As declines continue in the cryptocurrency market and general uncertainty persists, Avalanche (AVAX), once considered one of Ethereum’s biggest competitors, has drawn significant attention with a noticeable drop in the last 24 hours.

Movements in AVAX

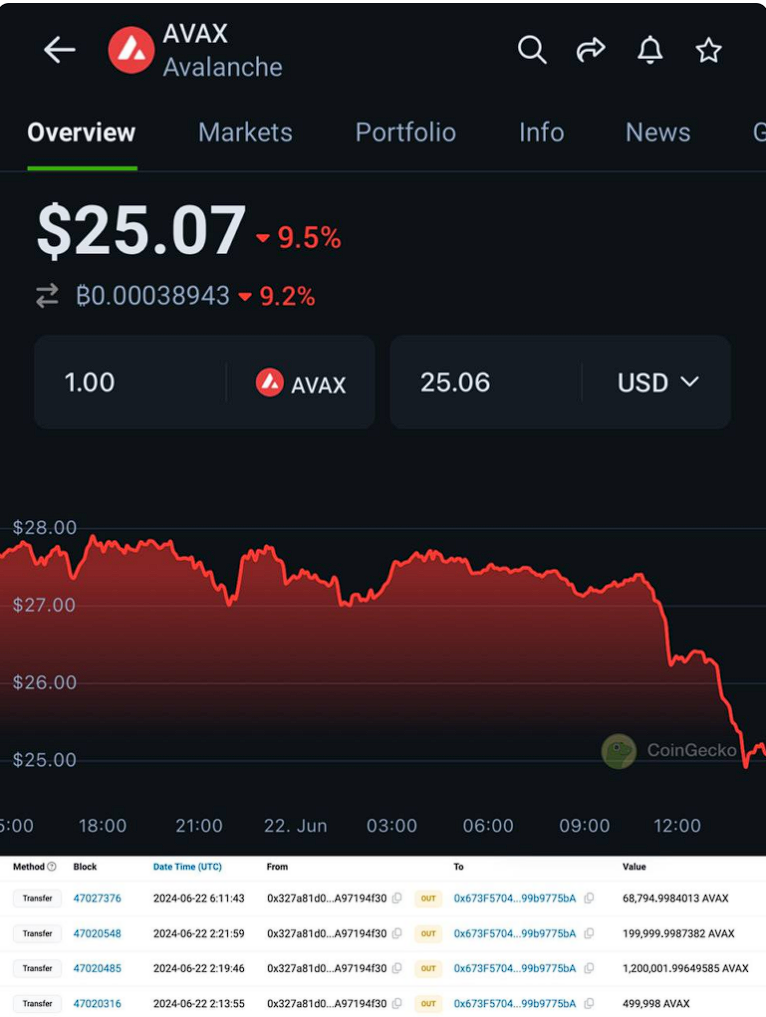

In addition to the market’s price drop, the question of why AVAX experienced a decline has caused a significant stir. During the day, AVAX’s price saw a noticeable 10% drop, and popular crypto analyst ZachXBT shared a post about why this decline might have occurred.

ZachXBT’s post indicated that approximately 1.96 million AVAX tokens, valued at around $54.2 million, were sent to exchanges via cross-chain, suggesting it could be a whale movement.

In these transactions, Coinbase, Binance, and Gate exchanges were used, and AVAX tokens were recorded via THORChain to facilitate cross-chain bridging.

It has been observed that whale token transfers of this magnitude can create significant price impacts in the past. In this context, it would not be wrong to say that the price might experience even greater declines in the coming days.

AVAX Price Prediction

The future price outlook of AVAX continues to be a topic of curiosity. Coincodex’s AI algorithms, examined in this context, revealed important data.

CoinCodex’s model predicted that AVAX’s price could rise to $33.82 on July 1, 2024, which is 30% above the current price.

Despite whale activity, the AI’s prediction in this direction holds significant importance. Generally, such transfers trigger downward movements in the market.

Current AVAX Price

As of the time of writing, AVAX is trading at $25.82, indicating a 5.45% drop in the last 24 hours and over a 13% drop weekly.

AVAX has maintained a significant level around the $25 region over the past 7 days, especially on June 21-22. If the $25 level breaks, the psychological support at $24 remains intact.

Conversely, the resistance level between $27.50 and $28 remained significant, as the price failed to stay above $28 between June 19-21. On June 16, the price rose to $30.27, and after a pullback, $30 was considered a resistance level.

Türkçe

Türkçe Español

Español