Anonymous crypto analyst Rekt Capital warned that Bitcoin (BTC) might be heading towards a significant price correction. The analyst, who accurately predicted Bitcoin’s pullback before its block reward halving, suggested that the largest cryptocurrency could potentially drop by more than 8% from its current value.

Risk of Decline in Bitcoin Continues

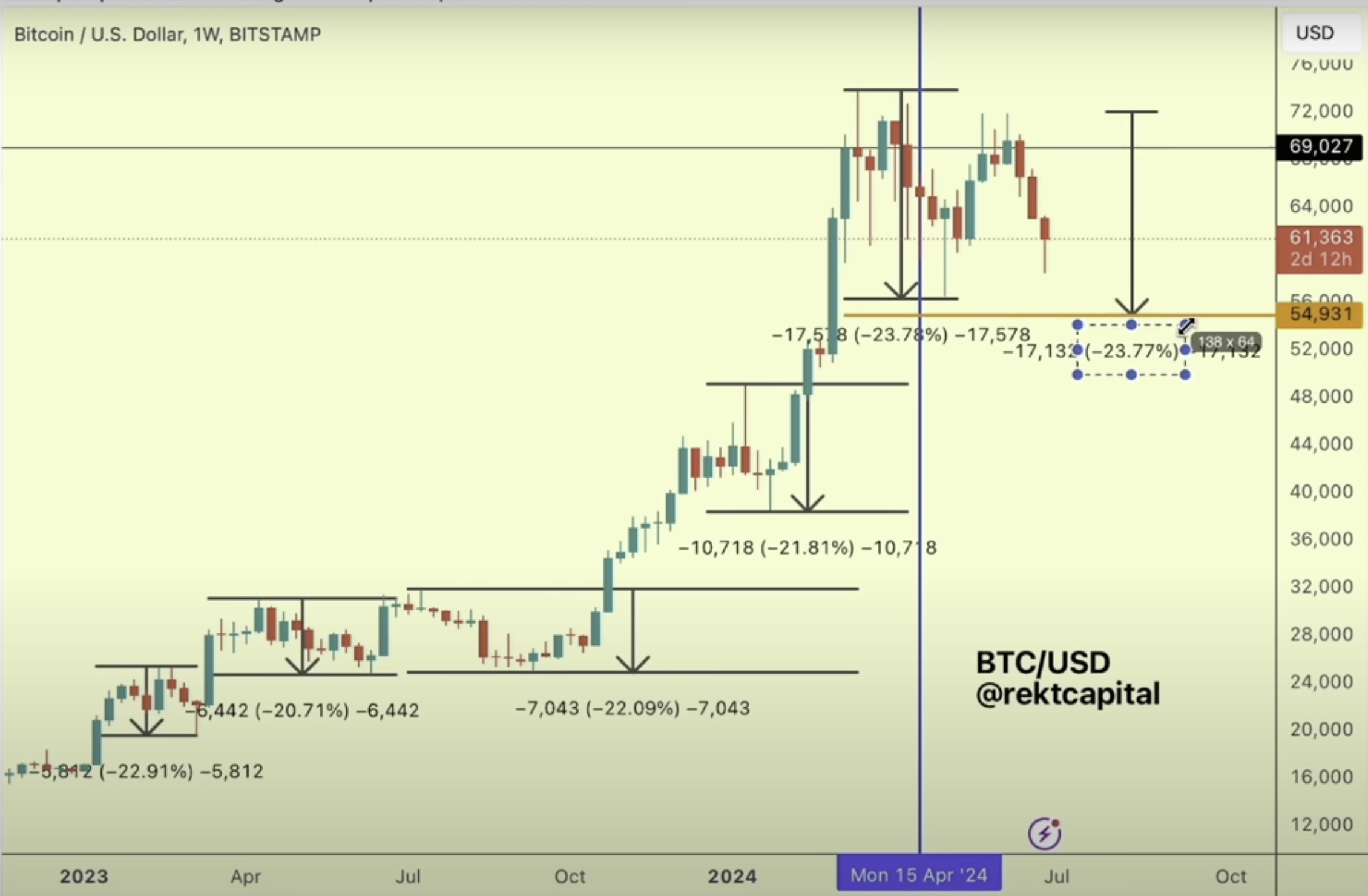

Rekt Capital highlighted that if Bitcoin experiences a correction equivalent to the deepest correction of 23.8% in its current cycle, the price of the largest cryptocurrency could drop to around $55,000. This forecast is based on historical patterns observed in Bitcoin’s price movements during similar market cycles. The analyst also added that this extreme scenario might not necessarily occur.

The analyst emphasized that although there is a possibility of a deep decline, it is not the most likely outcome at this stage of the cycle. Instead, he suggested that Bitcoin might have already formed a local bottom or could be experiencing a milder pullback. Rekt Capital noted that the deepest correction in this cycle occurred between late April and early May and surpassed previous pullbacks, including the significant correction at the beginning of 2023.

On the other hand, Rekt Capital continued by explaining that it took about half a year for the recent deep correction to surpass the previous one. Therefore, he does not see it as likely for another record-breaking correction to occur so soon, just a month and a half after the last one. According to him, it is more realistic to expect either the current level to mark the bottom or for Bitcoin to experience a slight additional pullback, and investors should be prepared for these scenarios.

Current State of Bitcoin

At the time of writing, BTC is trading at $60,958, up 0.43% in the last 24 hours. The price has dropped over 5% in the last 7 days, causing investors to worry about the potential for further price declines.

Despite all this, Rekt Capital’s analysis offers a perspective that while significant corrections are part of Bitcoin’s market behavior, the likelihood of another major short-term decline is low.

Türkçe

Türkçe Español

Español