Bitcoin price recently fell below $60,000 for the first time in a long while, struggling to hold this level. The market lost the $70,000 level last week, leading to a noticeable decline. Data and interest rate policies from the US are believed to have significantly impacted this.

Analyst’s BTC Comments

An analyst who made significant predictions about Bitcoin (BTC) in the past stated that the bull run for Bitcoin might be ending, and a period of significant declines could begin.

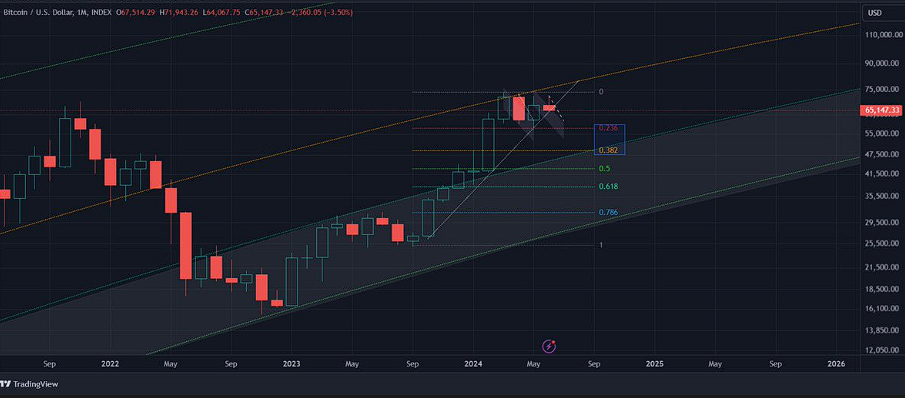

Dave the Wave, an analyst, made important statements to his thousands of followers on X. His statement suggested potential chaos for BTC. He indicated that BTC might experience a downward price movement soon, possibly retreating to the 0.38 Fibonacci level at $50,000.

With the break of the trend line, a weighted view should shift towards more consolidation of BTC price in the short term. A range formation [0.23 fib] or support in the buying zone [0.38 fib] is expected. This could set the stage for a better Q4.

The trader mentioned that he continues to monitor the monthly chart to obtain clearer results on the market’s reversal.

I still want to see a follow-up on a monthly basis to confirm the trend change… these things take time.

Since the publication of a chart by Dave the Wave, Bitcoin’s monthly decline has become more pronounced, and it continues to stay below the support level.

Analyst’s 2025 Bitcoin Prediction

Recently, the analyst made another significant prediction. Ignoring short-term price movements in the market, Dave the Wave used the logarithmic growth curve (LGC) chart, which aims to reveal the long-term cycle lows and highs for Bitcoin, to predict that a market peak for Bitcoin could occur by December 2025.

If you adopt BTC’s four-year cycle theory, this might not help you much with the peak. However, if you adopt the LGC theory, it might be useful once again.

According to the analyst’s examination, BTC price could exceed $300,000 by the end of 2025.

As of the time of writing, Bitcoin price continues to find buyers at $60,300 after a 5.9% drop in the last 24 hours.

Türkçe

Türkçe Español

Español