Arthur Hayes, the former CEO of BitMEX and a prominent figure in the investment world, has sparked considerable discussion with his bold analysis of the global financial system. In a recent post on social media platform X, Hayes argues that U.S. Treasury bonds have lost their status as global reserve assets, and that gold and Bitcoin (BTC)  $105,237 will rise again. He believes that the economic and trade policies that Trump will implement in the new term will accelerate this shift. Another striking point made by Hayes is that gold will return as a neutral reserve asset in international trade. While he suggests that gold may not completely replace the U.S. dollar, it will regain a crucial role in global payments. His assessments are pertinent not only to traditional market investors but also to those engaged in the cryptocurrency scene.

$105,237 will rise again. He believes that the economic and trade policies that Trump will implement in the new term will accelerate this shift. Another striking point made by Hayes is that gold will return as a neutral reserve asset in international trade. While he suggests that gold may not completely replace the U.S. dollar, it will regain a crucial role in global payments. His assessments are pertinent not only to traditional market investors but also to those engaged in the cryptocurrency scene.

The Cost of “Prosperity”: U.S. Bonds Are No Longer a Safe Haven

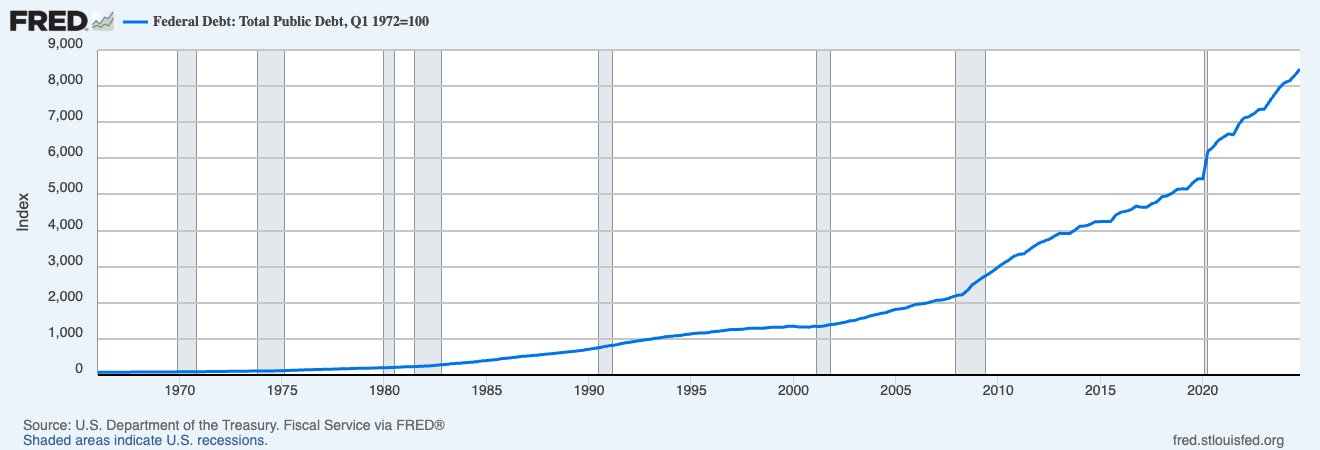

Hayes asserts that we are nearing the end of a new monetary order that began when the U.S. abandoned the gold standard in 1971. Over the last 50 years, U.S. Treasury debt has increased 85-fold. This expansion has provided the dollar liquidity necessary for global economic growth, but it has not benefited every American equally, particularly those who feel excluded from this “prosperity.”

If the U.S. eliminates its current account deficit, foreign nations will no longer be able to create excess dollars. This means a rapid decline in external demand for U.S. bonds and stocks. Countries, particularly those looking to support their own economies, will be forced to sell their U.S. assets and focus on domestic economic issues. According to Hayes, this transition is inevitable, as Trump’s erratic policies do not allow other nations to consider a return to the old ways.

Gold and Bitcoin Emerge as New Neutral Assets

Hayes posits that gold will once again become the backbone of global trade in the new era. While the dollar’s status as a reserve currency will continue, countries will need to bolster their gold reserves. Notably, Trump’s indication that gold should be exempt from tariffs signals this transformation. Hayes emphasizes that the fundamental principle of the new era will be the free and low-cost circulation of gold.

Addressing investors, Hayes advises, “Those wanting to return to pre-1971 trade relationships should purchase gold, gold mining companies, and Bitcoin.” The role of Bitcoin in this system is particularly noteworthy. According to Hayes, the escalating trade war between the U.S. and China, along with the depreciation of the Chinese yuan, could pave the way for Bitcoin to reach a value of one million dollars. He adds that a significant rise in the USDCNY exchange rate would set the stage for a major rally in the cryptocurrency market.

Türkçe

Türkçe Español

Español