While the boring trend in cryptocurrencies continues, altcoins continue to lose value. BTC is still at the $26,500 threshold. Whales generally turn to altcoins that they see as promising in this foggy environment. Recent data suggests that a popular cryptocurrency has seen an influx of $83 million. This data could be a significant signal for the future price.

Ripple Whale Movements

Ripple (XRP) price has risen above $0.52 after the Fed meeting. On-chain data suggests that there could be further growth for the popular cryptocurrency. After three weeks of stagnation, the price that exceeded $0.52 on Thursday could sustain the upward momentum. This is especially true when we consider that BTC has stubbornly defended the critical support level of $26,520.

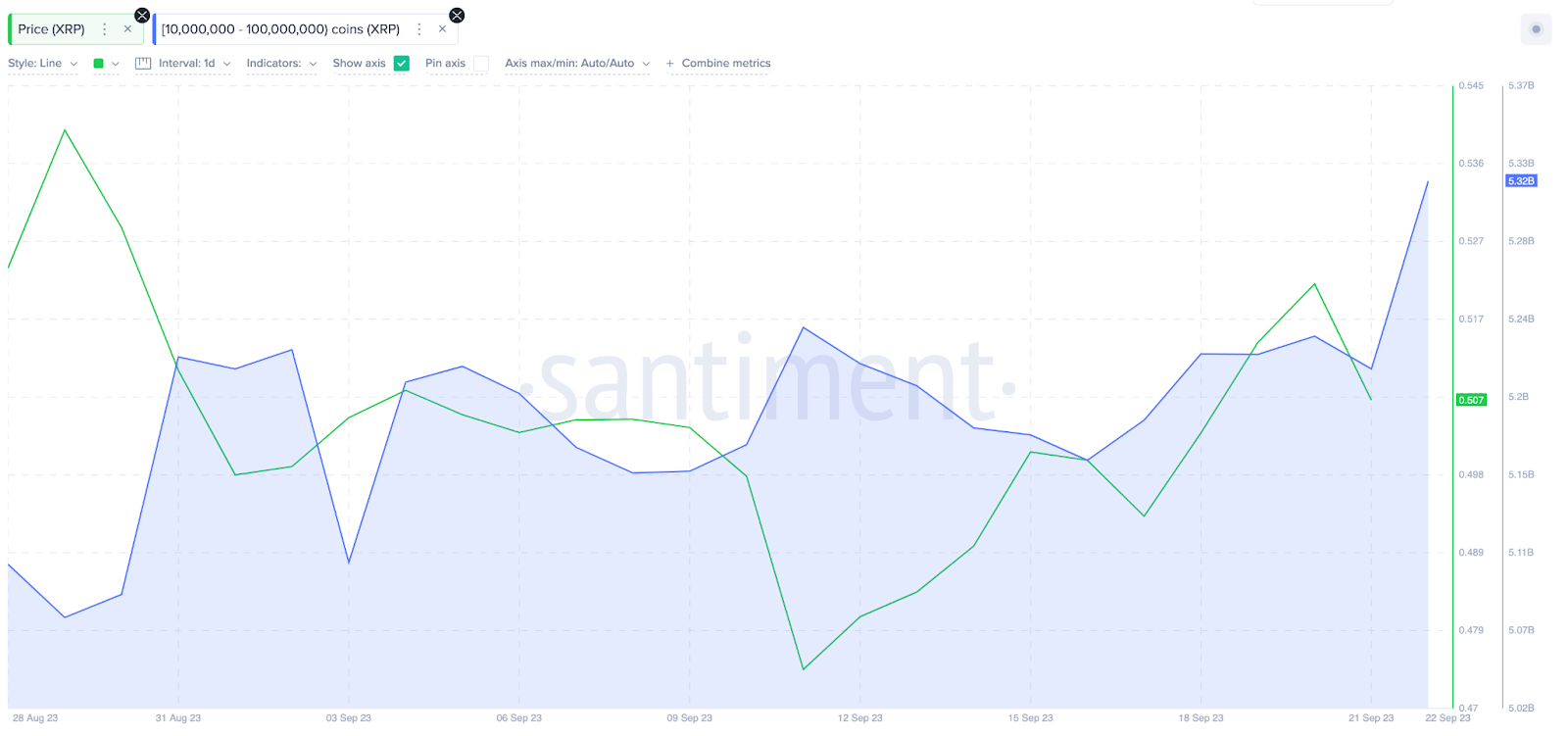

Whales are the main supporters of the increase in the XRP Coin price. On-chain data shows that the cluster of millionaire crypto whales holding between 10 million and 100 million XRP has taken risks in the volatile market. The chart below shows that whale investors added an additional 160 million XRP to their cumulative wallet balances between September 16 and September 22.

At the time of writing, the accumulated value of this accumulation is approximately $83 million at the $0.52 level.

XRP Coin Price Predictions

Whale investors hold their assets for much longer periods compared to individuals. If the recent entries are in line with the general consensus, we can say that the ready-to-sell supply on exchanges has further decreased. Whales are also more experienced than individual investors and can read the markets better. This makes their recent purchases more meaningful.

The NVT ratio sends signals in the opposite direction of whale sentiment. This metric, which suggests that the price of XRP Coin may be overvalued, supports the possibility of the price dropping to $0.5. The NVT ratio evaluates the market value of the cryptocurrency against the fundamental transaction activity on the network. When this ratio constantly rises, it indicates that the network’s transaction activity cannot keep up with the price increase.

The MVRV ratio also suggests that markets can move downward with short-term profit-taking sales. Decreasing volumes as the weekend approaches often lead to high volatility. Especially if we remember waking up to large sales on Saturday mornings (GMT), we should be prepared for surprises.