Miners Sold 1.12 Million BCH

After ending June 2023 with triple-digit gains, Bitcoin Cash (BCH) has failed to deliver the same impressive performance in July. Bitcoin Cash miners and whale investors now seem to be taking a bearish stance. Bulls appear to have given up their efforts to prevent a prolonged Bitcoin Cash price decline.

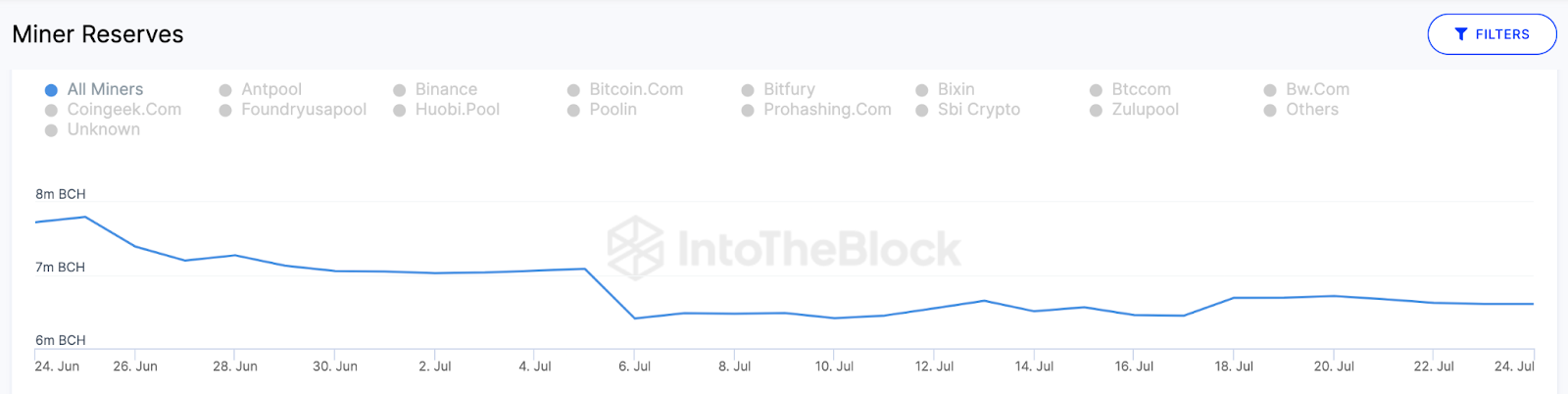

According to IntoTheBlock data, Bitcoin Cash miners took advantage of the recent price rally to offload 1.12 million tokens last month. On June 24, miners had a cumulative reserve balance of 7.73 million BCH. However, as of July 25, this number has dropped to 6.61 million.

The Miners Reserves data tracks real-time changes in the cumulative wallet balance of recognized miners and mining pools. Miners sell their block rewards instead of holding onto them, anticipating future gains.

During the past month, BCH miners reduced their holdings by 1.12 million BCH tokens and made a total token sale of $263 million at the current price of $235 each. This process reduced miners’ circulating supply of Bitcoin Cash from 40% to 34%. This indicates that Bitcoin Cash miners are not confident about achieving higher prices in the near future. It could also be a matter of time before other strategic investors start to feel a similar bearish sentiment towards BCH.

