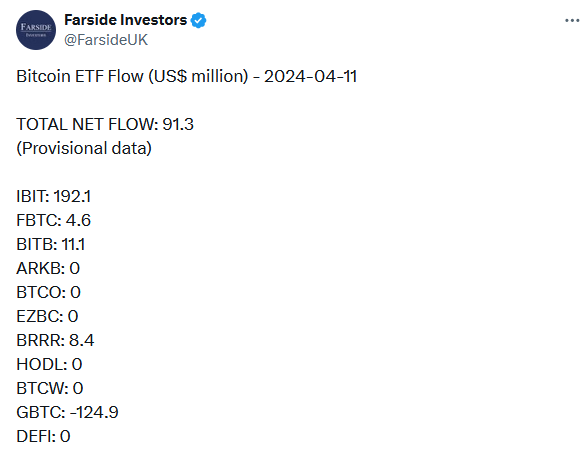

According to recent data, a significant period is unfolding in the crypto currency world. BlackRock’s iShares Bitcoin Trust (IBIT) has recorded an impressive entry of $192 million, drawing attention. Bitwise’s Bitcoin ETF follows with an entry of $11.1 million, while Fidelity Wise Origin Bitcoin Fund (FBTC) secured the third spot with an entry of $4.6 million.

Bitcoin ETFs Surge, Grayscale’s Outflows Continue

On Thursday, Bitcoin ETFs showed a strong momentum with a total entry of $91.3 million. However, the market value of the largest cryptocurrency is currently trading just above the $71,000 level.

Although Wednesday offered a glimmer of hope to the bulls, Grayscale‘s outflows continue. On Thursday, Grayscale sold off about $125 million worth of Bitcoin, a figure significantly higher than the previous day’s $17.5 million outflow. However, compared to the $303 million lost by Grayscale’s GBTC on Monday, the latest figure is relatively small.

Crypto Community Awaits with Hope

The crypto currency community is hopeful for an end to Grayscale’s series of exits. According to Grayscale CEO Mike Sonnenshein’s predictions, the company’s flagship fund, GBTC, is in the process of reaching a balance. Sonnenshein attributed most of the sales to bankruptcy proceedings.

While Bitcoin ETFs may not be the driving force behind Bitcoin’s price movements, many believe that Grayscale’s exits are fueling a bearish sentiment. Moreover, as algorithmic trading protocols tend to react to daily ETF flows, this could influence Bitcoin’s price performance.

Excitement for Bitcoin ETFs in the Crypto Market

This activity in the crypto currency market continues to be closely monitored by investors and observers. Developments regarding Grayscale’s exits and ETFs’ performance in the coming days will play a significant role in determining the direction of the crypto currency market.

If the exits cease, there is a possibility of a rally in Bitcoin’s price. Discussions even suggest that six-figure price levels could be on the horizon. However, one reality remains: Bitcoin ETFs have brought vitality to the crypto currency market. If this vitality continues, altcoins will also be significantly affected by the rise in Bitcoin’s price.

Türkçe

Türkçe Español

Español