Crypto experts have their favorite altcoins, and the main reason behind their special affection is often their investments in these coins. However, this particular cryptocurrency, which caught the attention of world-renowned analyst Poppe, is truly different from the others. It has monopolized its field and is collaborating with globally famous brands.

The Future of Chainlink (LINK)

Chainlink is a venture that has completely monopolized the field of blockchain-based oracle solutions. Almost all DeFi protocols you can think of rely on it for price feeds. Chainlink has been providing professional data feed services for years and is also working with global business partners such as Swift.

If we believe that blockchain-based payment infrastructures will have a presence in our future, Chainlink may find its place in this future. This is the main reason why Poppe consistently markets the LINK Token. The latest news on the LINK Token has been positive, but we see that it hasn’t immediately reflected on the price. For example, the CCIP (Cross-Chain Interoperability Protocol) took a significant step to unlock the interoperability of token assets. Moreover, it received great interest from the Depository Trust and Clearing Corporation (DTCC), a global securities settlement platform.

Taking even bigger concrete steps in the tokenized asset market, Chainlink, which also collaborates with giants like Swift, will make its future even brighter.

LINK Token Review

As fantastic as Chainlink is, the LINK Token is equally functional. Until the stake pool was opened at the end of last year, the LINK Token had little use. The team will make some important updates and expand the pool to further enhance the role of the token within the dynamics of the system by the end of 2023.

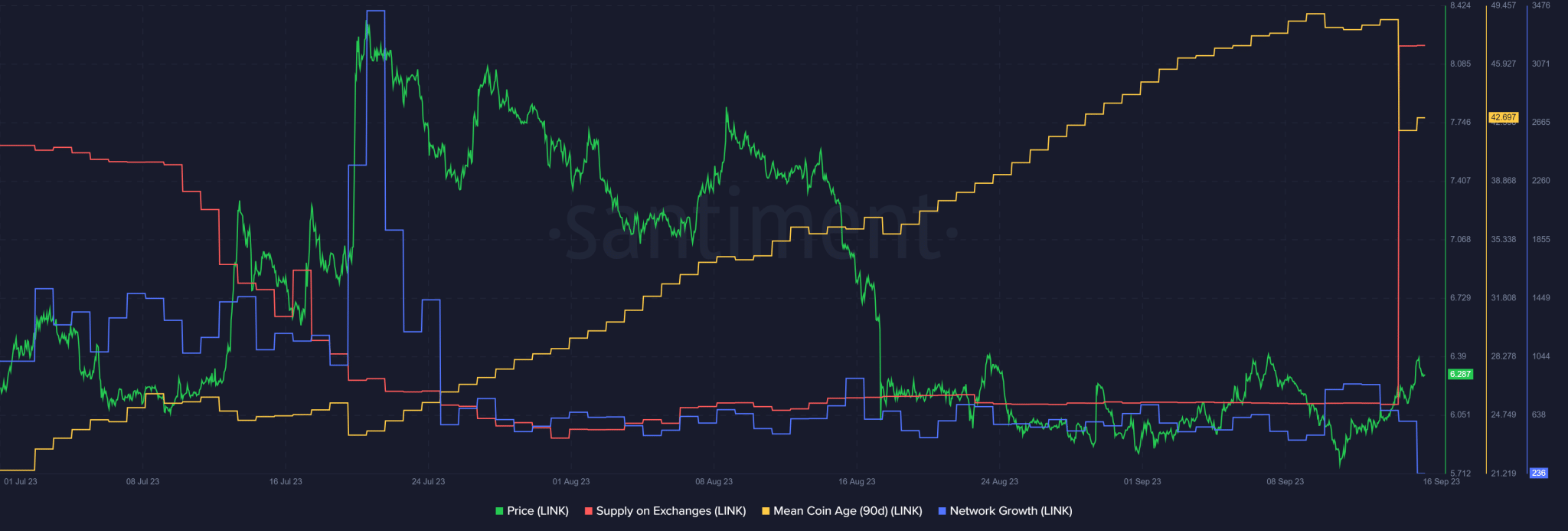

On-chain, the 90-day Average Coin Age has been showing the continued accumulation of LINK tokens since the end of August. The opening of a $100 million lock this week resulted in short-term selling pressure (and a sharp drop in Average Coin Age) and increased net inflows into exchanges.

On the 4-hour chart, $6.2 may serve as a support level, but the $6.094 and $5.76 regions are risky in the event of a possible decline.

For a real comeback, LINK Token investors need daily closings above $6.48. If the bulls can achieve this, the price may experience a $1 increase.

Türkçe

Türkçe Español

Español