The price of Bitcoin is running worryingly towards $25,300. At the time of writing, the price was at $25,560. As the Fed meeting approaches, concerns are growing that tight monetary policy could last longer than expected. Although the Fed appears to be successful in current data, it has not guaranteed reaching its 2% inflation target.

NEO Coin Review

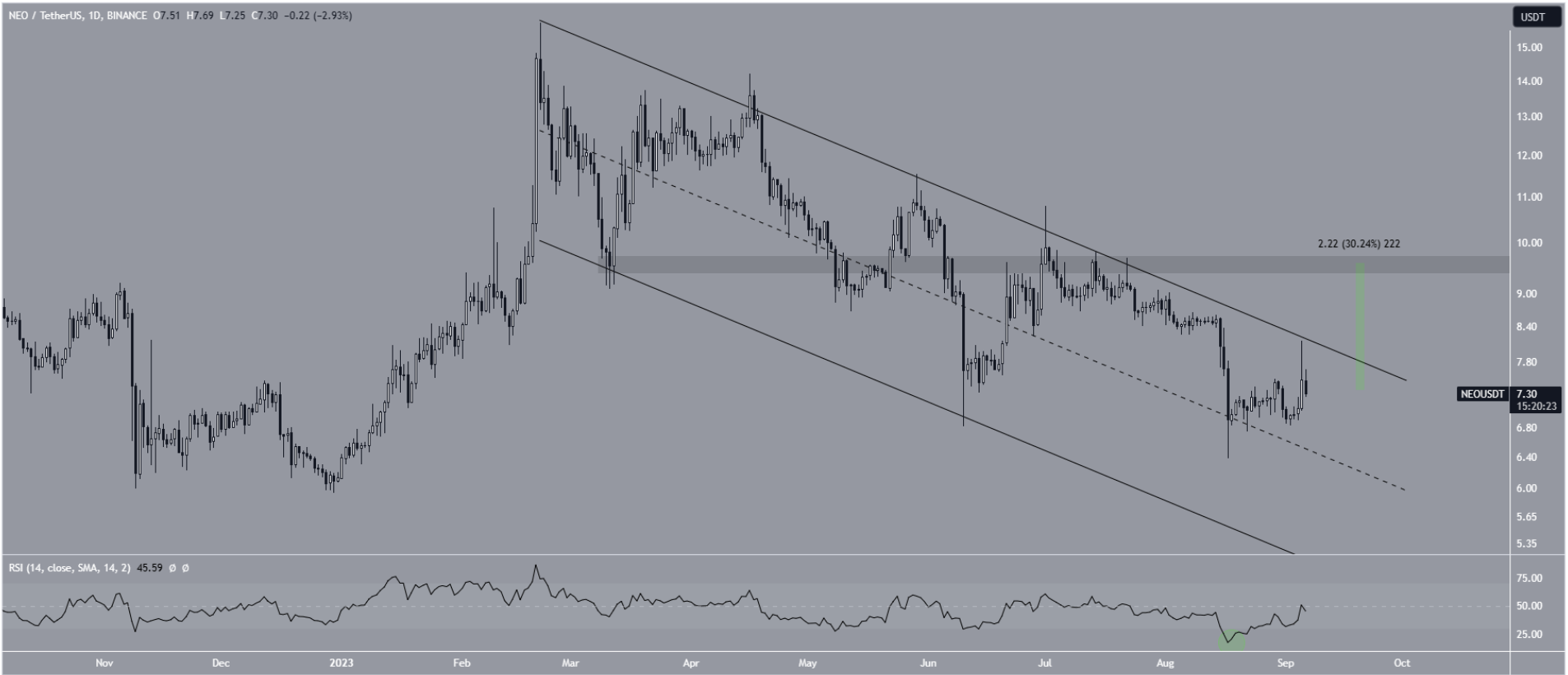

The price of NEO is trading within a short-term upward formation just above the long-term horizontal support area. While long-term readings are still uncertain, short-term ones indicate that a breakout is imminent.

The technical analysis on the weekly timeframe shows that NEO price broke out of the 609-day declining resistance line at the beginning of January. Breakouts from such long-term levels lead to significant price increases in the future.

Following the breakout, NEO reached its annual high at $15.80 in February. The highest level occurred above the $12 horizontal resistance area. It was expected that the region would provide support after the breakout, but it did not.

NEO Coin Price Prediction

The breakout on the weekly chart was a false move, and after confirming the area as resistance, the price dropped to $6.38. So, where will the price go from here? The nearest support area is $6.30, which is 15% below the current price, and the nearest resistance is $12, which is 60% above. The technical analysis conducted on the daily timeframe is full of details that give hope for NEO Coin. Since February, NEO has fallen into a descending parallel channel. These channels usually contain corrective movements. Therefore, the most likely price scenario in the future is a breakout from the channel. Additionally, NEO is trading at the upper part of the channel, which is another sign supporting a breakout.

Another detail supporting the expectation of an upward movement on the daily chart is the RSI. According to this, we cannot ignore the possibility of a recovery towards $9.6. If the prediction on the daily chart comes true, we will see a 30% increase in the price.

On the contrary, a downward movement of 15% from the current price could lead to a retest of the long-term support at $6.30.

Türkçe

Türkçe Español

Español