In the rapidly evolving world of technology and finance, a select group of companies have emerged as true giants. They have rewritten the rules of their industries and amassed unprecedented wealth for investors.

Tesla, Apple, and Microsoft Shine

The remarkable rise of technology giants like Tesla (NASDAQ: TSLA), Apple (NASDAQ: AAPL), and Microsoft (NASDAQ: MSFT) can be seen as evidence of the power of innovative and game-changing products. These industry leaders have reshaped our lives with electric vehicles (EVs) and sleek smartphones, making their stocks beloved in many portfolios.

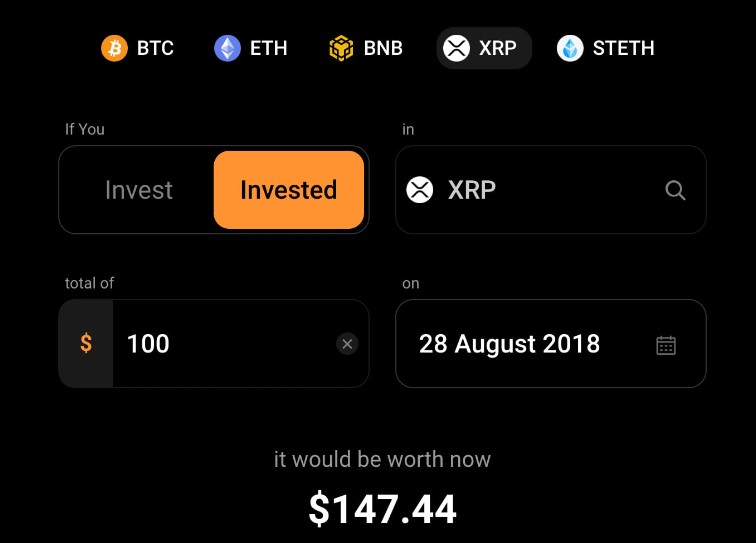

In the following analysis, the return on investment (ROI) ratios between a $100 investment in Apple and Tesla versus the same amount invested in the world’s leading cryptocurrencies, XRP, are calculated.

XRP 5-Year ROI vs Apple and Tesla

Simply put, an investment of just $100 in Tesla, which became the world’s largest electric vehicle manufacturer in August 2018, would be worth approximately $1,108 today. This means that TSLA’s annualized return rate over the past 5 years has exceeded 61%, with total profits surpassing $1,000.

Similarly, those who invested $100 in Apple’s shares in August 2018 saw their investment grow to over $345 over the past 5 years, with an annual return rate of 28% and a total profit of approximately $245.

Finally, according to CoinStats, crypto investors who invested the same amount in XRP 5 years ago would have a modest return of approximately $147 by August 2023, starting from $100 in August 2018.

Based on this analysis, it is apparent that investors who chose to invest in AAPL and TSLA stocks have had more solid ROI rates over the past 5 years compared to those who chose XRP. However, it is important to acknowledge that these rates are specific to this period and longer time frames may yield different results in terms of ROI.

Meanwhile, XRP was trading at $0.52 with a 1.34% decrease during the day. The cryptocurrency has experienced a decline of 0.88% over the past week and approximately 27% throughout the month. The impact of ongoing legal issues and uncertainties on the price continues to be debated among investors.

Türkçe

Türkçe Español

Español