Last month, the importance of November’s inflation data increased significantly following the release of October’s figures. The November inflation data has now been announced. The Federal Reserve’s two primary responsibilities are maintaining price stability and preserving employment. Today’s data could substantially affect the Fed’s interest rate reduction cycle. What does this mean for cryptocurrencies?

U.S. Inflation Data

As the offshore yuan dropped by 0.5%, the dollar index rose by 0.3%, reaching its highest level in two weeks. The potential resurgence of trade tensions with China under Trump’s administration signals turbulence for both the global economy and the U.S. inflation outlook.

Market Reactions

In recent statements, Bank of Japan officials expressed no objections to a potential interest rate hike in December, although the next meeting is also anticipated. Amidst this complex environment, some Fed members have hinted at a possible pause in interest rate cuts. While an increase in October’s inflation could have been tolerated, another above-normal figure in November would negatively impact the December 18th rate decision, prompting the markets to focus intently on the data.

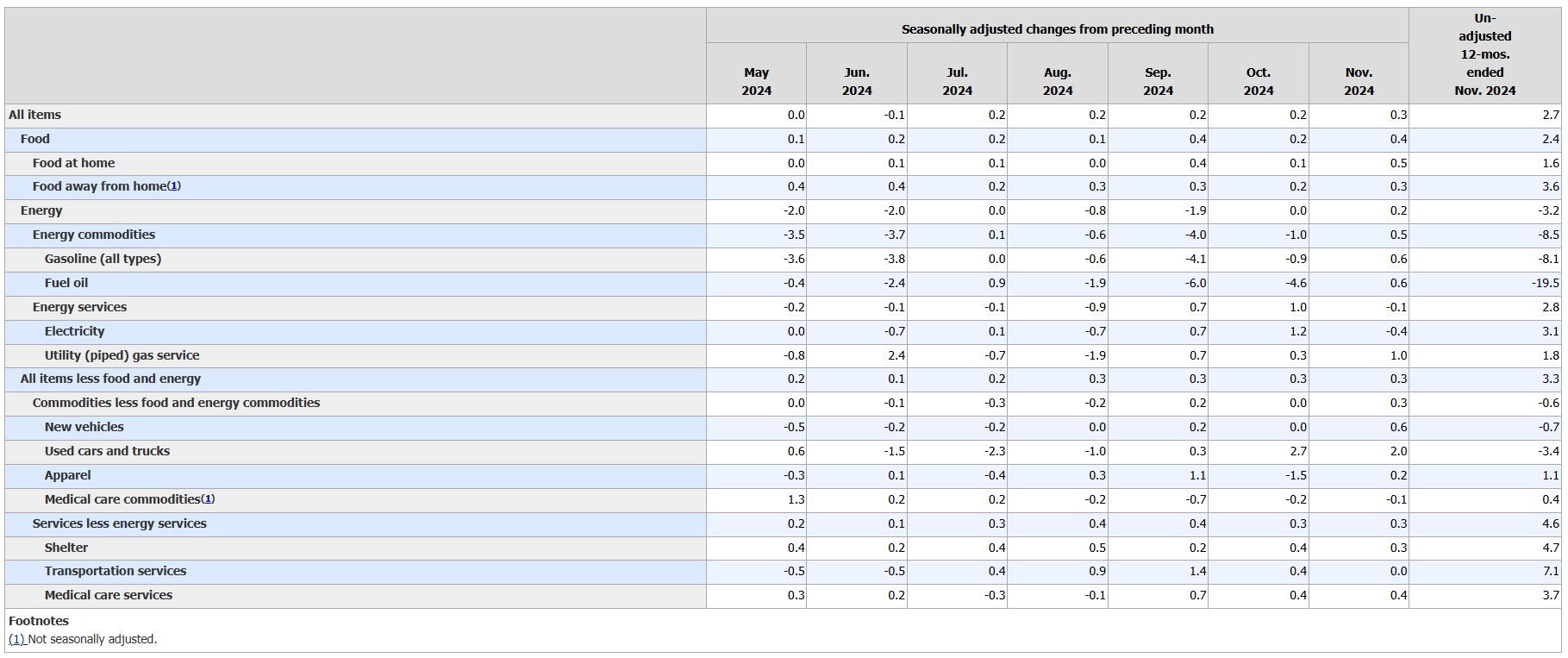

The U.S. inflation data has finally been released. The expectation for inflation was 2.7%, while the core inflation expectation was set at 3.3%. The announced figures are as follows:

- U.S. Inflation Announced: 2.7% (Expectation: 2.7% Previous: 2.6%)

- Core Inflation Announced: 3.3% (Expectation and Previous: 3.3%)

Following the announcement of data in line with expectations, Bitcoin  $94,544‘s price surged to $98,700. The likelihood of the Fed making a 25 basis point cut at the December 18 meeting has increased to 86%. Favorable data for cryptocurrencies could further support positive openings in the stock markets.

$94,544‘s price surged to $98,700. The likelihood of the Fed making a 25 basis point cut at the December 18 meeting has increased to 86%. Favorable data for cryptocurrencies could further support positive openings in the stock markets.

Türkçe

Türkçe Español

Español