With Bitcoin‘s price rising to $67,000 for the first time in a long period, there has been a noticeable increase in analysts’ comments in the market. According to a popular cryptocurrency analyst, the “basic laws of supply and demand” might be moving in favor of Bitcoin (BTC).

Analyst’s Bitcoin Comments

Ali Martinez, a well-known figure in the cryptocurrency world, made important statements to his followers on the social media platform X. The analyst noted that Bitcoin reached an all-time high of over $73,700 in March, putting most long-term investors in a profitable position.

The increasing BTC supply in the market led to a corrective phase where demand levels were surpassed, causing Bitcoin’s price to drop below $57,000. This decline pulled Bitcoin below the Realized Price of Short-Term Holders, creating a sense of fear in the market as short-term holders were more likely to sell based on price fluctuations.

As of today, the Realized Price value for Short-Term Investors is $60,500, which, despite being a feared level for investors, remains an entry level. Looking back, it was observed that long-term investors were confident in adding more than 70,000 BTC at these levels after making profits in March.

To briefly explain what the realized price is, it can be defined as the average price at which circulating Bitcoin was last purchased. The realized price value for short-term holders can be defined as the average purchase price level of all Bitcoins acquired within a 155-day period.

Martinez also predicts that the demand for Bitcoin will start to surpass supply over time.

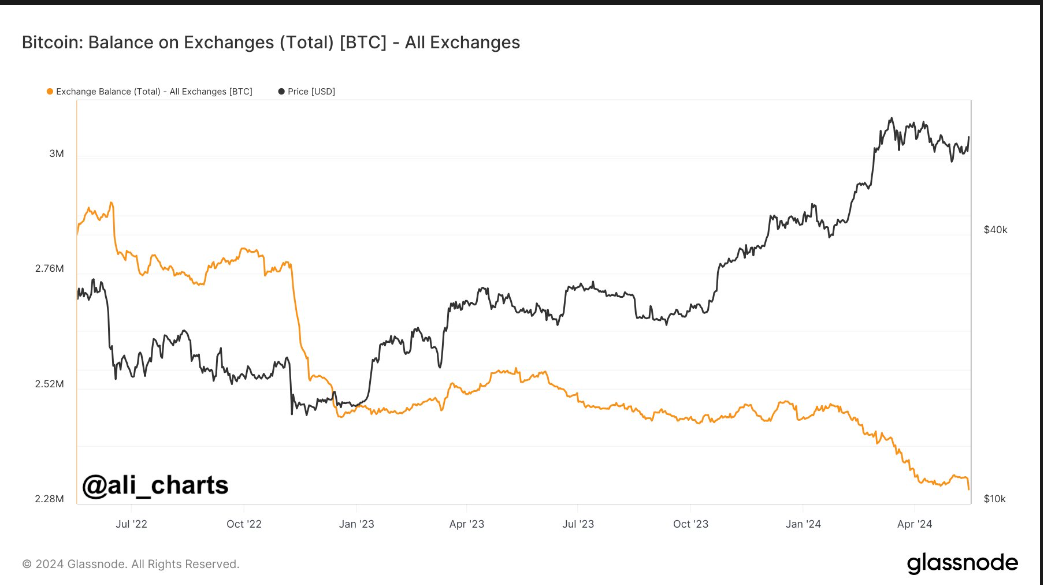

Observing Bitcoin’s Balance on Exchanges can confirm these supply and demand dynamics. Since the beginning of May, more than 30,000 BTC have been moved to private wallets for long-term holding, indicating Bitcoin holders’ confidence in Bitcoin’s future value.

How Much is Bitcoin Worth Now?

How Much is Bitcoin Worth Now?

With Bitcoin surpassing $67,000 again today, the market seems to have taken a breath. As of the time of writing, Bitcoin is trading at $66,900, just below the mentioned level, following a 2.49% increase.

The market volume on the Bitcoin side also appears to have surpassed the critical threshold of $1.3 trillion. However, BTC’s 24-hour trading volume does not look very promising. Following a 12% drop, indicating a loss of interest from investors, this value stands at $27.9 billion.

Türkçe

Türkçe Español

Español