Following the announcement by CBOE, excitement around Ethereum peaked, but comments from an analyst raised significant questions. According to the analyst, if the current rate of supply increase continues after the excitement around spot Ethereum ETFs fades, the price may drop.

Ethereum Chart and Analyst Commentary

Cryptocurrency investor and founder of Into The Cryptoverse, Benjamin Cowen, made significant statements in a post on July 19:

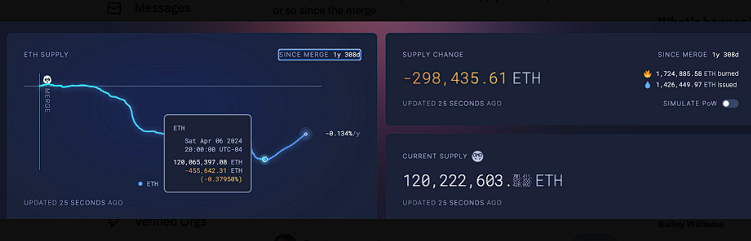

“If ETH supply continues to increase by ~60,000 per month as it has since April, it will return to its level during the merge by December.”

Referring to the past, the analyst warned of similarities to the transition to the proof-of-stake consensus model during the Merge event in September 2022.

After the Merge event, Ethereum became deflationary, with its supply expected to decrease to around 455,000 ETH by April 2024.

Since April, the supply has increased by approximately 150,000 ETH. According to Cowen, if this rate of increase continues, the price movement experienced over the past two years could repeat, and the price could fall to the same levels.

Cowen stated:

If ETH supply continues to increase by 60,000 ETH per month, we will see the supply return to its pre-merge level. If it follows 2016, the ultimate capitulation of ETH/BTC will not start until September 2024, giving enough time for the novelty of the spot ETF relative to BTC to potentially wear off.

Ethereum Price May Drop

The general consensus in the market is that Ethereum will be higher than its current price within the next 1.5 years. However, it is believed that it may experience another drop in the next 3 to 6 months. Following price movements in the last 24 hours, ETH increased by 2.33% and is trading at $3,503.

On the other hand, well-known on-chain analyst Leon Waidmann indicated that Ethereum might face a potential supply crisis.

Waidmann shared his findings in a post on July 16. He noted that the amount of Ethereum on exchanges has dropped to 10.2%, while 39.3% of ETH is locked in smart contracts, highlighting the issue of low supply.

Türkçe

Türkçe Español

Español