The expectation of increased ETF approvals from November onwards was the primary reason for the impressive rise in Bitcoin prices. While everyone expected further increases and higher peaks, Bitcoin did not disappoint. Of course, there were intermediate corrections, but the direction was consistently upward. As a result, demand in futures saw all-time high levels. So, what comes next?

Spot Bitcoin ETF and Expectations

Firstly, a significant portion of the current billion-dollar net inflows comes from clients of asset management firms issuing ETFs. Despite this, except for GBTC, the total reserves of ETF issuers quickly reached an all-time high level. However, this is just a preview. Clients of trillion-dollar asset managers represent a significant percentage in traditional financial markets, but a much larger slice is still outside.

It has not even been 1.5 months since the launch day, and permissions for banks to store BTC for their clients are yet to come. A finance group representing Wall Street’s biggest firms requested the SEC, four days ago, to consider changes to the accounting of crypto asset custody obligations in Staff Accounting Bulletin 121 (SAB 121).

This revision will allow banks to act as custodians for BTC funds. At the same time, we know that major investment advisory firms have not yet categorized spot Bitcoin ETFs. After observing the 3-6 month price performances, companies and independent advisors around the world will decide whether to classify them as investable, high-risk, or not suitable for investment.

Afterward, the real show is expected to begin with the opening of access to spot Bitcoin ETFs from the US and around the world, leading to larger volumes. Remember, some of the biggest names like Vanguard have not yet given the green light to Bitcoin ETFs.

Current Status of Spot Bitcoin ETFs

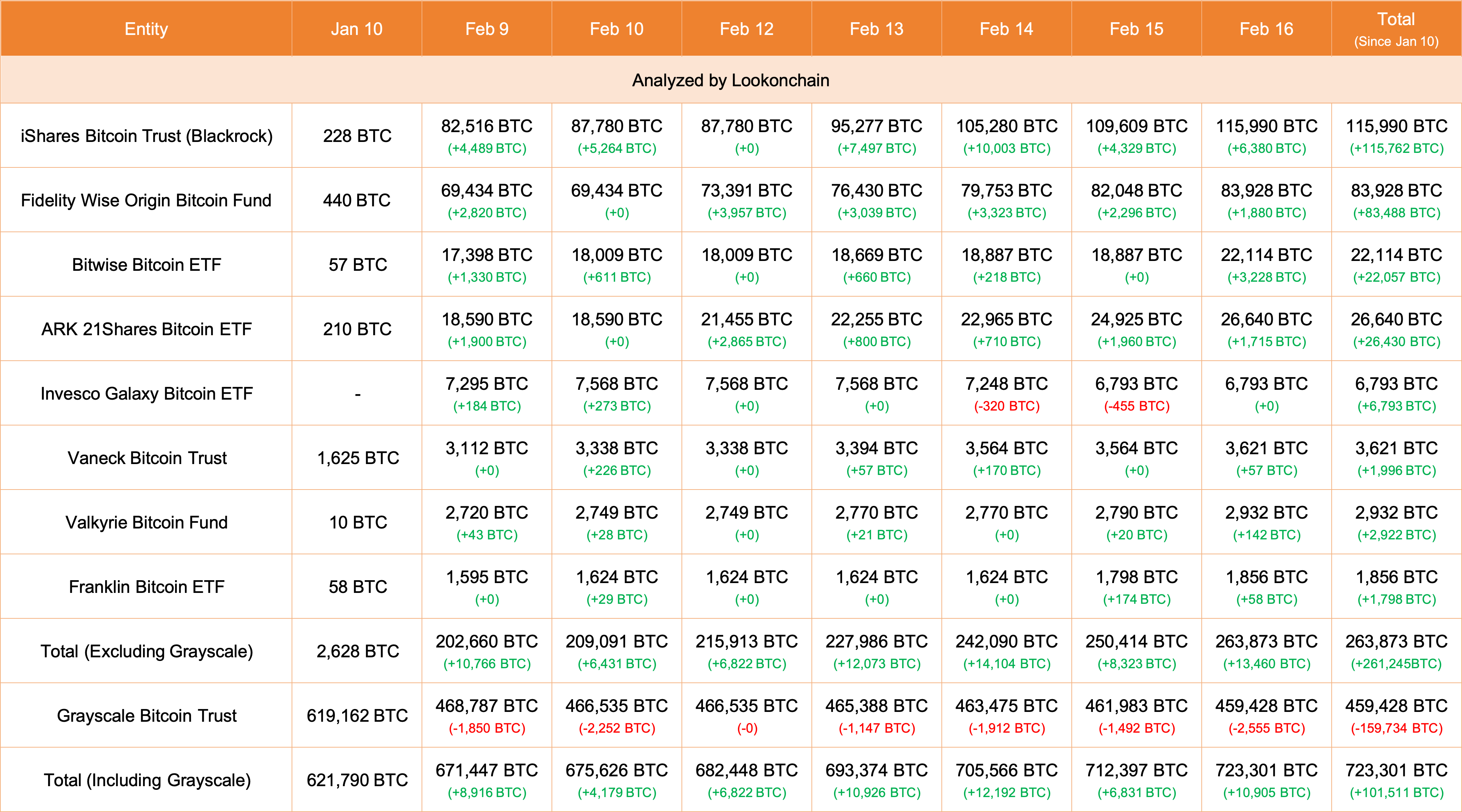

Net inflows continue, exceeding the threshold of 2 billion dollars weekly. BlackRock’s reserves alone increased by 6380 BTC last Friday. Cumulative demand varies between 10-20 times the total daily BTC issuance. Approximately 70 days later, when the halving occurs, this could turn into a demand 20-40 times higher solely due to ETFs, provided the current pace of net inflows continues.

All ETFs hold 723,301 BTC. While this may seem small, it’s important to remember that miners only have 1.92 million BTC in total. Moreover, 263,873 BTC of this was collected by issuers of spot Bitcoin ETFs, excluding GBTC, in just one month.