Users can borrow cryptocurrency assets or lend their assets in exchange for interest payments through a multi-chain borrowing and lending DeFi protocol called Aave, which has initiated the integration of PayPal’s stablecoin PayPal USD (PYUSD). According to the ongoing governance vote, the Aave community is preparing to incorporate the stablecoin PYUSD issued by Paxos Trust Company, a move initiated by payment giant PayPal.

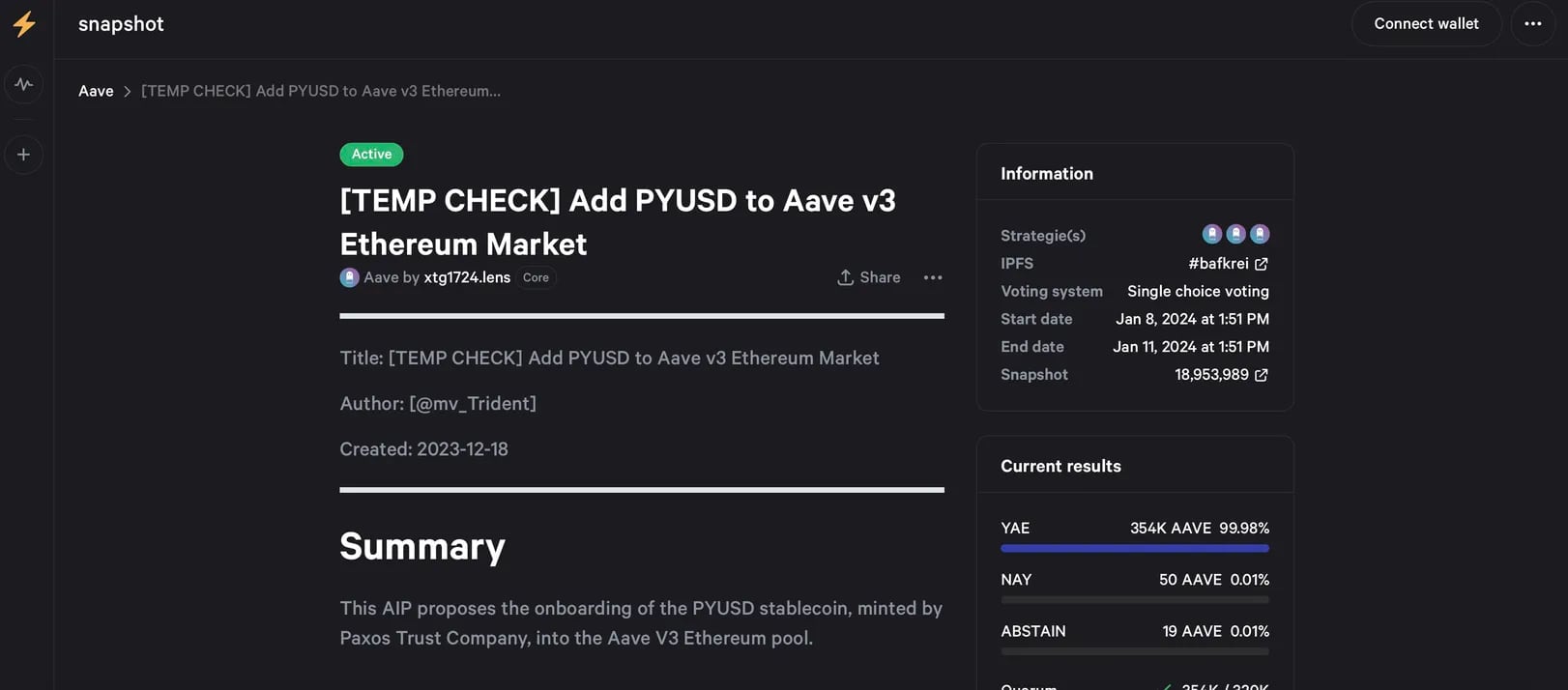

Proposal Receives 99.98% Support from Participants

In the ongoing governance vote, 99.98% of AAVE token-holding participants have supported the integration of PYUSD into the protocol’s Ethereum (ETH) based liquidity pool. The proposal, presented by Trident Digital on December 18th and referred to as a temperature check, will conclude today. This vote follows the decentralized exchange Curve’s decision to host PYUSD in December.

PYUSD, a stablecoin pegged to the value of the US dollar, was launched in August 2023. PYUSD currently has a market value of $289 million, which corresponds to 0.3% of the stablecoin sector leader Tether‘s (USDT) market value of $94 billion.

Aave is a DeFi protocol that allows users to lend and borrow directly without an intermediary. According to data from DappRadar, Aave is the third-largest DeFi protocol with a total value locked (TVL) of assets at approximately $5 billion.

Creating Synergy with PayPal’s PYUSD

Trident’s proposal states that Aave’s integration of PYUSD will help create synergy with PayPal’s stablecoin and strengthen the relationship between PYUSD and Aave’s decentralized multi-collateral stablecoin GHO.

The company mentioned in its governance proposal that Trident, which has been promoting the PYUSD/USDC liquidity pool on Curve, will contribute between $5 million to $10 million in liquidity for PYUSD in Aave from day one.

Türkçe

Türkçe Español

Español