The eyes in the cryptocurrency market will be on a lawsuit today. The decision that will be made in the lawsuit, which is particularly closely related to the price of Bitcoin, is eagerly awaited. The legal battle between the SEC and Grayscale is becoming the most important topic of the day for the cryptocurrency markets. Analysts are discussing what decision may come out of the lawsuit that will highly affect Bitcoin, which has been trading around $26,800 in the past hours.

The Big Day for Bitcoin Has Arrived

Price data obtained by TradingView shows that the price of Bitcoin is moving in a narrow range. This indicates that there has been no change since October 12. Cryptocurrency market analysts have examined potential outcomes such as the Securities and Exchange Commission (SEC) appealing a court decision regarding the denial of a Bitcoin exchange-traded fund (ETF) by a Bitcoin spot exchange investment fund.

Micheal van de Poppe, the founder and CEO of MN Trading, shared his thoughts in a tweet. According to the analyst, after a series of data indicating that inflation will continue to persist longer than market expectations, there should be a break from macro data pressures. The analyst emphasized that today’s Grayscale decision with the SEC appeal is an important day and made the following comment:

“If nothing else, we might see a situation where Bitcoin turns upside down in the coming weeks. I took a long position.”

GBTC Impresses with its Performance

Meanwhile, ahead of the final appeal day, Grayscale Bitcoin Trust’s (GBTC) performance, for which Grayscale has initiated a legal battle, continues to rise. Grayscale announced that GBTC, which is the focus of the legal battle, will be offered to customers as a spot ETF, and the company will increase its revenue in the second quarter with this development, claiming a victory.

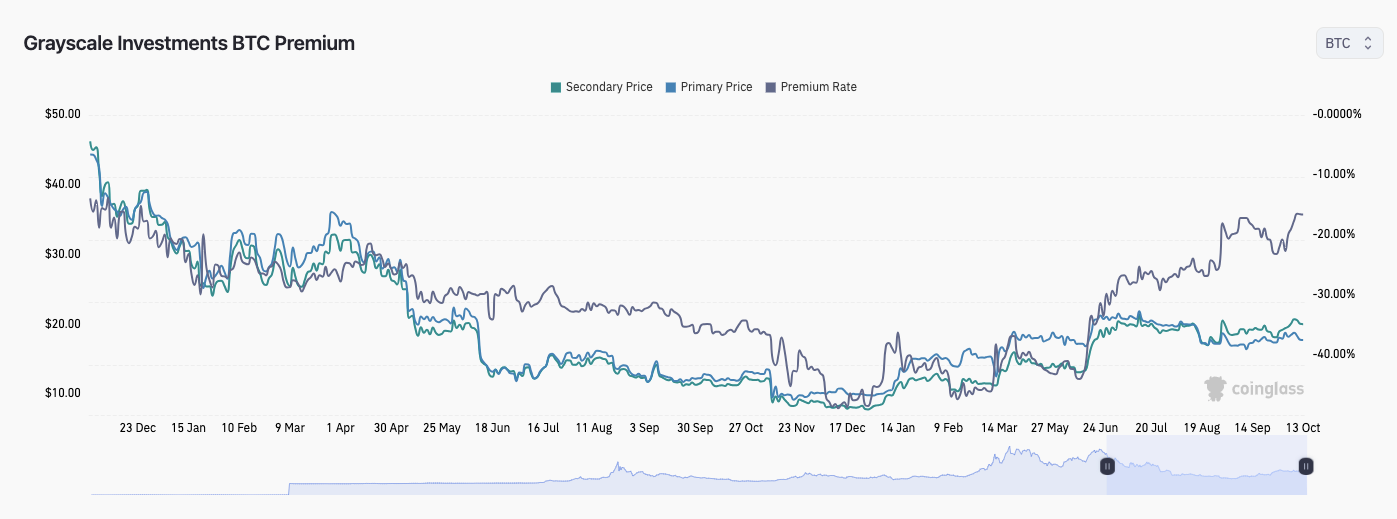

On October 11, GBTC achieved its lowest discount compared to the net asset value of Bitcoin spot price since December 2021. Technically, the discount, which is a negative premium, is defined as “discount” in the dictionary. According to data from the analysis platform CoinGlass, GBTC’s discount reached -16.44% compared to the Bitcoin price.

Türkçe

Türkçe Español

Español