Today, we discuss the market perspectives of three different cryptocurrency analysts. Two of them share their insights on Bitcoin, while the third analyst expresses a bullish outlook on FTM Coin, along with specific targets. These analyst opinions can broaden our understanding of market dynamics. However, it is essential to remember that these commentators cannot predict the future accurately, and we should not base our investment strategies solely on their analyses.

Bitcoin Analyst Insights

Analysts AskCryptoWealth and Jelle shared their views on Bitcoin (BTC)  $110,565 just a few hours ago. With negativity in the US markets triggering the typical Monday drop, their charts provide valuable insights. Bitcoin maintained above the $60,000 level over the weekend but is showing a decline again ahead of the Fed meeting despite discount expectations.

$110,565 just a few hours ago. With negativity in the US markets triggering the typical Monday drop, their charts provide valuable insights. Bitcoin maintained above the $60,000 level over the weekend but is showing a decline again ahead of the Fed meeting despite discount expectations.

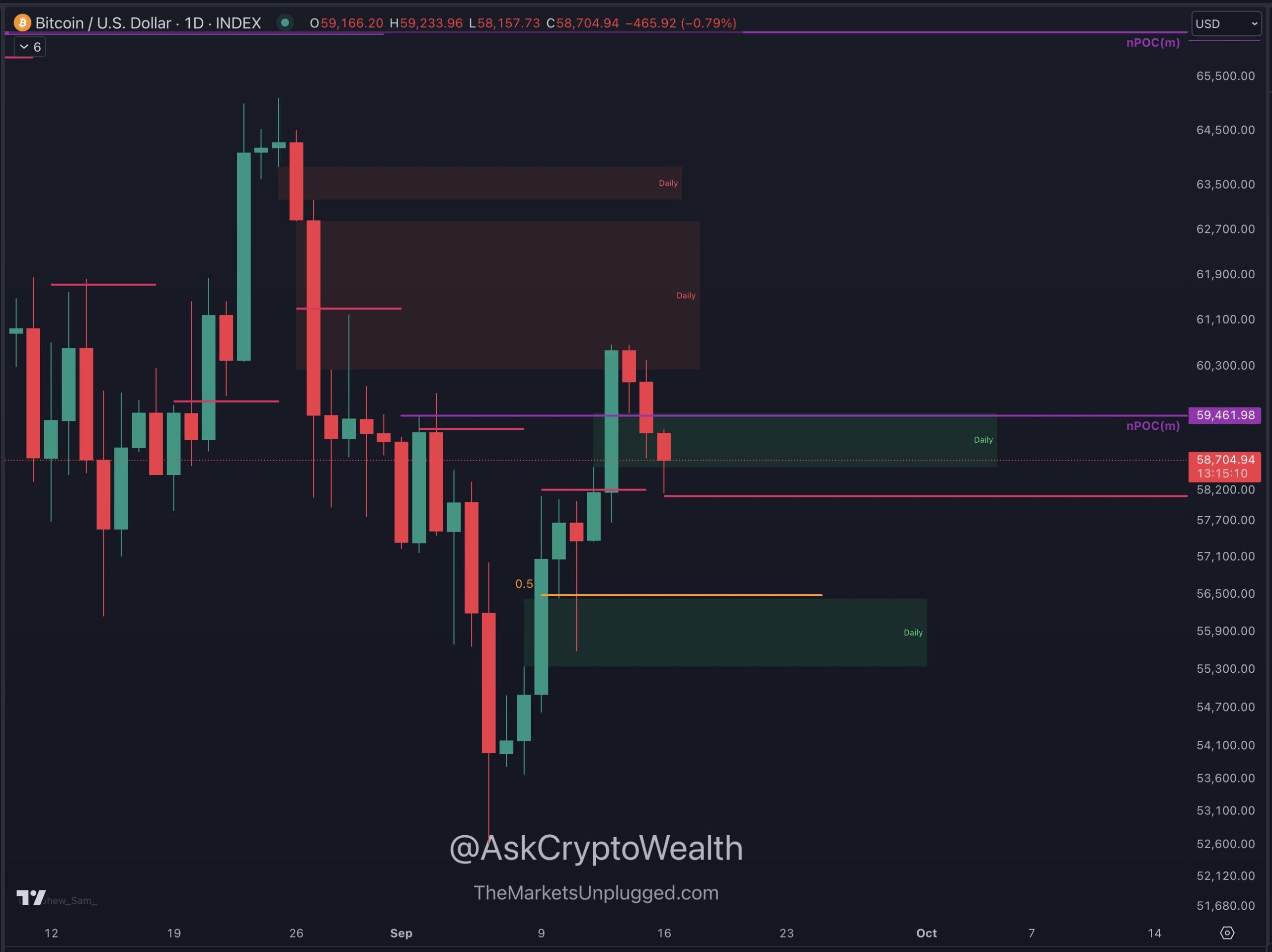

Analyst AskCryptoWealth, who shared the graph below, highlighted the liquidity target at lower levels and warned investors. If Bitcoin fails to reclaim the $59,400 level, we could see more significant losses.

“After rising to $60,000, BTC broke through the daily resistance area, showing a downtrend. The weekly support is coming from $58,000, with a liquidity target at $56,400. We need to reclaim $59,400 on the monthly chart and see closes above $61,000.”

The second analyst, Jelle, noted that the EMA50 support level on the four-hour chart has been tested. He argues that this does not necessarily mean a bad start to the week and does not target deeper lows. Currently, BTC is hovering around $58,300, and volumes are recovering compared to yesterday.

Future of Fantom (FTM)

Fantom, a highly intriguing protocol led by what is referred to as the father of DeFi, is gaining attention. As Crypto Bullet expresses bullish expectations for the upcoming quarter, the historical performance of FTM Coin draws focus. The analyst anticipates a swift recovery and provides two reasons for the optimism.

- FTM Coin tends to experience rallies when the market turns bullish.

- Fantom is among the high-cap companies.

The analyst’s chart highlights price targets of $0.96 and $1.94 before eyeing a level of $3.39. The eventual break of the indicated resistance level forms the foundation for the bullish sentiment from a technical analysis perspective.

Türkçe

Türkçe Español

Español