MATIC Coin has shown impressive performance in the cryptocurrency markets, especially in 2022. While the entire market was collapsing, MATIC Coin remained strong. This can be attributed to its solid marketing team and the deals it made. However, the year 2023 did not go as well. Despite the ZK move, the Polygon team failed to generate the same level of excitement this year. This caused the price to align with the overall market sentiment.

Polygon (MATIC)

Polygon (MATIC) price dropped below $0.55, its lowest level since July 2022, as investors shift their attention to newer Layer 2 networks. The number of Ethereum scaling solutions is increasing day by day. On the other hand, alternatives like BASE are proving that old L2 solutions like Polygon are not the only option. Even the Shiba Coin community has its own L2 solution with Shibarium.

The L2 solutions resemble the token frenzy we witnessed in previous years. Teams that copy or improve open-source blockchains are now releasing their own L2 solutions, just like how tokens were issued before. This raises the possibility that layer 2 network tokens, which experienced parabolic growth in 2021, may not experience the expected growth in the upcoming potential bull season. This could negatively affect not only L2 solutions like Polygon, but also L1 networks like Avalanche and Solana.

MATIC Coin Price Prediction

Setting aside the long-term pessimistic outlook, there is still hope for MATIC Coin in the multi-chain future. So, what is the short-term outlook? The continuous decline in Polygon’s Network Growth seems to be the main reason for the downward trend in MATIC’s price in the second half of this year. For instance, on August 20, Polygon only recorded 527 new addresses, followed by 556 new addresses on August 22. It was noteworthy when Polygon registered fewer addresses than 530 in February 2021. The number of newly created wallet addresses on a daily basis sheds light on how many new users are adopting the network.

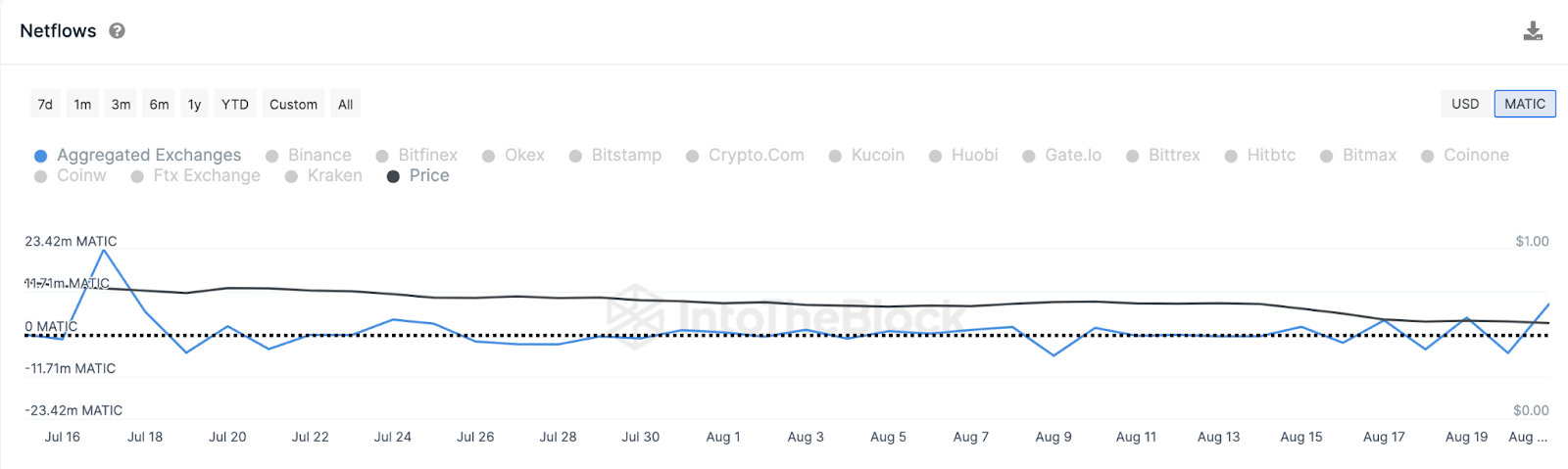

As another confirmation of the bearish outlook, MATIC investors seem to be preparing for more selling actions in the coming days. As shown below, on August 21, deposits to exchanges exceeded withdrawals for MATIC with a volume of 8.41 million tokens.

This is a significant development as the last time MATIC recorded a higher Net Exchange Flow than 8.4 million was on July 17, when it reached 23.42 million. It particularly triggered a 15% price pullback for MATIC by the end of the month. The signals here make a potential downward scenario evident, with a possible test of $0.5.

Türkçe

Türkçe Español

Español