Whales Follow Miners’ Lead

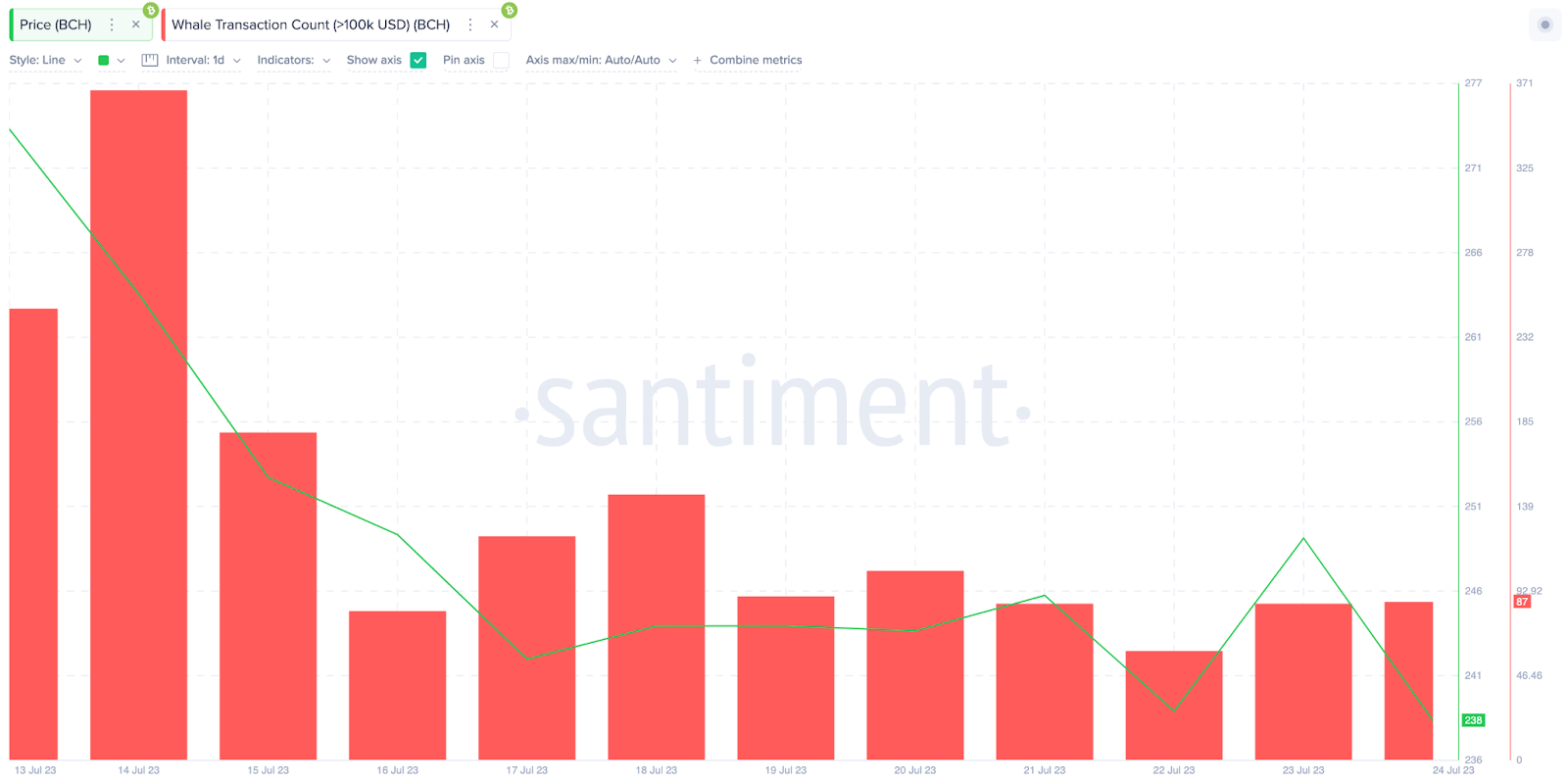

Bitcoin Cash whale investors, who confirm the miners’ pessimistic trend, have also started to reduce their trading activities. Between July 14 and July 25, BCH whale transaction volume decreased by 76%.

Whale transaction volume data indicates the level of trading activity among large institutional investors in a blockchain network. It is obtained by aggregating all transactions that exceed $100,000 within a specific period.

The decrease in whale transaction volume always implies that big investors are less certain about their BCH price expectations. If the decline in transaction volume continues, it could push BCH to new lows in the coming weeks.