CoinGecko, one of the leading independent crypto data aggregators, has added a new index that lists the best crypto assets in the securities category. The classification of tokens was created according to the opinion of the U.S. Securities and Exchange Commission (SEC).

CoinGecko Creates a New Category

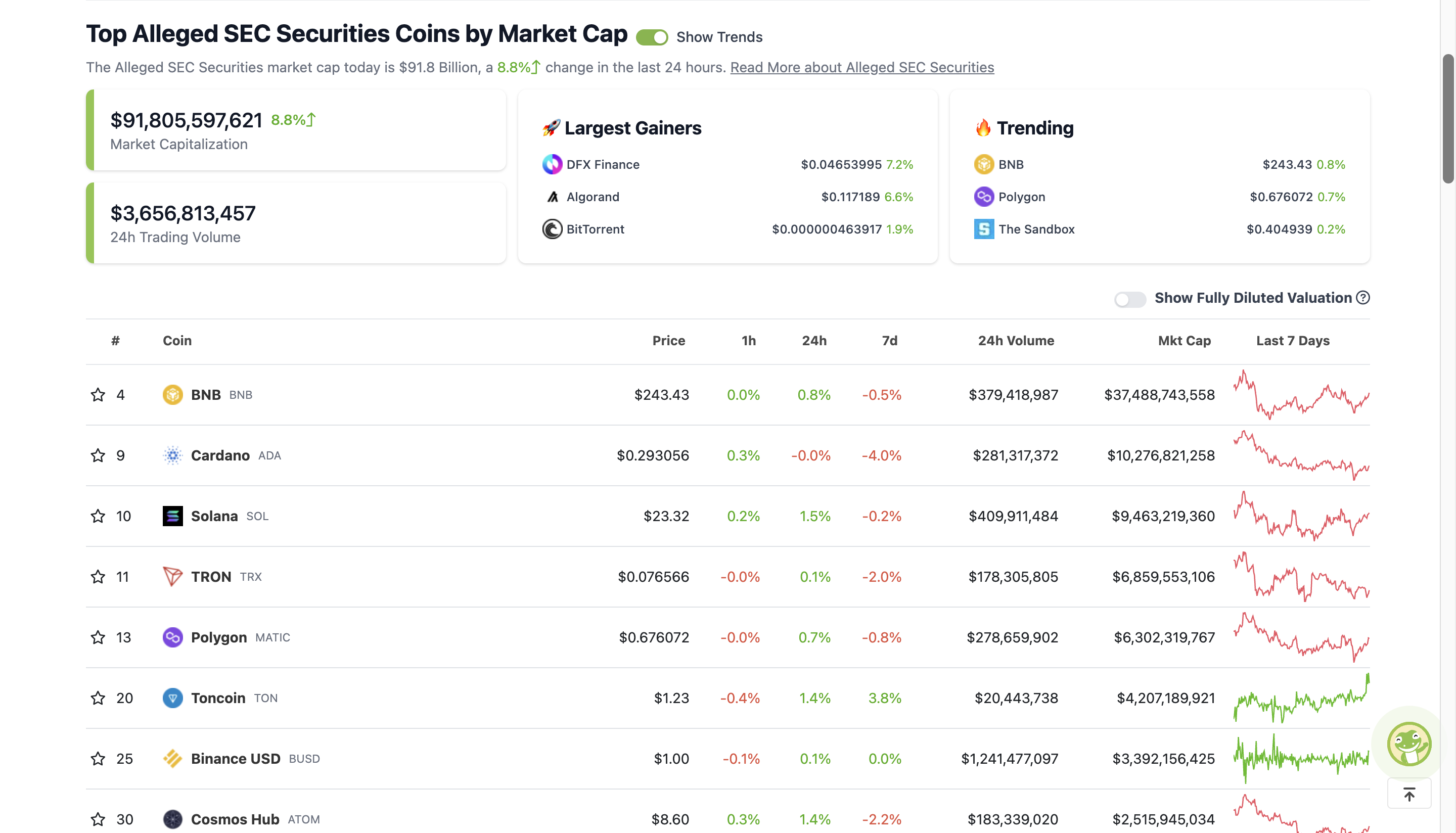

CoinGecko has introduced the “SEC Securities Crypto Assets” page in its listing, ranking crypto tokens according to their market values. BNB is at the top of the list, followed by Cardano (ADA), Solana (SOL), Tron (TRX), and others.

A spokesperson for CoinGecko announced that the new index was launched in the first week of August. The category was developed by selecting the leading crypto assets that SEC claimed to be securities in its recent lawsuits. According to CoinGecko’s new index, the crypto assets claimed to be securities have a cumulative market value of $90.76 billion. This accounts for approximately 7.5% of the total crypto market value, which is around $1.201 trillion.

The total trading volume of all tokens in the category is $2.86 billion in the last 24 hours. CoinGecko has also issued a disclaimer regarding the assets listed in the so-called SEC Securities Crypto Assets index.

“Labeling these cryptocurrencies as securities by the SEC does not constitute legal classification until proven in a court of law.”

SEC’s Pressure on Crypto

In June, the SEC filed different lawsuits against crypto exchanges Binance and Coinbase. In the documents related to the lawsuits, SEC listed several crypto assets classified as securities. The number of securities tokens listed by SEC has reached 68. However, CoinGecko’s SEC Securities Crypto Assets new index consists of only 24 crypto assets.

SEC Chairman Gary Gensler continues to pursue a stricter regulatory approach for the crypto market. He has gone as far as classifying most crypto assets as securities. According to Gensler, every crypto asset except Bitcoin is a security. This means that all assets fall under the agency’s regulatory jurisdiction.

Furthermore, if Gensler’s claim is true, approximately 25,500 crypto assets listed by CoinMarketCap need to be regulated by the SEC. The agency’s enforcement actions and allegations create regulatory uncertainty for most crypto firms and protocols.

Türkçe

Türkçe Español

Español