This article explores the current state of Bitcoin and selected altcoins such as FLOKI and Solana (SOL) amidst a volatile economic environment affected by political uncertainties, including issues related to Trump. Bitcoin continues to aim for liquidity hunts, reaching back to $90,000. However, there is lingering insecurity among altcoins traders, resulting in a lack of substantial movement. The insights from two analysts on FLOKI and SOL Coin predictions, as well as remarks by the analyst Darkfost regarding ETFs, offer a deeper understanding of the current market dynamics. Readers will gain insights into potential investment strategies during these uncertain times.

Bitcoin ETF

Powell’s early hour video shook confidence in the institutional independence, raising concerns for cryptocurrencies. Although Bitcoin has seen some gains, factors like the inflation report and the Supreme Court’s tariff decision on Wednesday urge caution among investors.

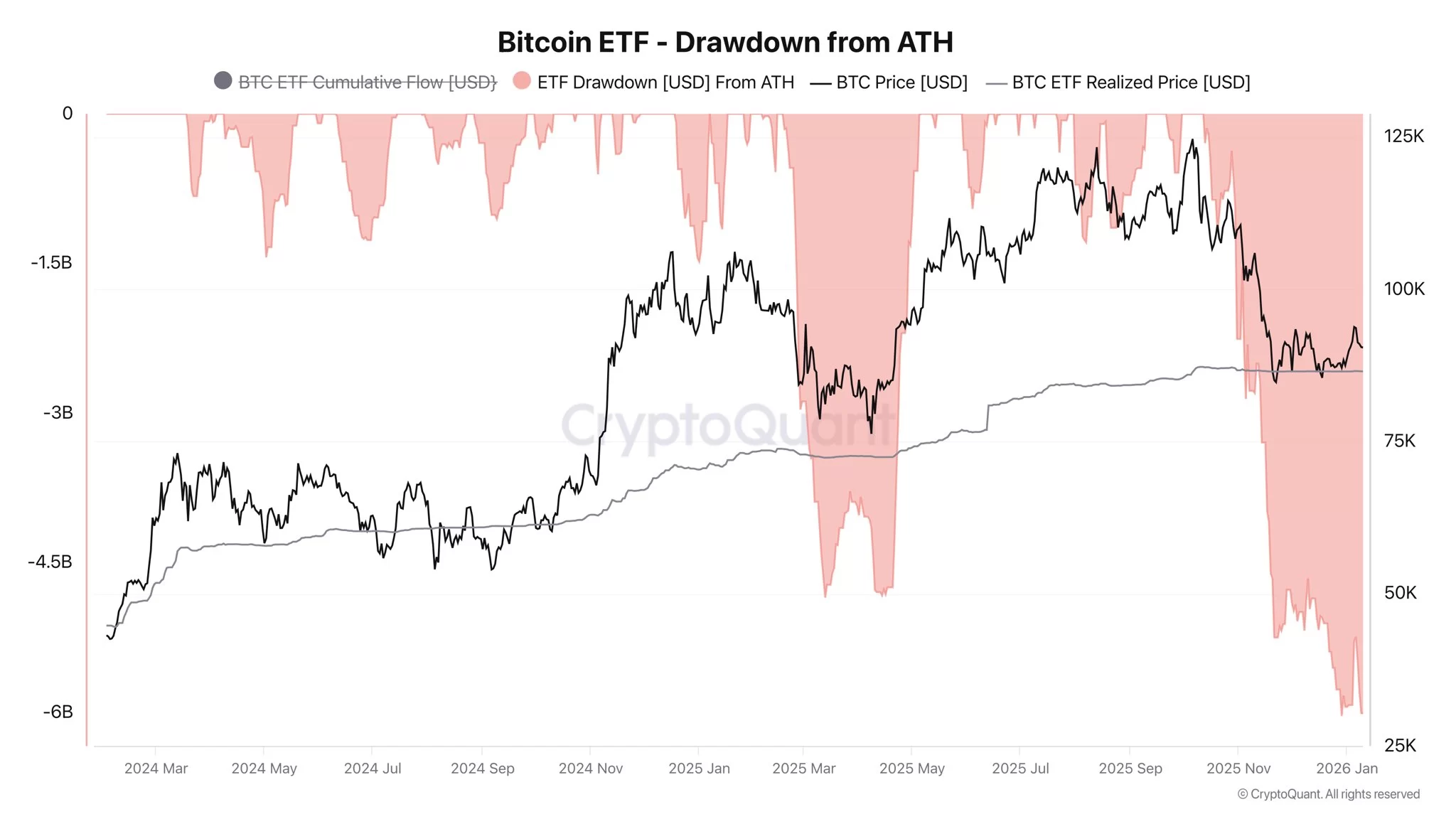

Darkfost, an analyst at CryptoQuant, highlighted the situation in the ETF channel, noting the lack of desired interest in this area for months. The recorded liquidity loss in ETFs is the largest to date, with an average realized price of around $86,000. Since the all-time high reached in October 2025, most funds that entered ETFs are currently at a loss. Over $6 billion have exited spot Bitcoin ETFs, setting a new record since their approval.

