Bitcoin (BTC) has been delicately balancing against a downward trend since March 14, currently trading below the $70,000 threshold. In recent weeks, the $70,000 level has been indicated as a turning point, considered crucial for progress towards $100,000. In contrast, in addition to the rhetoric surrounding Bitcoin‘s short-term expectations, closely followed cryptocurrency analyst TradingShot stated that he expects a significant drop after the expected fourth block reward halving around April 20, and he indicated that the price could potentially fall below the $60,000 level.

Anticipating a Drop for a Rise

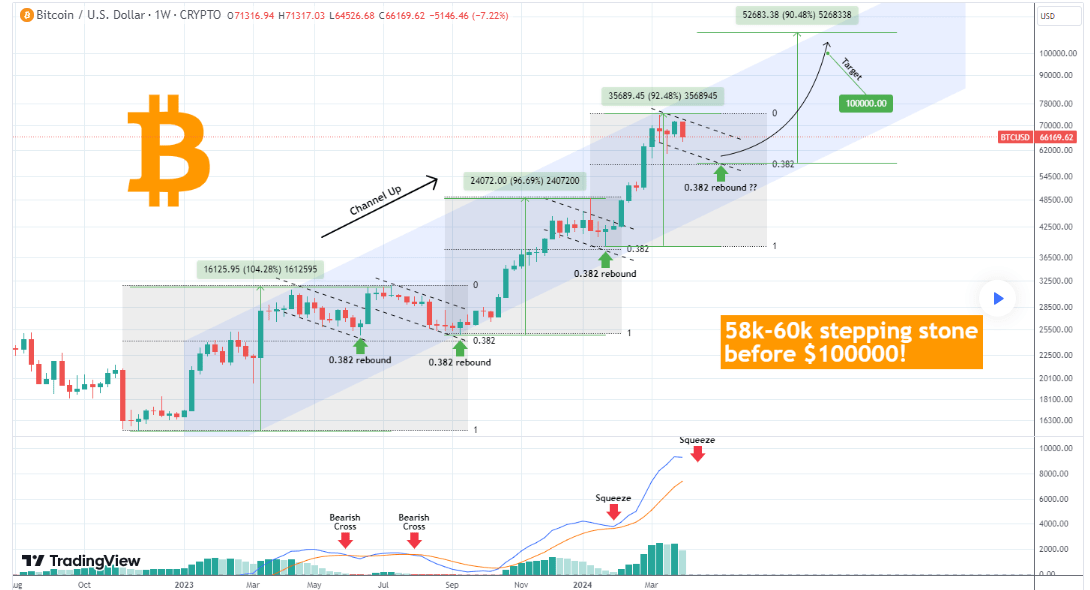

Anonymous cryptocurrency analyst TradingShot warned investors for the short term in his analysis on TradingView on April 4, based on Bitcoin’s historical price behavior and using Fibonacci retracement levels.

According to the analyst’s analysis based on the weekly time frame, Bitcoin’s price trajectory could enter a correction phase towards the 0.382 Fibonacci retracement level, a trend observed in previous market corrections. This suggests that the largest cryptocurrency could fall to the $58-60,000 range.

TradingShot’s analysis particularly reveals that Bitcoin has been moving upwards within a channel since its November 2022 low. It is noted that each successive rise within the channel has been with marginally decreasing performance.

The analyst pointed out a decreasing rate of gain percentage for each successive high level, predicting a potential 2% drop for the next high level. Based on this model, he expects Bitcoin to fall below the $60,000 threshold after the fourth block reward halving and then rally towards the $100,000 milestone.

US Inflation Closely Monitored

As is known, Bitcoin fell below the $70,000 threshold due to fundamental reasons such as the yield on US Treasury bonds reaching the highest level of the year and the US dollar continuing to strengthen. Amid these developments, increasing voices that US inflation has not decreased have heightened concerns in the cryptocurrency market. The underlying concerns are expectations that the Fed may delay the anticipated interest rate cut due to high inflation or settle for a single rate cut instead of three within the year.

Meanwhile, as investors remain focused on closely monitoring BTC, the price continuing to trade above the $65,000 support level is leading to comments that it will serve as a catalyst for more upward momentum. As a result of Bitcoin staying above this level, a rise towards the $70,000 level is expected.

Türkçe

Türkçe Español

Español