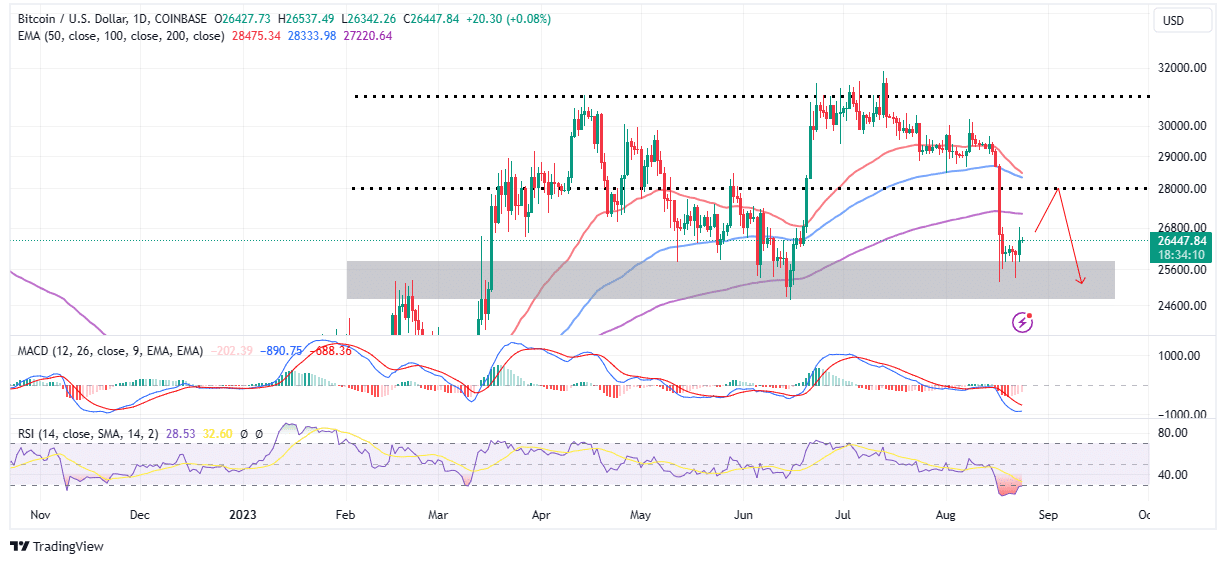

Bitcoin (BTC), after dropping to $25K following a long period of low volatility defined by the $29K support and $30K resistance, is trying to recover. The crypto king, who is trying to recover the losses caused by the leverage reduction event last week, is trading at $26,465, with a 1.64% increase in the last 24 hours.

US Composite PMI Index Triggered the Recent BTC Rise

Bitcoin bulls defended against a potential drop to $20K by showing strong defense at the $25K support level. The upward outlook resulting from this support led BTC to break the $26K resistance.

The significant drop caused the price to drop to $25K, leading the Relative Strength Index (RSI) indicator to enter the oversold zone. The entry of RSI into the oversold zone may be a catalyst for investors looking for an opportunity to enter BTC. Furthermore, it is considered that the rise of the largest cryptocurrency follows the stock market increase in the US. The S&P 500 and Nasdaq Composite indices rose by 1% during the trading session on August 23rd.

The rise on Wall Street came after the publication of S&P Global’s flash US Composite PMI Index, which is used to measure economic activity in the manufacturing and service sectors. The data indicated that economic expansion was on the verge of a slowdown in August. Investors were optimistic that the slowdown in consumer spending could lead to the Federal Reserve halting interest rate hikes, which was promising news for the crypto market, as reflected in today’s price increases.

Crypto market data tracking platform Coinglass reported that a total of $37.7 million was liquidated in Bitcoin on August 23rd. The share of long positions in this liquidation amount was $9.64 million. With this liquidation, the size of the short positions liquidated in Bitcoin surpassed the long positions for the first time since last week. Experts see this as a positive signal that sensitivity in the market has increased.

Bitcoin Price Rebounds, But Challenges Remain

Currently, Bitcoin’s daily price chart is in the process of completing its second consecutive bullish candle. In the middle of this process, the next obstacle before the expected rise towards $30K, after reducing the selling pressure at $26,800, will be the $28K level.

At this point, investors who want to make long-term investments in Bitcoin may want to wait for the Moving Average Convergence Divergence (MACD) indicator to give a buy signal. This call to buy BTC will be significant considering that the latest buy signal on the daily timeframe price chart was around mid-June. As RSI returns from the oversold zone below 30 to the neutral zone and finally above the overbought zone at 70, the upward trend will emerge.

As September approaches and with the anticipation of the Fed announcing its next interest rate decision based on developments in economic policy, investors must proceed with caution. In the latest FOMC minutes, it was observed that members were open to further interest rate hikes to reduce inflation in the US. If the Fed raises interest rates once again, it will cause a decline in risky assets such as Bitcoin and altcoins, prolonging the recovery process.

Türkçe

Türkçe Español

Español