ARK Invest, founded by <a href="https://en.coin-turk.com/bitcoin-price-analysis-expert-predictions-and-current-market-outlook/”>Bitcoin advocate Cathie Wood, continues to attract attention with its recent transactions. The company announced on November 29th that it had bought approximately $1.5 million worth of shares after SoFi Technologies (SOFI) exited the crypto market. With this step, ARK Invest continues to buy shares of Robinhood (HOOD), while it keeps selling shares of Coinbase (COIN).

SoFi Stock Purchases Continue

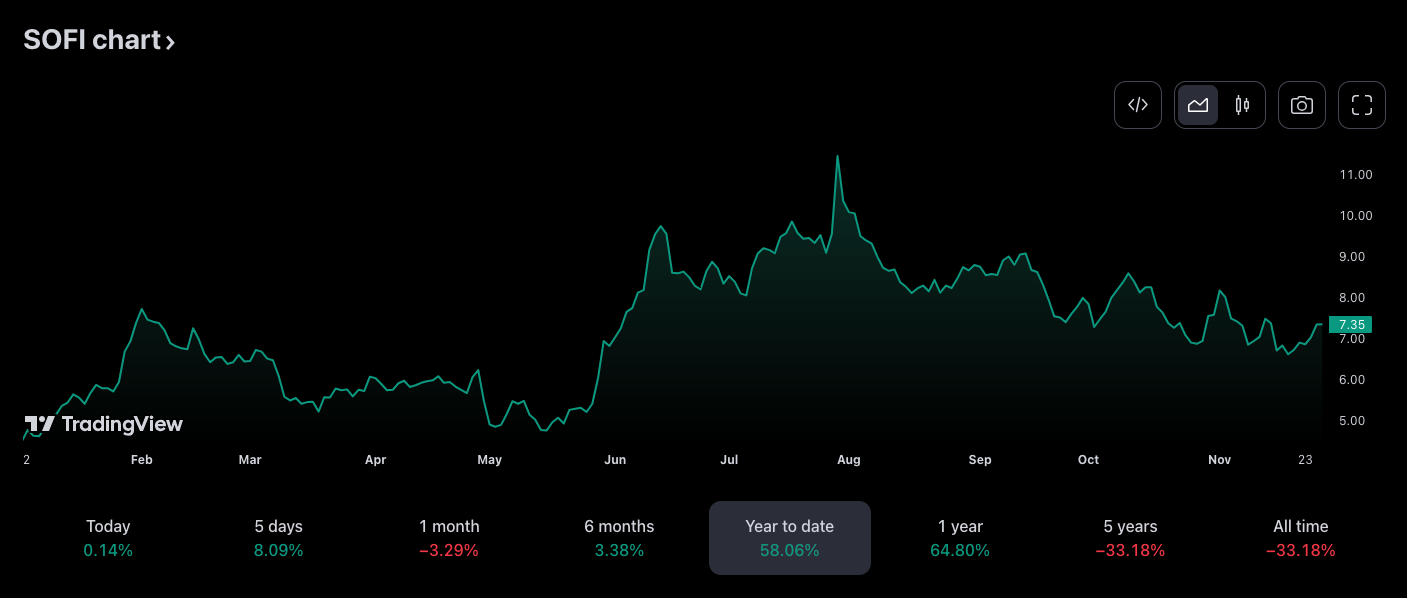

ARK Invest purchased 200,275 SOFI shares on November 29th to allocate for its ARK Fintech Innovation ETF (ARKF). According to data from TradingView, this amount is worth a total of $1.47 million, with each share valued at $7.35 based on SOFI’s closing price of the day.

The SOFI purchase by ARK Invest occurred on the same day SoFi Technologies officially announced its decision to discontinue cryptocurrency services by the end of 2023. The company stated in the announcement, “After careful consideration, we have decided to suspend our crypto services by the end of this year.”

In line with this decision, SoFi directed its customers to transfer their crypto assets to the online crypto wallet Blockchain.com. Throughout the year, ARK has been regularly purchasing SoFi shares and has bought a total of 1,772,991 SOFI shares for the ARKF fund to date. The SoFi shares in the ARKF fund are worth approximately $13 million at current prices.

ARK Invest’s Notable Decision-Making

SoFi shares experienced some volatility in 2023, increasing from a value of just $4.5 at the start of the year to $11.45 in July. Since then, SoFi’s shares have been gradually declining, falling below $7 in mid-November.

In addition to purchasing SoFi, ARK continued its regular stock acquisitions by buying 221,759 HOOD shares on November 29th, consistently investing in Robinhood (HOOD). Robinhood’s trading app allows for the buying and selling of cryptocurrencies like Bitcoin in the United States. The platform formally announced plans to expand its services in the UK on November 30th, without mentioning whether crypto assets would be part of the offering.

While buying shares of SoFi and Robinhood, ARK Invest continues to sell shares of Coinbase (COIN). On November 29th, ARK sold about 38,000 COIN shares from the ARKF ETF fund, generating approximately $5 million in cash.

- ARK Invest adjusts its crypto-related portfolio.

- SoFi discontinues crypto services, influencing trades.

- ARK balances SoFi and Robinhood against Coinbase.

Türkçe

Türkçe Español

Español