After the approval of Ethereum exchange-traded funds (ETFs), top analyst Michaël van de Poppe made significant comments about five altcoins. His statements indicated an increase in interest in the Ethereum ecosystem and created expectations for an altcoin process. So, which are the five altcoins van de Poppe is considering buying, and why were they chosen for their potential to provide significant gains?

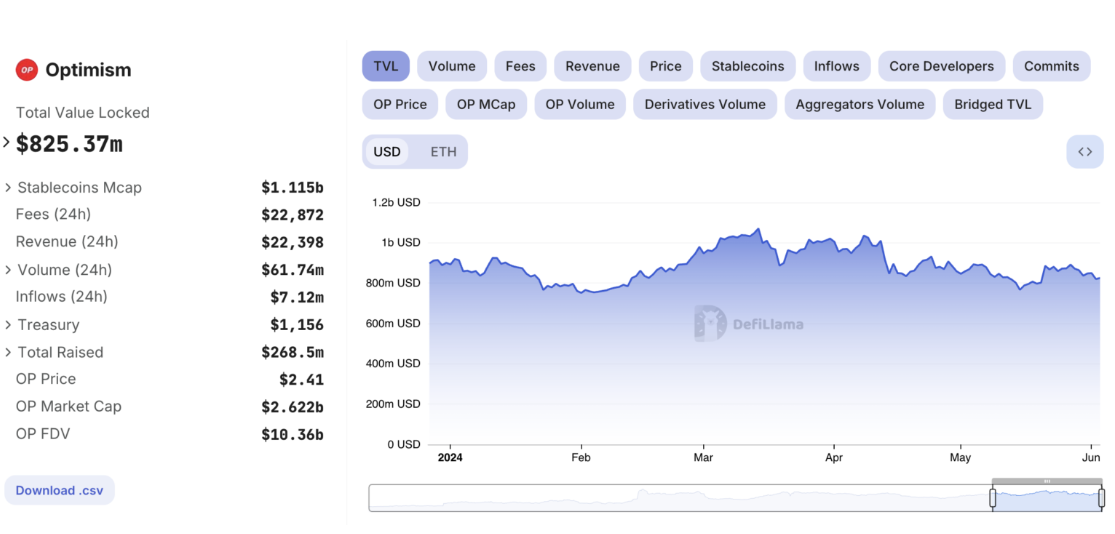

Optimism (OP) Comments

Ethereum serves as a Layer-2 scaling solution, and Optimism tops van de Poppe’s list. A potential price increase on the Ethereum side is thought to impact solutions aiming for efficiency gains.

Michaël van de Poppe emphasized the notable total value locked (TVL) ratio, indicating an important building block of the ecosystem. The relatively low circulating supply of Optimism could be a significant factor in upward price movements.

I think a coin like Optimism could see a 300% to 800% increase in BTC value within the next six months. I believe this is very likely and probably the first round.

Arbitrum (ARB) Future

The second on the list is none other than Arbitrum, a major competitor to Optimism and a layer-2 solution-focused project. Since the massive unlock in February, Arbitrum has been struggling with its price but could host strong ecosystem development.

According to van de Poppe, ARB’s TVL and ongoing development process make it a solid investment tool, and significant recovery is possible.

If you look at Arbitrum’s TVL, you’ll see it’s almost the same amount as its market cap. So, as the ecosystem grows, this is a super bullish sign. However, when we look at the price action, we see that it’s trash.

Woo Network (WOO) Comments

The surprise name on the list is Woo Network, a decentralized exchange with high liquidity and low transaction fees, which van de Poppe plans to buy.

When Ethereum starts doing well and volumes are already waking up, WOO comes into play. Also, revenue is generated, so I think it’s a great thing to have. I think when the entire cycle starts for WOO, it could actually provide returns between 500% and 1,500%.

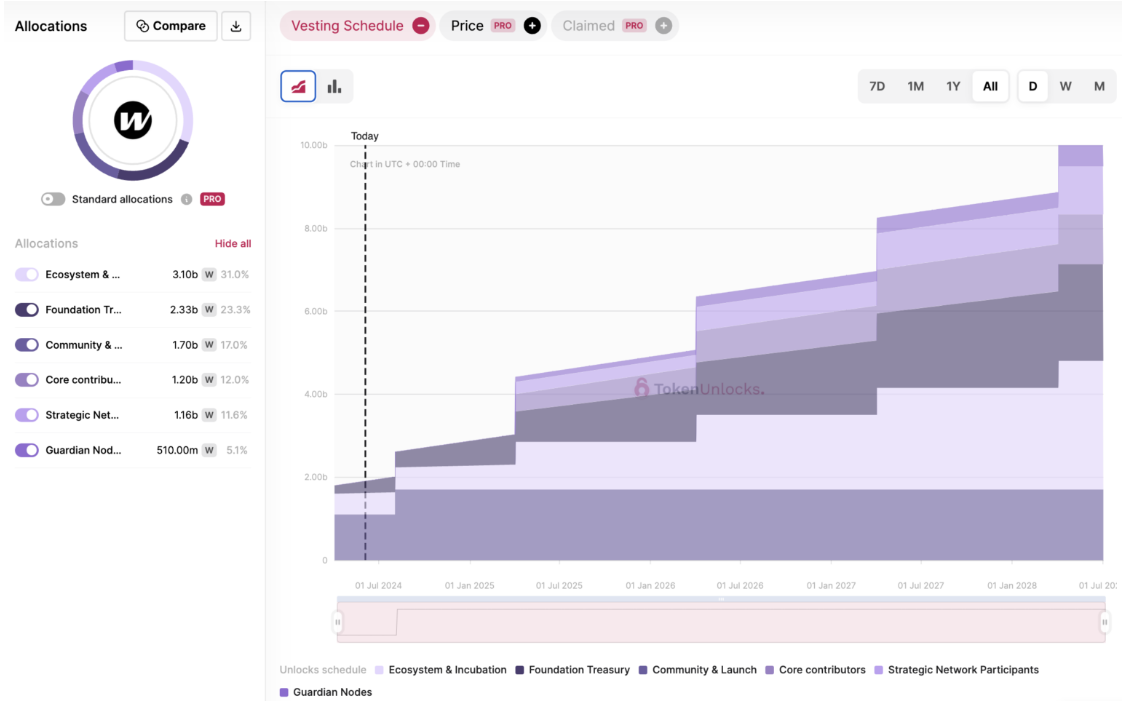

Wormhole (W) Comments

Wormhole, which acts as a bridge to provide cross-chain interoperability among blockchains, ranks fourth. The growing DeFi environment makes seamless asset transfers between different blockchains increasingly important.

I want to bet on secure Solana (SOL) solutions. The only tricky part about Wormhole is that the locks are still open, but it will take some time for these locks to be released, so I think it will do really well.

Dogecoin (DOGE) Comments

Lastly, van de Poppe chose a meme coin, specifically Dogecoin, the undisputed leader in the meme coin market. The analyst highlighted the price volatility and community support for Dogecoin, seeing it as a short-term opportunity.

According to Michaël van de Poppe, DOGE has the potential to provide significant gains relative to the risk taken during a possible market uptrend.

Like it or not, you see all meme coins doing well. Floki, Book of Meme, Bonk. All these meme coins are doing well. When you want to position yourself in Dogecoin, now is the time. It’s the easiest. It will do 4x to 5x or maybe even more.

Türkçe

Türkçe Español

Español