CryptoQuant analyst Crypto Dan today published a chart showing a comprehensive analysis of Bitcoin‘s active addresses and price fluctuations over a specific period. The chart can be considered for capturing significant trends and patterns within the Bitcoin network’s activity and market value. Let’s take a look at what conclusions we can draw from the chart and Crypto Dan’s comments.

Bitcoin Addresses Peak and Trough

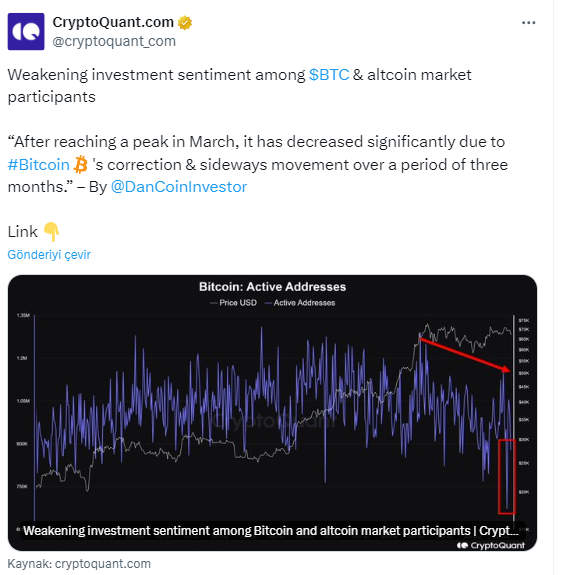

The chart starts from February 2023 and extends to June 2024. During this period, the number of active addresses frequently peaked and troughed, showing significant fluctuations. This fluctuation is actually a fundamental feature of the cryptocurrency market. It also reflects the dynamic nature of user participation and transaction activity in the Bitcoin network.

However, as the chart progresses towards 2024, there is a decline in active addresses. The number of active addresses significantly drops below 800,000, while the price sees a range between 35,000 and 40,000 dollars.

One of the standout observations from the chart is the sharp increase in active addresses towards the end of 2023, coinciding with a significant rise in Bitcoin’s price. The price, represented by the white line, shows a price tag of approximately 45,000 dollars during this period. This correlation indicated that higher Bitcoin prices tend to attract more users and transactions, increasing network activity.

Address Decline After March 2024

We are at a stage where the number of active addresses peaked in March 2024. It was a period when BTC broke a record with 73,777 dollars. Since March, as the Bitcoin price leveled off, we see a significant decline in active addresses. So much so that active addresses have dropped below the 750,000 band.

The decline in active addresses can be attributed to various factors, including market corrections, regulatory changes, or broader economic conditions affecting investor confidence and market sentiment.

Analyst’s Interpretation

Analyst Crypto Dan interprets the chart as a decrease in investor sentiment. According to him, there is a decline in investor sentiment because BTC could not exceed 72,000 dollars. Since active addresses in Bitcoin show how many wallets are actively transferring coins, it indicates that investors expecting an increase in BTC’s sideways and price range movement have gone into a waiting mode.

According to the analyst, if this sideways movement continues, investor sentiment could worsen further. Finally, the analyst states that altcoins will take shape according to the direction Bitcoin goes.

Türkçe

Türkçe Español

Español