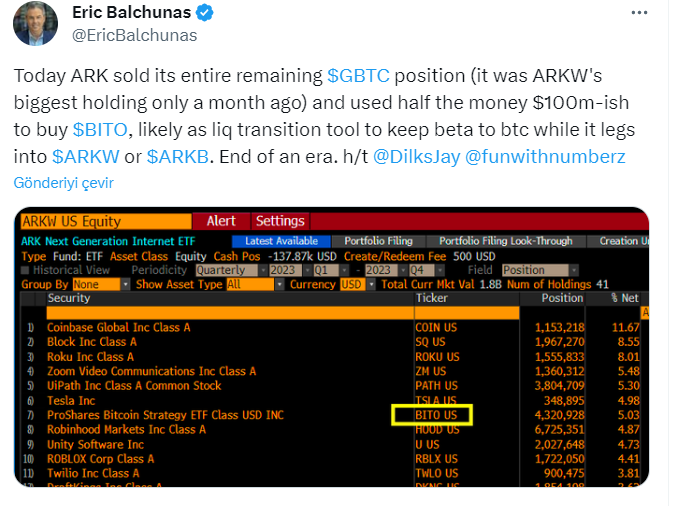

Famous Bloomberg analyst Eric Balchunas announced today that ARK Invest has made a strategic move by selling its entire position in Grayscale Bitcoin Trust (GBTC). Just a month ago, this position was the largest holding in the ARK Innovation ETF (ARKW), marking a significant change. The move involves reallocating about half of the proceeds, approximately 100 million dollars, to ProShares’ Bitcoin Strategy ETF (BITO), indicating that ARK is adopting BITO as a potential liquidity bridge.

Analyzing ARK’s Transition: From GBTC to BITO

In the dynamic environment of cryptocurrencies, ARK Invest’s decision to exit GBTC and embrace BITO underscores the continuously evolving strategies adopted by leading investment firms. Eric Balchunas’ views shed light on the motivations behind ARK’s restructuring of its crypto-related assets.

Managed by visionary investor Cathie Wood, ARK Invest has become a leading player in the cryptocurrency space by actively managing portfolios exposed to innovative technologies and disruptive trends. The latest move demonstrates ARK’s agility in adapting its positions to navigate the evolving crypto landscape.

Increased Focus on Bitcoin

The decision to liquidate the remaining GBTC position signifies a notable shift in ARK’s perspective towards Bitcoin. The traditional investment vehicle, Grayscale Bitcoin Trust, has been a significant component of ARK’s portfolio.

Moving away from GBTC indicates a reassessment of the advantages and disadvantages associated with this investment vehicle. On the other hand, BITO represents a Bitcoin futures exchange-traded fund (ETF) launched by ProShares in October 2021.

Choosing BITO as the target for a significant portion of the funds shows ARK’s strategic approach towards Bitcoin futures. This move could stem from considerations such as liquidity, operational efficiency, or specific features offered by BITO compared to traditional Bitcoin investment vehicles.

Implications for the Cryptocurrency Market

ARK Invest’s actions often resonate in financial markets, particularly in the cryptocurrency space. The decision to reallocate a significant portion of the funds to BITO could potentially impact market dynamics.

Investors and industry observers will closely monitor this move to assess its impact on the valuations of both GBTC and BITO and the potential effects on broader market sentiment. As institutional players continue to shape their strategies in the crypto space, ARK Invest’s decisions provide valuable insights into the evolving landscape.

The allocation of funds to a Bitcoin futures ETF represents a move in line with the growing popularity of such instruments, which offer exposure to Bitcoin’s price movements without direct ownership of the underlying asset. Consequently, ARK Invest’s shift from GBTC to BITO represents a strategic adjustment in response to the dynamic nature of the cryptocurrency market.

Türkçe

Türkçe Español

Español