Prominent crypto analyst Benjamin Cowen, who is closely followed in the crypto community, suggests that Bitcoin (BTC) and the crypto markets do not currently have a history on their side and are facing a significant downward correction threat.

BTC Analysis!

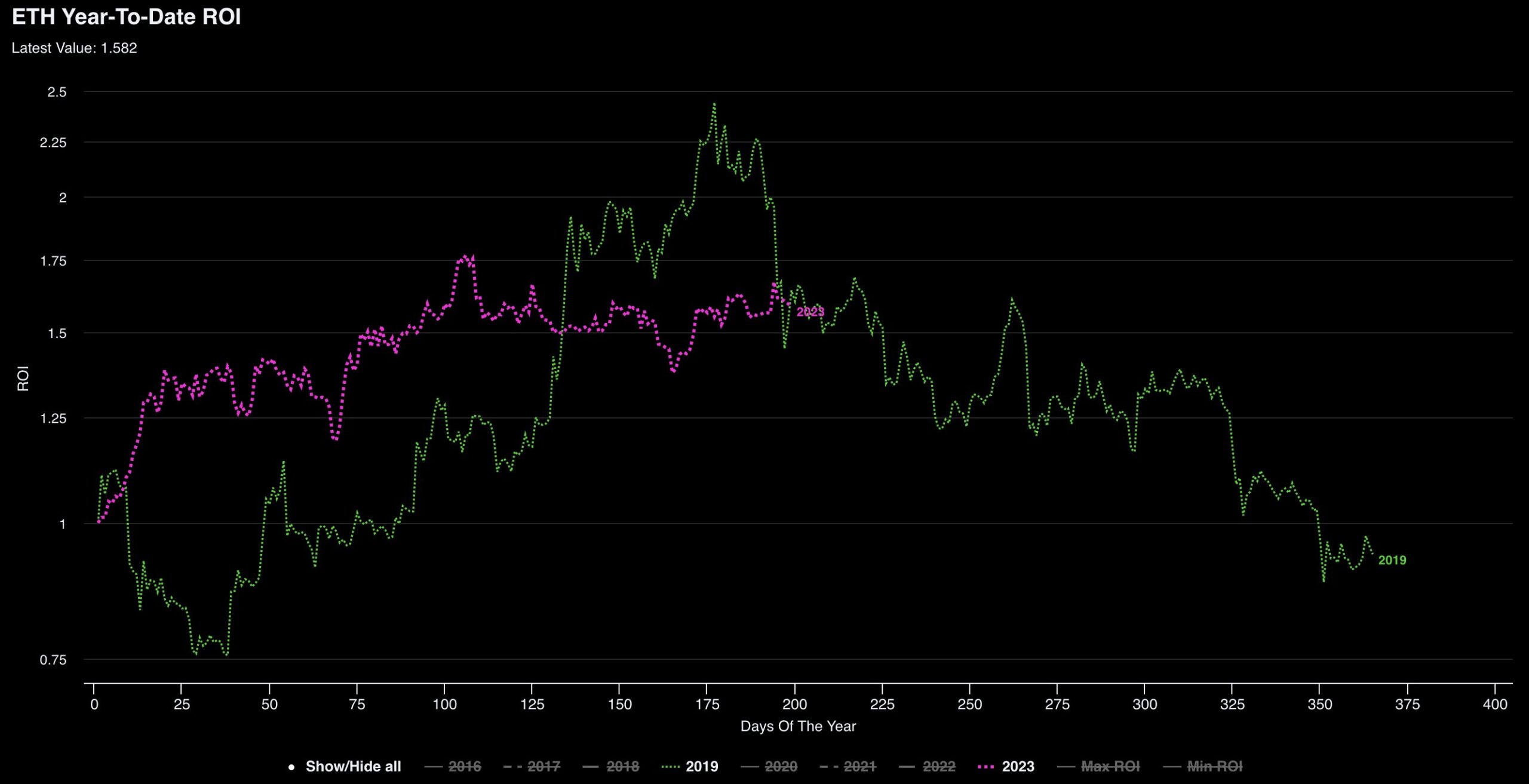

Cowen stated in his Twitter remarks that even in this year’s rally, BTC is following the same bear market patterns as in 2015 and 2019. Cowen shared a chart showing the return on investment (ROI) of Bitcoin from the current year covered by the average metric for 2015 and 2019. In his expert analysis, he stated the following:

I know there have been many calls for “this time it’s different,” but nevertheless, BTC in 2023 is closely following the 2015/2019 average.

If history repeats itself, the analyst gave a rough target of $23,000 for Bitcoin, which represents a approximately 23% drop from current levels, stating:

If we reach the lowest levels of the 2015/2019 average, it means BTC will return to $23,000 at some point this year.

Altcoin Expectations!

In a recent post, Cowen claimed that Bitcoin and altcoins, in general, are experiencing the same type of bear market bounce as in previous cycles, rather than the beginning of a bull run. Cowen stated the following:

In my opinion, until proven otherwise, the altcoin market is no different from what we’ve seen before. It’s not different. The alternative market bounced against Bitcoin in 2018, bounced against Bitcoin in 2019, but by the end of 2019, it retraced up to 25% of Bitcoin’s market value… The 2019 altcoin rally returned to the bull market support band around 0.53, which is roughly where the bull market support band is right now, maybe a little lower at 0.52, so 52%… My prediction is that the dominance of Bitcoin will continue at the end of the rally. It may be testing the 49% to 50% level retrospectively, but my prediction is that it will ultimately continue, and the reason for this will be the decline in net liquidity.