In the United States, spot Bitcoin ETFs have continued to see strong inflows recently as the price of Bitcoin (BTC) surpassed $71,000. On Wednesday, total Bitcoin ETF inflows were close to $500 million, with Fidelity’s FBTC once again dominating the market.

Bitcoin ETFs

While BlackRock has always dominated the inflows into spot Bitcoin ETFs, Fidelity’s FBTC has recently taken the lead. On Wednesday, June 5, Fidelity’s Bitcoin ETF FBTC witnessed an inflow of $220 million, bringing the two-day total to nearly $600 million. Consequently, the total assets under management (AUM) for FBTC exceeded $9.5 billion.

When considering the assets under management for spot Bitcoin ETFs, Fidelity remains BlackRock’s closest competitor. Despite recent inflows, BlackRock’s IBIT is still twice the size of Fidelity’s FBTC. On June 5, Bitcoin spot ETFs experienced a significant net inflow of $488 million, marking the 17th consecutive day of positive inflows. The previous day’s figure was $887 million.

Expert Commentary on ETFs

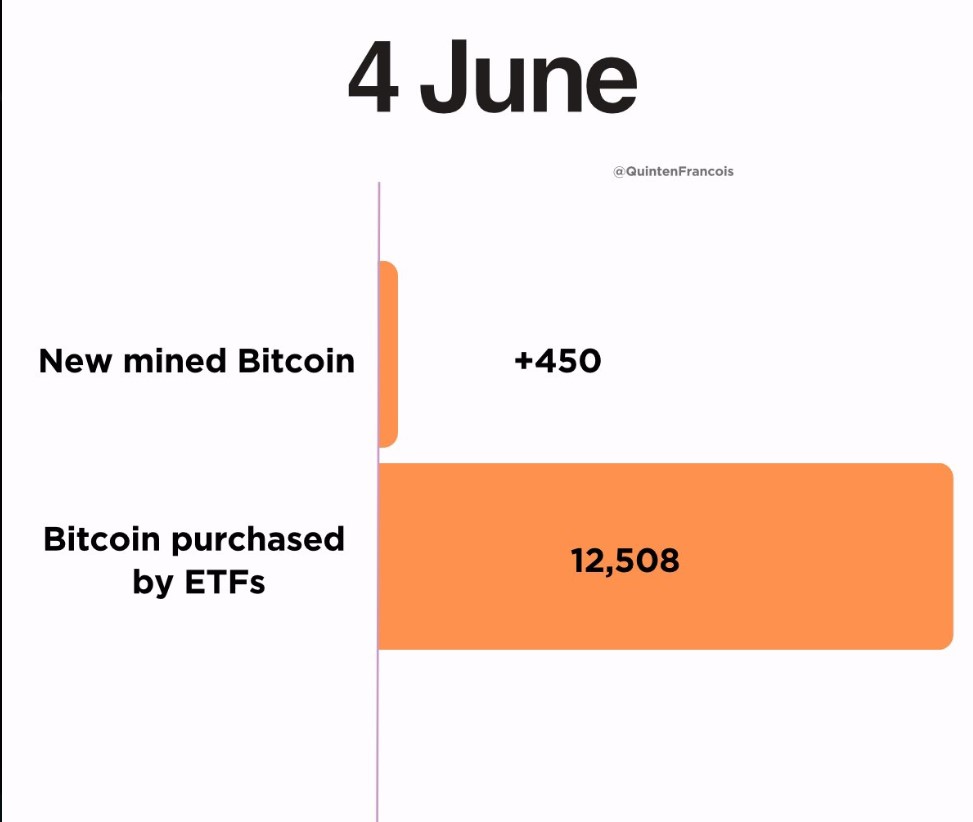

On Wednesday, Grayscale’s ETF GBTC reported a single-day inflow of $14.58 million. Fidelity’s ETF FBTC attracted $221 million, and BlackRock’s ETF IBIT drew $155 million. The total net inflow into Bitcoin spot ETFs has now impressively reached $15.338 billion. The total BTC purchase by spot Bitcoin ETFs was 27 times the daily mined Bitcoins. Franklin Templeton’s CEO commented on the increasing adoption of Bitcoin ETFs:

This is truly the first wave of early adopters. The next wave will be much larger institutions.

CEO Jenny Johnson emphasized that the current bullish trend still underestimates the potential influx of larger institutional investors into the Bitcoin ETF market. Moreover, Franklin Bitcoin ETF currently has over $420 million in AUM, making it relatively small compared to other major players.

Türkçe

Türkçe Español

Español