Following a wave of profit-taking for some and panic sales for others, ETF flows have begun to stabilize over the last two weeks. As Bitcoin liquidity remains periodically low, the influence of ETFs becomes increasingly significant, necessitating close monitoring of ETF flows.

ETFs, already under strain, continued experiencing outflows ranging between $243 million and $486 million over the past four business days.

Solana (SOL) and FLOKI

While several metrics suggest it’s time to transition from the bottoming phase, recent news provides a different narrative. Bitcoin’s significant candle movements on the 15-minute chart indicate upcoming increased volatility, yet investors, scarred from the challenging period leading up to the late 2025 slump, remain cautious. A resounding market rally is needed before shaking off these weary days.

FLOKI remains in discussions today, with analysts reassured by its position against the bear market ceiling support. Analyst Jelle expressed satisfaction, suggesting the distinctive deviation might serve as the fuel needed to push higher.

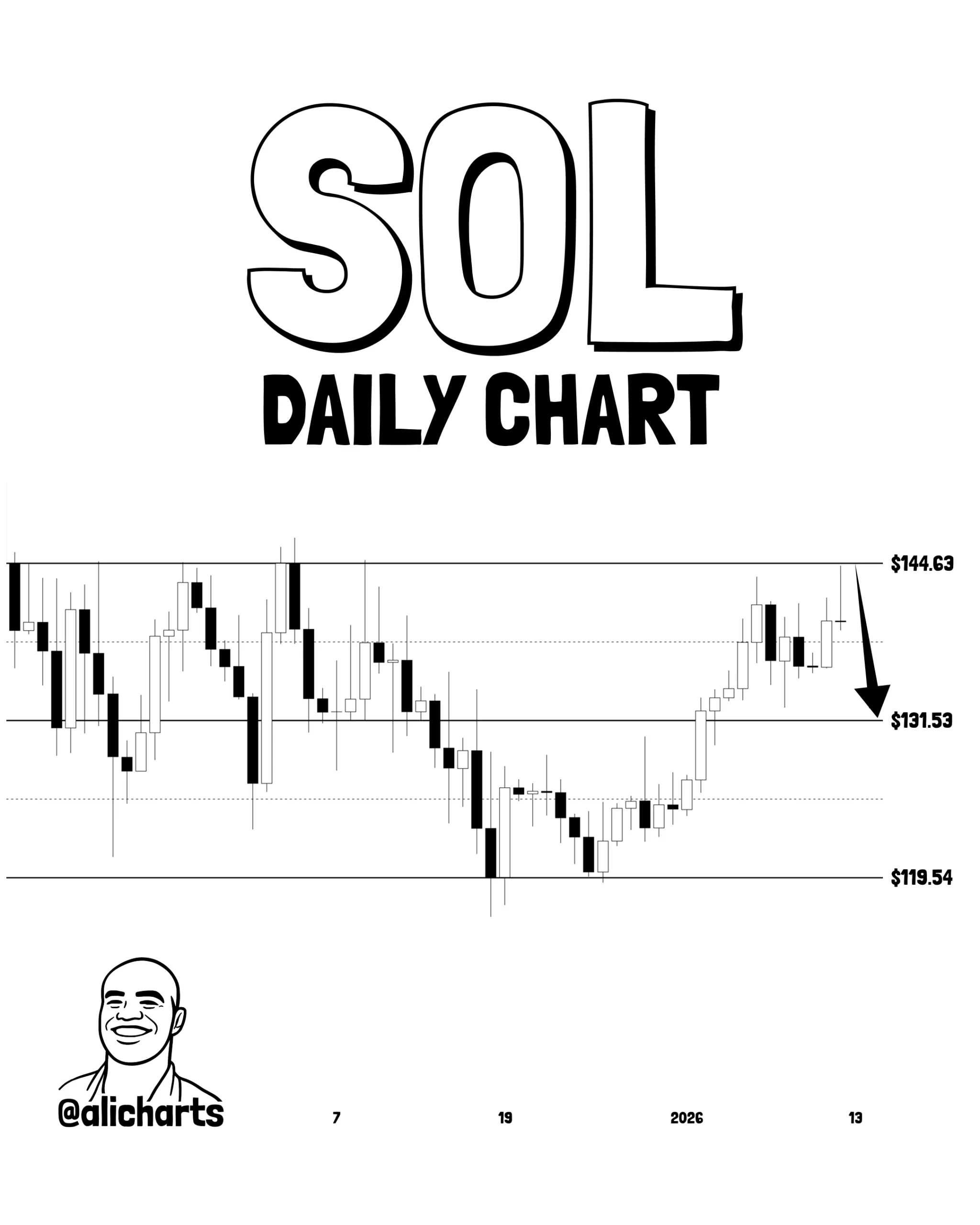

Analyst Martinez continues to present bearish targets for Solana, pinpointing $131.5. However, if Solana could unexpectedly climb to $144.63, it might make a return to $180 possible, yet, under current conditions, a further decline seems more probable.