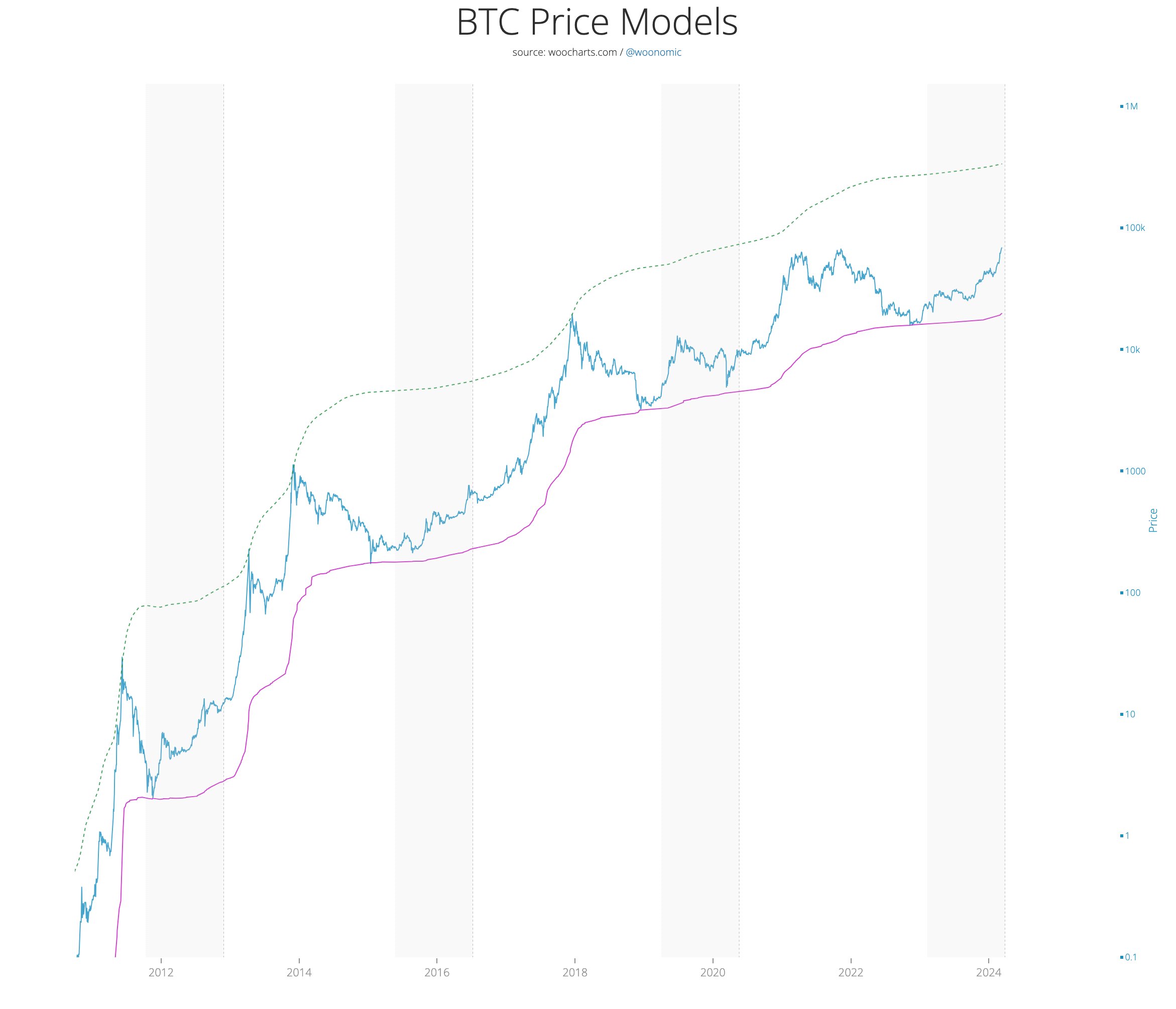

We are in the midst of a new bull market, and even without the occurrence of the Bitcoin halving event, the price has reached an all-time high (ATH) level. This suggests that we may see even more impressive gains in this bull market compared to previous ones. So, what are the predictions? How high could this bull market peak in dollars?

Bitcoin (BTC) Predictions

According to Laurent Benayoun, CEO of Acheron Trading and Expert in Trade Strategies, the Bitcoin price is still far from the real peak zone. His predictions indicate that we could see gains exceeding 150% in the current bull market. Taking into account the upcoming supply contraction due to Bitcoin halving, the expert bases his prediction on a combination of various factors.

The investment strategy expert’s target for Bitcoin in this cycle is a full $180,000. Laurent Benayoun shared his prediction by saying;

“If we look at historical performance, the multiplier of all-time highs is decreasing with each cycle. If we apply this logic, it could be 2 to 3 times what we saw in previous cycles, which means about $120,000 to $180,000 per unit.”

Macroeconomics and Bitcoin

Laurent is also optimistic about the potential impact of the current Fed interest rate policy on the price of Bitcoin. According to him, reductions in interest rates will be one of the significant price catalysts in this cycle. While some experts expect the rate cuts to happen much later than anticipated, the general consensus is that we will see about a 75 basis point reduction this year.

“The market is pricing in the decrease in interest rates because they are going to fall. We should start seeing the cuts soon.”

Analysts at Bitfinex have similarly predicted prices above $120,000, stating;

“Our analysis suggests that by the fourth quarter of 2024, we will reach a conservative price target between $100,000 and $120,000. In addition, we should see a cycle peak in terms of the total cryptocurrency market capitalization by the year 2025. ETFs have created passive demand, meaning that a large portion of the demand comes from investors independent of the price.”

Meanwhile, asset management giant Bernstein expects Bitcoin to reach $150,000 by mid-2025. Willy Woo announced on March 11 a much larger peak target of up to $337,000. According to him, the current price is equivalent to the previous cycle’s peak of $20,000.

Türkçe

Türkçe Español

Español