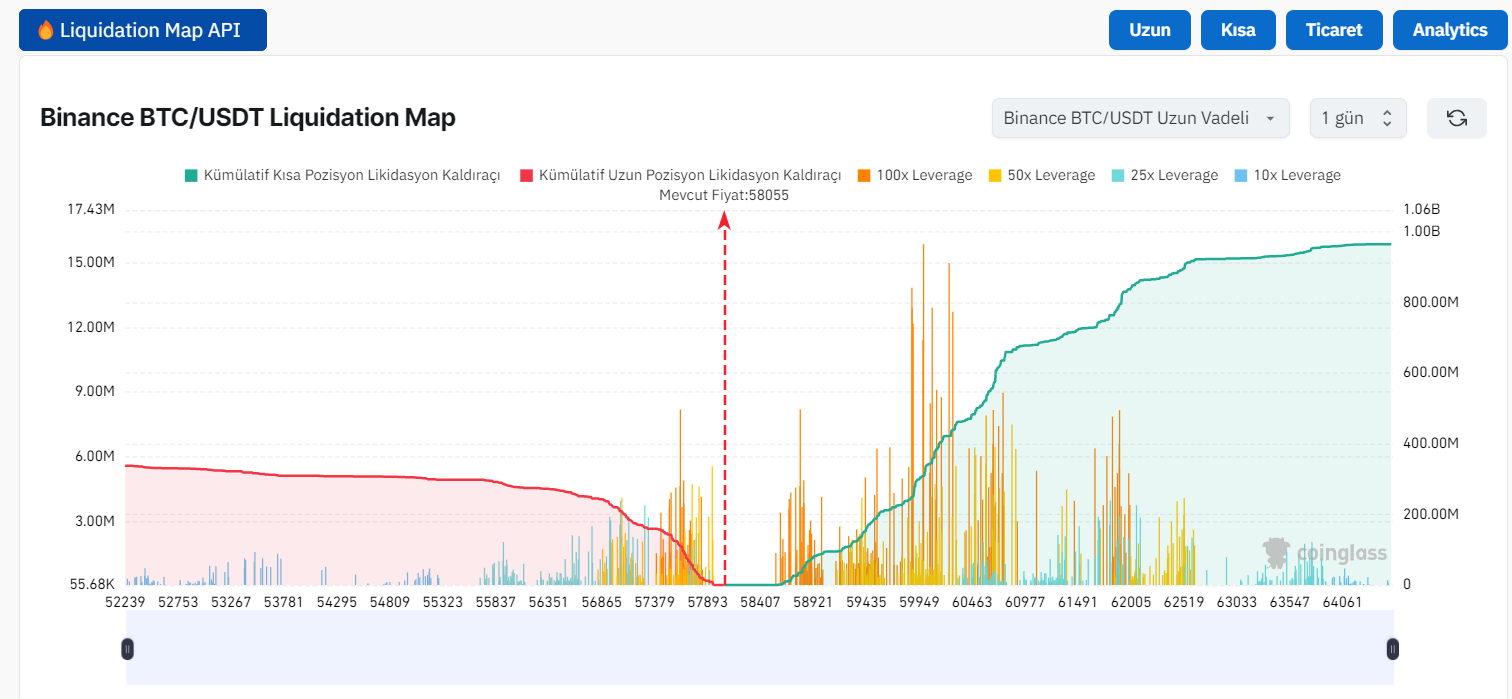

Cryptocurrency markets remain turbulent. Bitcoin, if it falls below $57,000, faces a major liquidation wave. Coinglass data indicates that below this level, the long position liquidation power on leading centralized exchanges (CEX) will reach $607 million. On the other hand, if Bitcoin rises above $59,000, the short position liquidation power will reach $217 million.

Bitcoin’s Turning Point: Liquidation Risk

Bitcoin’s price movements are always closely watched. However, the $57,000 level makes investors even more vigilant. This level poses a significant risk, especially for long positions held on centralized exchanges. If the price falls below this critical threshold, a $607 million liquidation wave awaits investors. This implies that the market could experience a significant shock.

While alarm bells ring for long positions, the situation is somewhat different for short positions. If Bitcoin surpasses the $59,000 level, the short positions will face a $217 million liquidation power. In other words, an upward price movement could severely challenge short positions and initiate a new search for balance in the market.

What Does the Liquidation Chart Indicate?

Liquidation charts are often among the most intriguing data for investors. However, these charts do not clearly show the exact number or value of contracts to be liquidated. The important aspect here is to show how significant each liquidation cluster is compared to adjacent clusters, i.e., its strength.

Liquidation charts help predict how the price will react when it reaches a certain point. A high “liquidation column” indicates that the price will react more strongly to a liquidity wave when it reaches this point. This means that price movements could be more intense. Therefore, investors should be more cautious about price movements at these critical levels and adjust their strategies accordingly.

This is the cryptocurrency market. Everything can change at any moment. Therefore, it is crucial for investors to closely monitor these critical levels and their potential outcomes to adjust their losses or gains accordingly.

Türkçe

Türkçe Español

Español