Bitcoin‘s (BTC) price has been moving within a narrow range for some time. Looking at the price chart, it is noticeable that the largest cryptocurrency has been predominantly trapped between $40,300 and $44,500 since its rise on December 4, 2023. On-chain data reveals that despite this consolidation, there is significant activity in whale-level Bitcoin wallet addresses.

Activity in Major Bitcoin Wallets Catches Santiment’s Attention

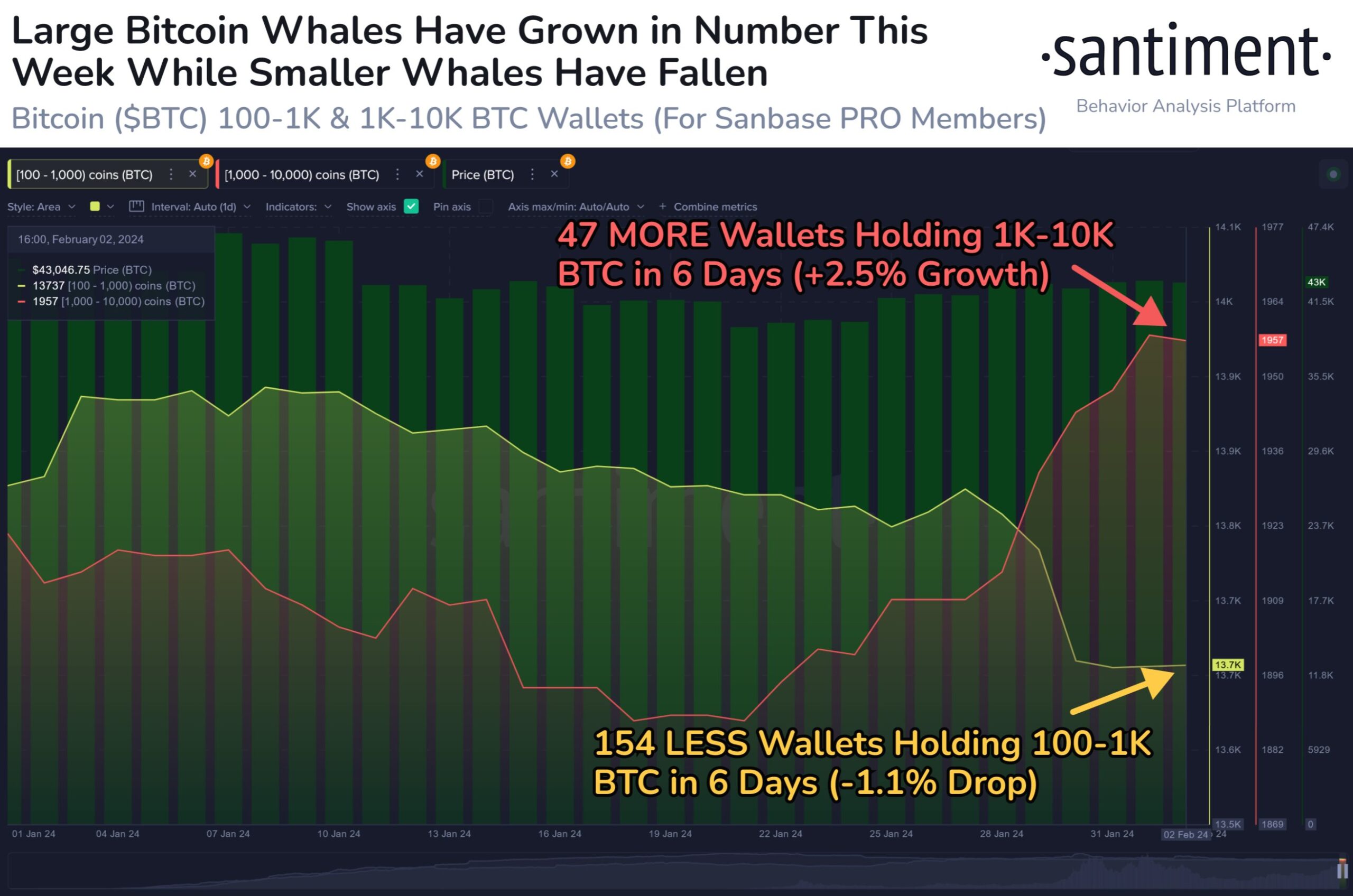

The on-chain data platform Santiment has shed light on the current state of whale-level Bitcoin wallet addresses. According to Santiment’s latest data, the number of wallet addresses holding between 100 and 1,000 BTC has decreased, while the number of addresses with 1,000 to 10,000 BTC has increased.

Accordingly, the number of wallet addresses containing between 100 and 1,000 BTC dropped to 13,735 on February 1st. The data indicates a 1.1% decrease in the number of these wallet addresses over the last six days. Santiment added that this group of wallet addresses is currently at its lowest level since November 2022.

On the other hand, the number of wallet addresses with 1,000 to 10,000 BTC rose to 1,958 on February 1st. The data shows a 2.5% increase in the number of these wallet addresses in the last six days. This group of wallet addresses is now at its highest level since November 2022.

This situation indicates a trend where smaller whale-level wallet addresses are selling Bitcoin, while larger whale-level wallet addresses are buying.

Bitcoin Whales and BTC Supply Distribution

The distribution of BTC supply among Bitcoin wallet addresses can span a wide spectrum. Since Bitcoin is not regulated by any central authority, users can have varying amounts of BTC in their wallets. However, generally, some large wallets or those belonging to exchanges hold larger amounts of Bitcoin, and this distribution can cause a significant disparity between large investors, often called “whales,” and small individual investors.

Bitcoin wallets are typically controlled by exchanges, individual users, corporate entities, or even some funds. Determining the distribution of Bitcoin supply among these wallets is challenging, as a person can have multiple wallets and exchanges may have consolidated wallets for multiple users. Nevertheless, companies like Santiment that perform on-chain data analysis can track data on the Bitcoin Blockchain to estimate the amounts of Bitcoin held by large wallets or exchanges. Such research provides insights into the overall distribution of Bitcoin supply and the influence of major players.

Türkçe

Türkçe Español

Español