Recent uncertainties in tariff policies have dissipated, leading to a more realistic perspective for cryptocurrency enthusiasts. The next 24 hours are pivotal as countries may retaliate against tariffs, prompting the U.S. to respond with further actions. The release of the European Central Bank (ECB) meeting minutes has shed light on the current economic climate.

Insights from the ECB Meeting Minutes

The ECB meeting minutes hold significant relevance in understanding how tariffs were addressed during the central bank’s discussions. The European Union is reportedly preparing an emergency action plan regarding tariffs, with insider leaks suggesting that a response is imminent. Currently, Bitcoin  $85,150 is priced at $83,000, and the lack of testing the $81,000 support level appears to be a positive signal, indicating a stabilization of excessive fear in the market.

$85,150 is priced at $83,000, and the lack of testing the $81,000 support level appears to be a positive signal, indicating a stabilization of excessive fear in the market.

Key details from the ECB minutes include:

- The rising trade tensions and general uncertainties pose significant risks to economic growth.

- These factors could increase the risk of remaining below the inflation target in the medium term.

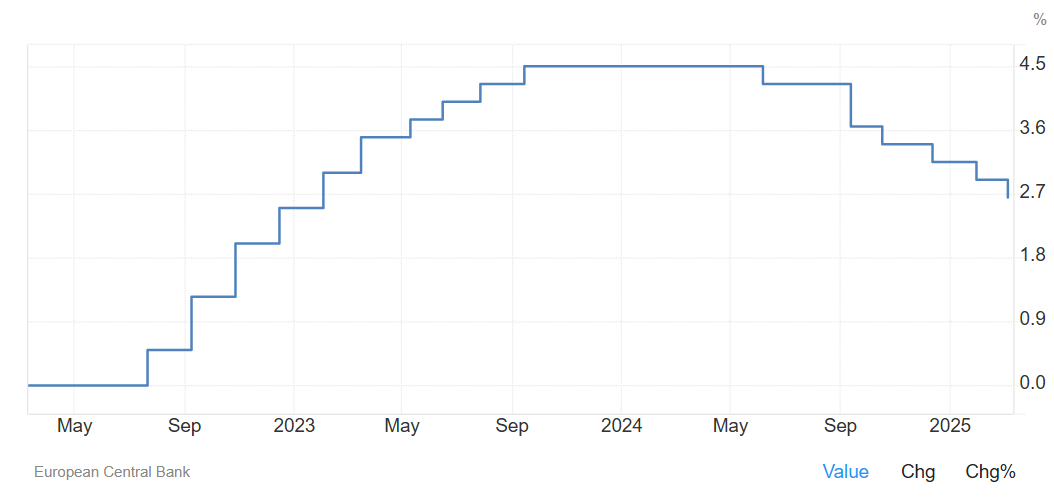

- Being cautious in the face of uncertainty does not imply gradual adjustments in interest rates.

- Uncertainty necessitates caution in policy determination and communication.

- Inflation uncertainty can manifest in both directions.

- A significant expansion of fiscal policy connected to defense could derail the disinflation process.

- The combination of U.S. tariffs and retaliatory measures may create upward inflation risks.

- It is no longer possible to ensure that monetary policy remains restrictive.

- The clarity regarding whether the policy is still restrictive is now uncertain.

While indicating that interest rate cuts may slow down, the ECB also addresses the negative impacts of retaliation on the economy. These insights are relatively positive as they help balance the risk of a major trade war.

Türkçe

Türkçe Español

Español