Bitcoin price closures below $70,000 continue to normalize. Today saw sharp sales. We mentioned on Sunday that we might face such an issue due to the data coming on Friday. Favorable data during the week reversed with poor figures on the last trading day. So, what are the predictions for PEPE Coin?

PEPE Coin Price Prediction

We wrote that the break in Bitcoin price could lead to a drop to $68,500 when the price was still above $71,000, an hour before the US markets opened. Bitcoin dipped to $68,420 in the last 24 hours. During this time, PEPE Coin price also lost the support at $0.0000142. The loss of this support level, which is crucial for new ATH attempts, naturally triggered a test close to the $0.0000109 support.

If weekend sales continue, there could be new tests between $0.0000091 and $0.0000075. In the opposite scenario, a return to support is expected. However, with only days left until the Fed meeting and the negative data from Friday, such a return would only be temporary speculative attempts by liquidity hunters.

LUNA Coin Predictions

In the long term, LUNA Coin is clearly finished. Do Kwon’s situation, the state of the team, increasing competition, and the community scattered after bankruptcy make the story of LUNA Coin rising from the ashes seem exaggerated. Of course, this is the world of cryptocurrency and nothing is impossible here.

The $0.560 support was lost, even if only temporarily. The price spiked down to $0.05, which was not surprising, and closures below this could continue down to $0.035. Below that, we will see a new all-time low price. If the market normalizes over the weekend, $0.593 is a region where closures can be made above.

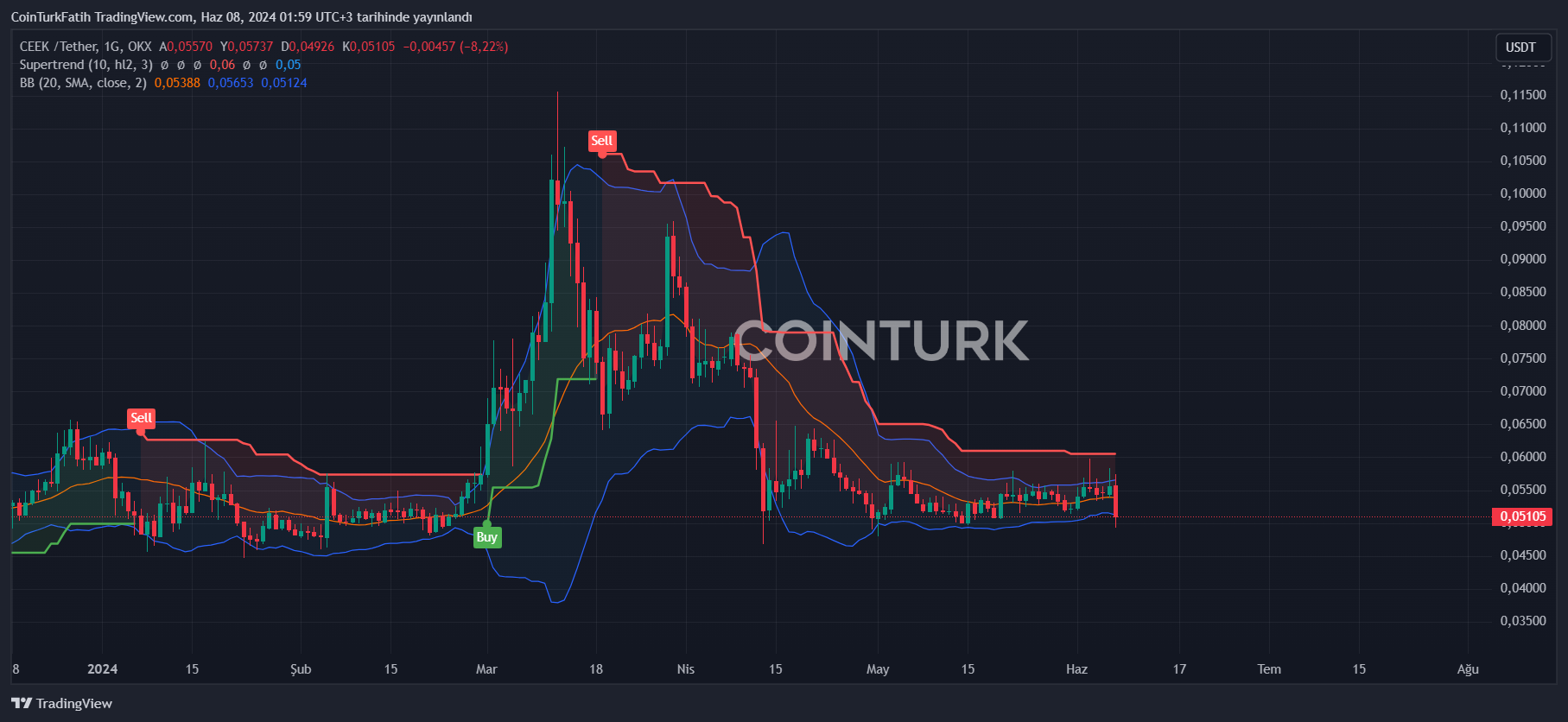

CEEK Coin Commentary

Here too, the $0.05 support was of key importance, and we mentioned this at every opportunity. Although sales accelerated, there were no closures below support. If it had continued, CEEK Coin would have made new dip tests towards $0.045 and $0.0413. Investors eagerly approached excessive sales in all three altcoins and bought the dip.

This was related to the BTC price maintaining the $68,500 support despite the Fed. If the support goes, dip supports in altcoins will be in jeopardy.

Türkçe

Türkçe Español

Español