Cryptocurrency investors are turning their attention to weak altcoins with a low chance of being classified as securities, following the recent lawsuit opened by the SEC. The appeal of PoW coins has increased as most of the mined cryptocurrencies fall into the commodity category. The rise of BCH and others should also be considered from this perspective. On the other hand, time is running out for Litecoin (LTC).

Litecoin Halving Date

If miners continue their operations with the current hash power, the Litecoin halving will take place on August 3, just 5 days and 14 hours from now. The LTC price is struggling to maintain the $90 support level. Historical price data from 2015 and 2019 shows that the Litecoin price usually drops as the halving event approaches. However, on-chain data is sending mixed signals.

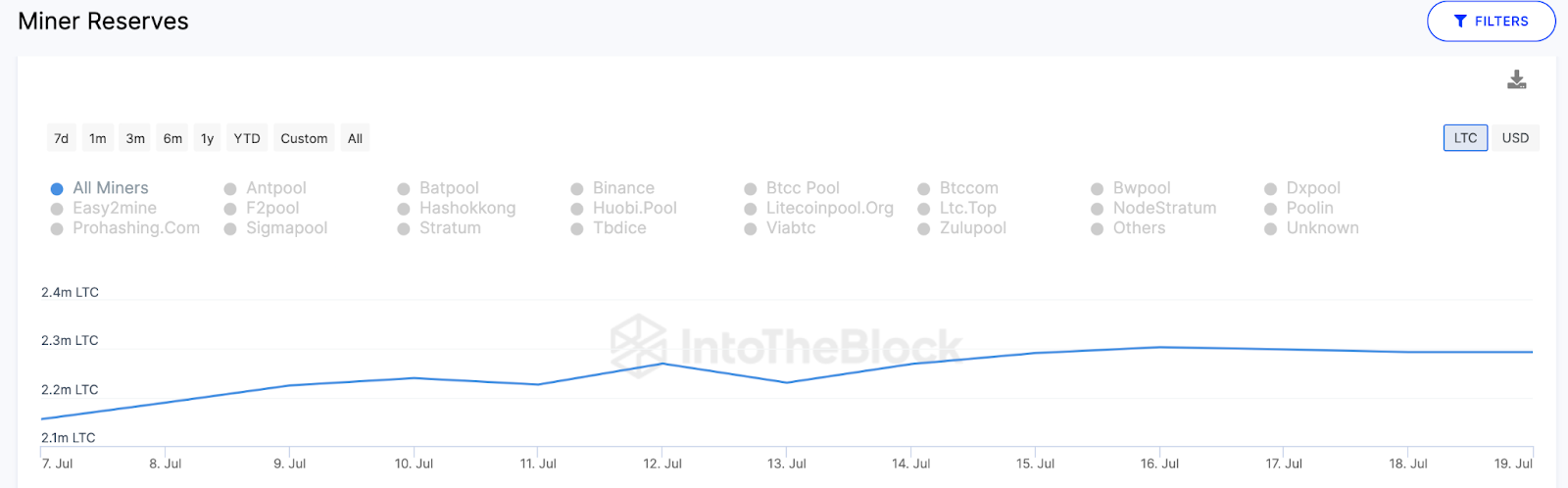

With the upcoming halving in early August, miners’ rewards per block will decrease from 12.5 LTC to 6.25 LTC. As a result, miners are accumulating more LTC. On-chain data compiled by IntoTheBlock shows that LTC miners accumulated 400,000 LTC between July 1 and July 28.

LTC Coin Analysis

Litecoin has witnessed a significant increase in user activity this week. The Santiment graph below demonstrates how the number of daily active addresses for Litecoin increased by approximately 37%, from around 221,000 to about 303,000 active users between July 20 and July 26.

Daily Active Addresses track real-time changes in network usage by summing the number of individual wallet addresses involved in transactions. Consistent increases in Daily Active Addresses, as observed this week, may indicate upcoming growth in transaction activity. Consequently, if LTC miners continue to stockpile their reserves and users start conducting higher volume transactions, Litecoin’s price may find the necessary support to avoid a halving collapse.

For now, the price is below the $90 support level and needs to convert it into a strong resistance. If LTC bulls fail to do so, the price could drop to $80. In a positive scenario, it is likely to visit the price targets of $95, $120, $170, and eventually $200. If this happens, the previous collapse story will be reversed.

For now, BTC continues its sideways movement within a narrow range, and an increase in volatility is expected after the release of next week’s data.

Türkçe

Türkçe Español

Español