After Bitcoin’s price reached $65,000 on Monday and then declined, an analyst shared insights on when the price might rise again. Despite the downward trend, the Bitcoin price movement appeared neutral on the charts, and the analyst’s prediction of an upcoming surge excited investors.

Bitcoin Price Surge Expectation

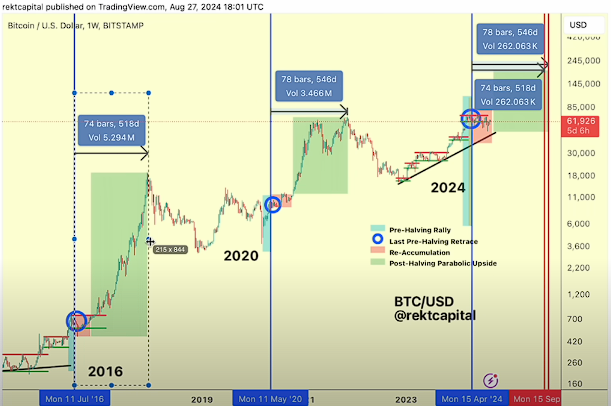

A well-known crypto analyst and investor suggested that Bitcoin (BTC) might rise sooner than expected. Rekt Capital stated that Bitcoin is in a reaccumulation phase and is “really close to entering the parabolic phase of the cycle.”

According to Rekt Capital, Bitcoin’s historical data indicates that it could surpass its ATH of approximately $73,800 sooner than expected, possibly within weeks.

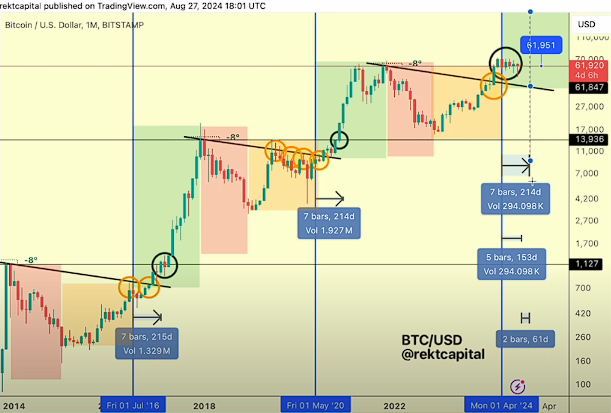

Typically, 214 days after the halving, we enter a new micro uptrend because… 214 days after the halving, we should already be heading towards new highs… technically, we have more than two months to reach all-time highs and enjoy this price discovery.

Rekt Capital suggests that considering historical data, the peak of the BTC price cycle tied to the bull market could occur around September 2025.

Considering how long it takes for Bitcoin to reach all-time highs and the ultimate bull market peak after the halving, it takes 546 days or 518 days… For example, in 2020 and 2021, it took 546 days to reach the bull market peak after the halving. And in the 2016-2017 cycle, it took 518 days after the halving. This shows that it takes 518-546 days for the bull market to reach its peak after the halving.

Bitcoin Price

At the time of writing, Bitcoin shows a completely neutral structure. BTC’s price is at $59,370 after a 0.01% drop in the last 24 hours. BTC’s market cap is at $1.172 trillion, while its trading volume dropped by 30% today, standing at $32.8 billion.

This situation in Bitcoin indicates that investor interest is declining despite positive news from the market. Investor interest might increase again in the coming days depending on the news flow.

Türkçe

Türkçe Español

Español