Amidst the deepening decline in the cryptocurrency market, altcoin Injective (INJ) managed to turn its course in its favor. Bitcoin (BTC), XRP (XRP), and Polygon (MATIC) among the major cryptocurrencies reached their monthly lows, but INJ challenged the overall market trend with its rise.

INJ Price Surges 10% in the Last 24 Hours

After hitting its monthly low of $6.75, INJ token found significant support and quickly swept away the downward momentum. As a result, INJ price reached its highest level in the last 24 hours, hitting $7.96 before encountering resistance. Currently, the price has risen to $7.81, a 7.08% increase from the previous day’s lowest level, indicating a strong upward trend in the INJ market.

With the breakthrough of the $7.96 resistance level, further upward movement can be expected, potentially testing the next resistance level of $8.50. If this level cannot be surpassed due to buyer pressure, a consolidation phase or a small correction may occur.

The market capitalization of INJ increased by 6.79% and the trading volume in the last 24 hours rose by 88.20%, reaching $650.48 million and $101.81 million, respectively. This significant increase reflects the growing investor interest and activity towards altcoins. The significant increase in trading volume indicates strong demand for INJ, which could contribute to further price increases.

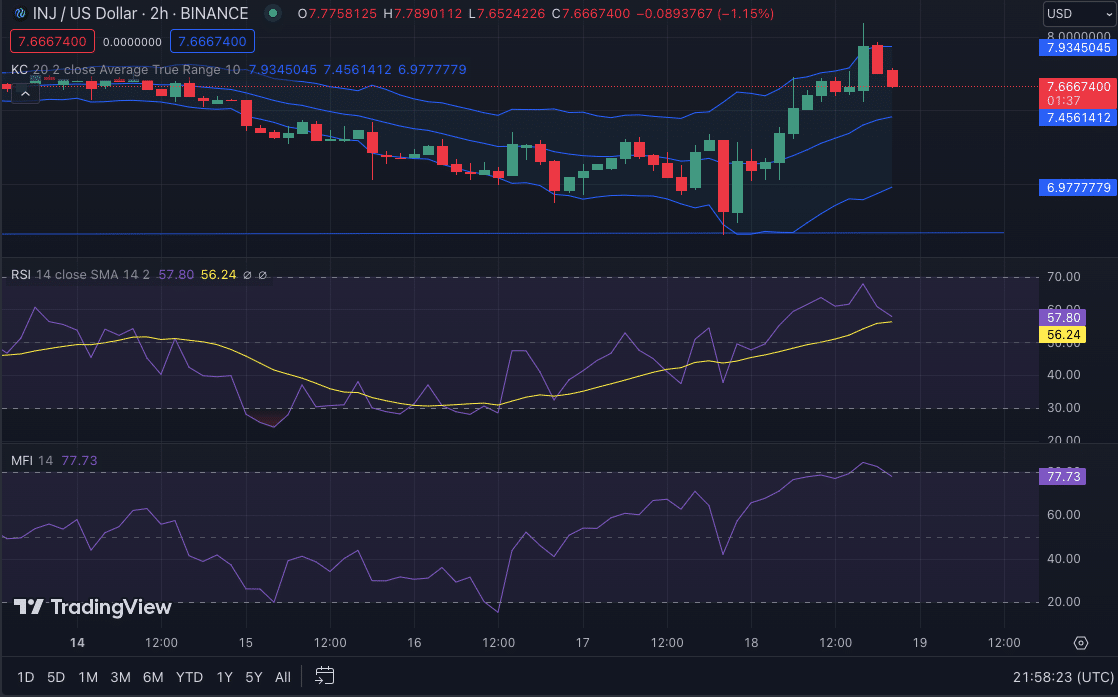

Potential Pullback in INJ Price

The Keltner Channel on the 2-hour price chart of INJ/USD is expanding, with the upper, middle, and lower bands touching $7.94, $7.46, and $6.98, respectively. This expansion indicates a period of increased volatility and potential price movement. However, the formation of red candlesticks after reaching the upper band indicates a possible short-term pullback or correction in the INJ price.

Furthermore, the Relative Strength Index (RSI) at 59.08, pointing downwards, contributes to a potential short-term pullback. The declining RSI suggests a weakening buying pressure and supports the possibility of a correction in the INJ price. If the decline in RSI continues and falls below the 50 level, it will confirm the possibility of a pullback in the short term.

Additionally, the Money Flow Index (MFI) at 77.86, showing signs of decline, provides further evidence of a potential pullback in the INJ price. MFI measures the inflow and outflow of money into an asset, and a decrease in MFI indicates that investors have started selling. If MFI continues to decline and falls below the 70 level, it will strengthen the possibility of a correction in the altcoin’s price.

Türkçe

Türkçe Español

Español