Cryptocurrency investors awoke to a tumultuous day, marked by Federal Reserve Chairman Jerome Powell’s desperate pleas. In the midst of this financial intrigue stands Donald Trump, a president known for his unorthodox methods and for disrupting the authority of federal institutions. The independence of the Federal Reserve is crucial for economic policy credibility. However, since assuming office, Trump has made repeated efforts to assert control over this institution.

White House Fed Statements

Powell faced the press, alleging that President Trump was attempting to seize the institution through intimidation. Last year, amid Fed renovations, Trump accused Powell of corruption and hinted at possible legal action against him. This fueled the Department of Justice to initiate proceedings, with Powell recently confessing, “I might go to jail for not reducing rates; I am being threatened.”

At the time of writing, Kevin Hasset, a Senior Advisor at the White House, issued comments on the situation. He noted significant cost overruns in the Fed building renovations, denying any involvement with the Department of Justice regarding the Fed lawsuit. Hasset also remarked that these financial discrepancies do not align with their documented justifications and insisted that interest rates have no connection with these unfolding events. Moreover, Hasset expressed his belief that President Trump’s Department of Justice is not privy to Fed lawsuit discussions.

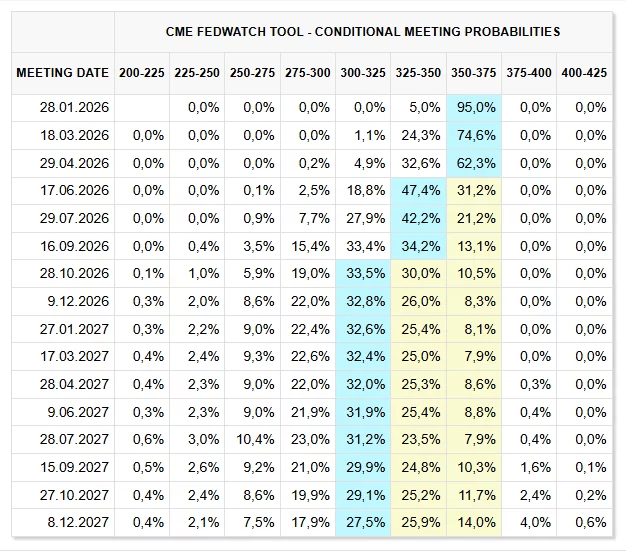

Current interest rate expectations suggest a 50-basis-point cut in 2026, but the unfolding drama adds a layer of uncertainty. The financial world continues to watch attentively as the interaction between the White House and the Federal Reserve unfolds. It remains to be seen how these tensions will influence economic policy and institutional autonomy. As it stands, Trump’s approach challenges longstanding traditions, symbolizing a broader question of authority within U.S. federal institutions.

This article first appeared on COINTURK, highlighting the growing confrontation between the White House and the Fed, a significant moment for U.S. economic governance. The evolving dynamics could serve as a critical case study for federal independence and executive power in shaping financial policy. Investors and policymakers alike must navigate this uncertain landscape as new information comes to light.