By the end of 2023, events centered around the Binance exchange had exploded onto the center stage of the cryptocurrency world. The company’s CEO CZ, considered the face of cryptocurrencies, admitted to all allegations against him and subsequently resigned from his CEO position. Following this incident, all eyes turned to BNB Coin. During this period, BNB Coin continued its rise in the cryptocurrency market, instilling confidence. So, what is the situation with BNB after the recent ETF decision?

Current State of BNB

When analyzing the Funding Rate of Binance Coin (BNB), it appears to parallel the past, which suggests that BNB might be gearing up for a new leap.

Following the Spot Bitcoin ETF decision, BNB moved in tandem with other altcoins, with its price falling from $334 to $291. Looking at the percentage of the decline, there has been a 6.14% drop over the past seven days.

Compared to other altcoins, it wouldn’t be wrong to say that BNB has shown a much stronger stance. Price analysis showed that most high-volume altcoins experienced double-digit declines.

According to data provided by Santiment, funding rates were at the bottom of the negative zone. At the time of writing, the metric was indicating -0.037%.

Will BNB Coin Rise?

Considering the recent price movements, the high negative Funding Rate could indicate a potential rise. This could be due to short position traders not finding enough liquidity.

Similar patterns in BNB’s past price performance have been observed by investors. For example, looking back at December 18, 2023, a similar funding rate structure was evident. On that date, BNB’s price was $243. Shortly after, on December 26, the price had risen to $305.

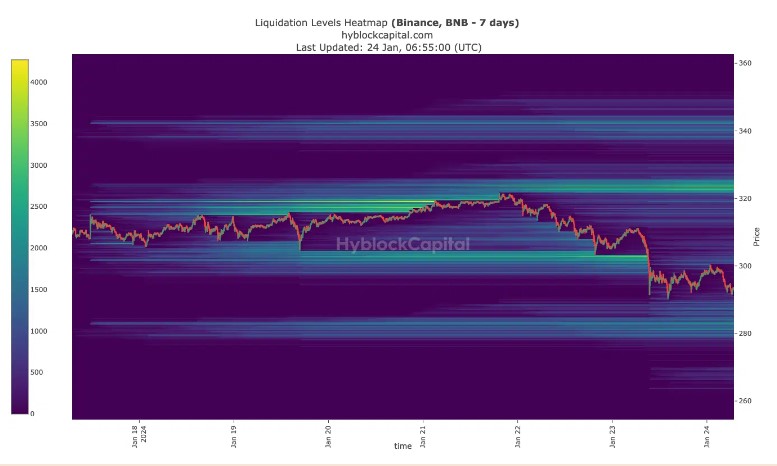

Recent attention to the liquidation heat map can also provide insights into future price movements.

According to data from HyblockCapital, there is a massive liquidation zone between $320 and $325. Consequently, investors taking long positions may want to be more cautious in these areas.

On the other hand, traders targeting lower price regions might be aiming for the $290 area for potential price movements.

How Much is BNB?

Looking at the 4-hour BNB chart, bears seem to be maintaining a strong presence. However, a potential Bitcoin movement could enable the bulls to push the price to retest the support around the $300 level.

If the price moves above this region, it could head towards the next resistance at $309.5. Meanwhile, the Relative Strength Index (RSI) was at a low point, indicating the strength of sellers. At the time of writing, BNB’s RSI was at 31.99, and its price was trading at $291.9.

Türkçe

Türkçe Español

Español