Cryptocurrency markets have seen a sharp decline, after which Bitcoin (BTC) dominance began to increase over the past few days. The recent rise in Bitcoin dominance is not a result of a BTC bull rally, but rather due to the decline of altcoins.

Momentum Declines in Bitcoin

According to data from 21milyon.com, the price of BTC has fallen more than 5% in the last seven days, pushing its price below $63,000. In fact, BTC saw a 2% decrease in just the last 24 hours. At the time of writing, it was trading at $62,369.67 with a market value of over $1.22 trillion.

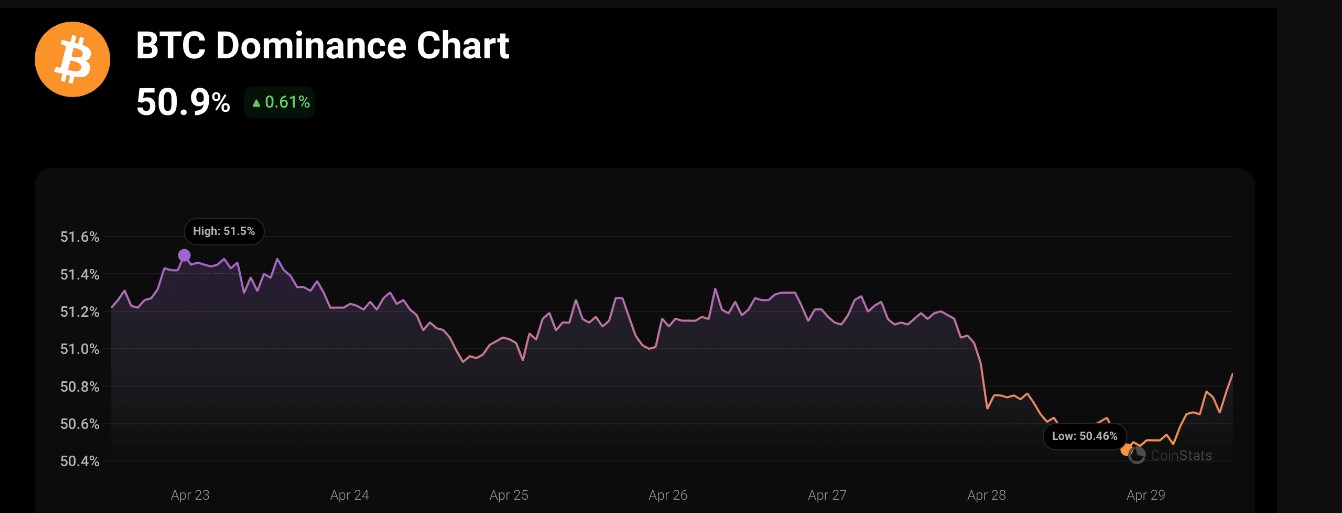

However, the decline is not limited to BTC alone. Ethereum (ETH) and many other altcoins also witnessed price corrections. The general decline in altcoin market value enabled Bitcoin’s dominance to rise again after a sharp drop on April 28. At the time of writing, Bitcoin’s dominance was 50.9%. The selling pressure on BTC decreased in the last few hours as exchange reserves diminished.

Exchange Reserves in Bitcoin

Additionally, net deposits on exchanges remained low compared to the seven-day average. According to CryptoQuant’s data, miners also sold at a slower pace, which might indicate their willingness to hold onto their BTC. The increase in buying pressure and investors’ desire to hold BTC could trigger a reversal in the trend, potentially leading to a rise in BTC charts.

Experts’ analyses indicate that Bitcoin’s Chaikin Money Flow (CMF) recorded an increase and was valued at 0.08 at the time of writing. Bitcoin’s Money Flow Index (MFI) also showed a similar upward trend. These technical indicators were pointing to potential price increases in the coming days. However, the Relative Strength Index (RSI) recorded a decline, continuing the downward trend. Additionally, analysts suggest that BTC’s price could first drop to the $61,000 support level in the near term.

Türkçe

Türkçe Español

Español