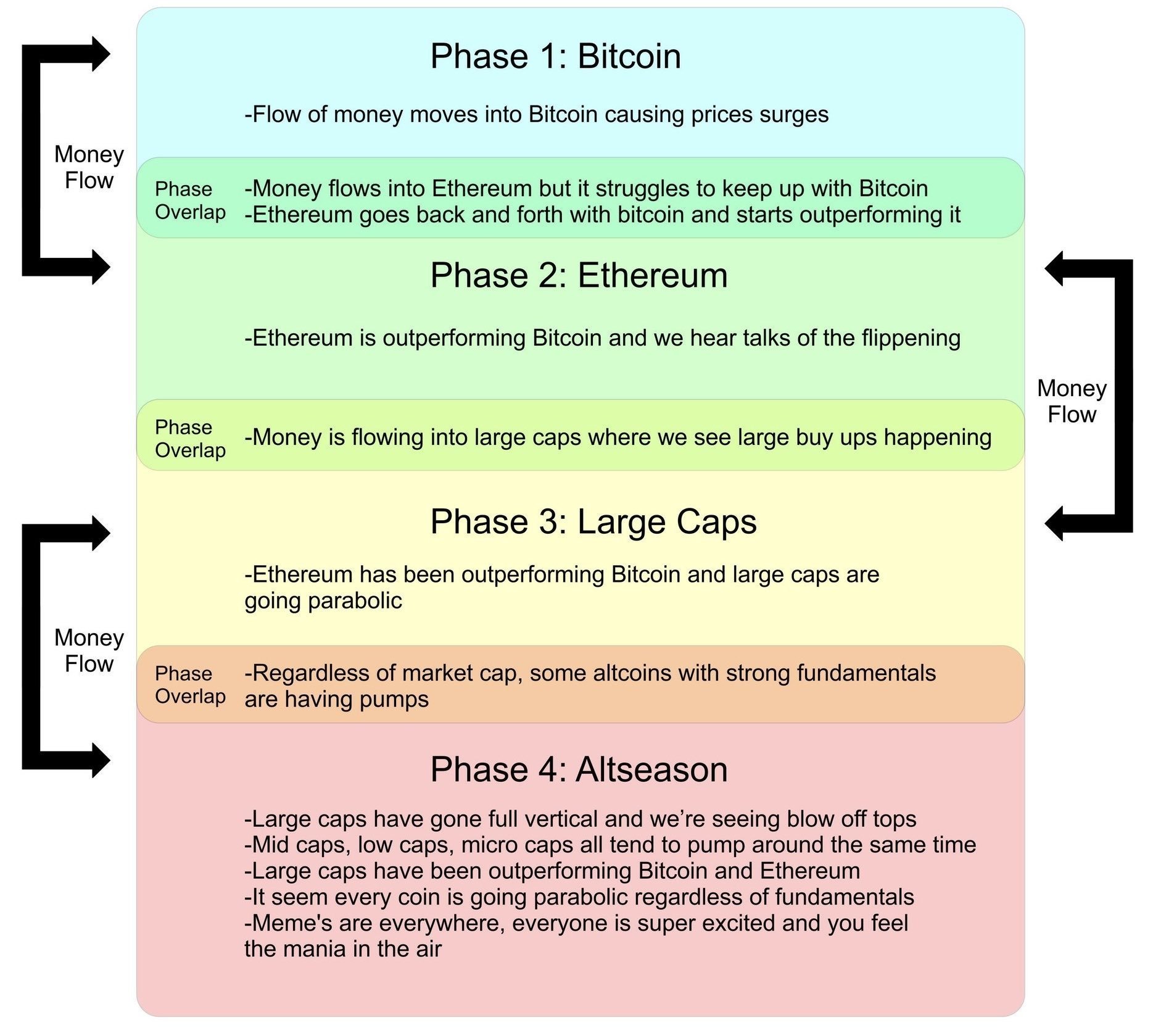

According to Poppe, the concept of a “rotation game” applies across all markets. This game starts with a primary asset’s price increase, which then triggers movement in the rest of the ecosystem.

The cryptocurrency market begins with Bitcoin’s rise, followed by expectations for Ethereum (ETH)  $2,517 to take action. Subsequently, a cycle forms where profits from Bitcoin

$2,517 to take action. Subsequently, a cycle forms where profits from Bitcoin  $107,056 shift to Ethereum and altcoins.

$107,056 shift to Ethereum and altcoins.

Poppe argues that the current market conditions present substantial opportunities for altcoins, stating, “Look at the values of altcoins against BTC. Altcoin prices in USD may be misleading as Bitcoin’s rise influences these prices.” He believes that altcoins’ current levels against Bitcoin are quite low, signaling an impending upward movement. Many altcoins have the potential to rise by 300 to 400 percent within the year.

Ethereum Ecosystem Takes the Spotlight

Poppe believes that Ethereum could surpass Bitcoin in performance. He summarized his strategy as using “ETH as a foundational asset.” The analyst highlighted his focus on large-cap altcoins and small projects within the Ethereum ecosystem. He anticipates that in the coming months, Ethereum will outperform Bitcoin.

Following Ethereum’s ascent, large-cap altcoins are expected to take action. Subsequently, smaller projects will come into play, providing high returns. Poppe also noted that profits from smaller projects will likely be redirected back to more stable assets like Ethereum and Bitcoin.

Türkçe

Türkçe Español

Español