Developments that closely affect the cryptocurrency market continue. According to the recent news, ARK Invest, which attracted attention by selling approximately 700,000 shares of Grayscale Bitcoin Trust (GBTC) last month, holds 4.3 million GBTC shares worth $131.8 million in its Next Generation Internet ETF fund. It remains a question what the company officials will do regarding this situation.

All Eyes on ARK Invest

Due to the excitement surrounding the expected approval of a spot Bitcoin exchange-traded fund (ETF), Bitcoin reached its highest levels in 17 months, even though ARK Invest sold 700,000 shares of Grayscale Bitcoin Trust (GBTC) last month.

According to the daily transaction data observed by ARK Invest, the ARK Invest Next Generation Internet ETF fund (ARKW) sold 36,168 GBTC shares on November 22, bringing the total GBTC shares sold since October 23 to 697,768.

On November 22, ARKW traded around $30 per share, while it made approximately $1 million worth of sales on the GBTC side. According to Google Finance data, the share closed the day at $30.50. The US markets were closed on November 23 due to Thanksgiving Day.

Notable Rises in GBTC and Bitcoin Prices

ARK started selling its Grayscale Bitcoin Trust shares as Bitcoin rose towards $34,000 on October 23, 2023. Prior to this transaction, the previous GBTC transaction disclosed by ARK Invest took place in November 2022, when company officials sold 450,272 GBTC shares.

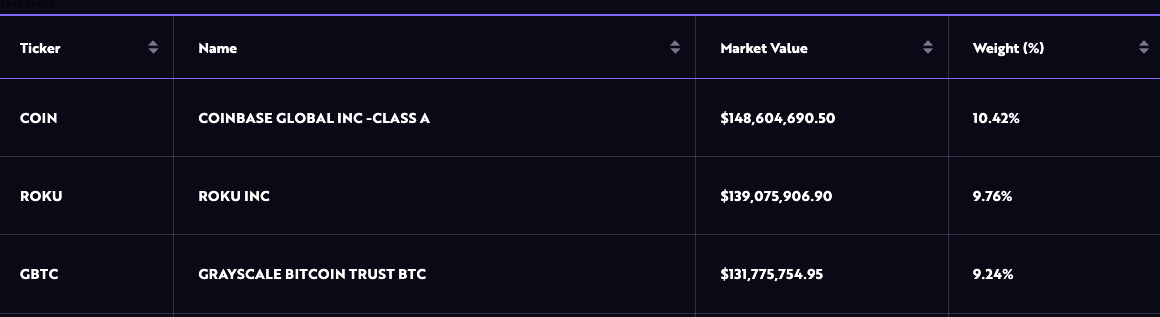

After selling approximately 700,000 GBTC shares last month, ARK Invest’s ARKW fund still holds 4.3 million GBTC shares worth $131.8 million. According to the data on its official website, as of November 24, Grayscale Bitcoin Trust constitutes 9.2% of the ARKW portfolio, ranking third after investments in Coinbase and Roku shares.

ARK ETF, which sold its shares, has shown an increase of over 68% since the beginning of the year, compared to the increase of over 271% publicly announced by Grayscale officials. Meanwhile, the price of Bitcoin has risen by 125% since the beginning of the year and is drawing attention by surpassing $38,000 on November 16, reaching its highest level since May 2022.

Türkçe

Türkçe Español

Español