Bitcoin (BTC) price reached over $67,000 in late November 2021, its all-time high, but has since been influenced by bears. In fact, this is the longest bear market in Bitcoin history, lasting for more than 490 days. While there are many reasons that have contributed to this bear market, it is important to note that it may not end anytime soon. A trigger may be needed for BTC to exit the bear market and achieve significant growth.

Expert Opinion on BTC!

There are expansion, major correction, accumulation, and renewed expansion periods in Bitcoin cycles. However, each cycle is not of the same length. Michaël van de Poppe, the founder and CEO of MN Trading, highlighted this in his recent tweet. The current bear market can be compared to the one seen in 2015 in some aspects. The consolidation phase usually reduces interest in assets, which was evident when looking at Bitcoin’s on-chain data.

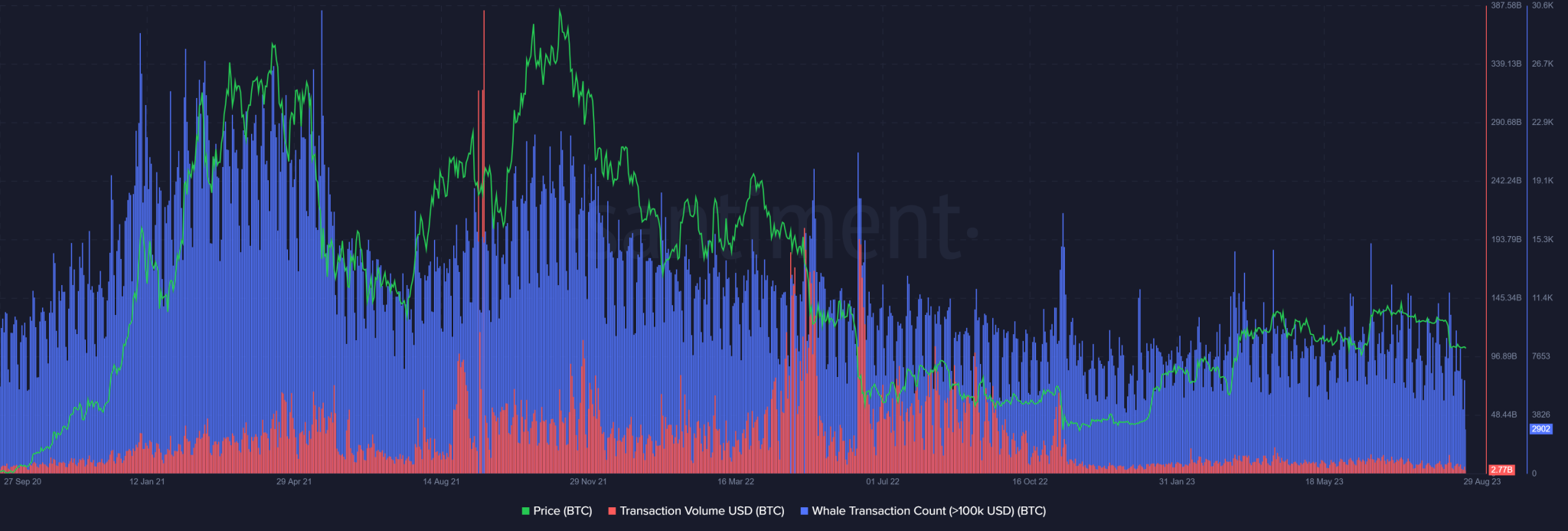

During the bear market, the number of whale transactions and BTC trading volume decreased. However, the adoption of Bitcoin increased while the price remained low. For example, BlackRock recently became the second-largest shareholder of the top four Bitcoin mining companies. Not only that, as previously reported, MicroStrategies announced the purchase of 467 additional Bitcoins, increasing the company’s assets under management to 152,800 units. While the BTC price trend remains bearish, the supply on exchanges decreased, and the supply outside of exchanges increased. Additionally, the total number of BTC holders consistently increased as a reflection of growing accumulation.

Increase in Institutional Interest in BTC!

This indicates that BTC is being adopted not only by institutional investors but also by individual investors. However, without considering marginal price movements, investors may have to wait longer for BTC to reach new highs. The halving event in 2024 could potentially be a trigger for Bitcoin.

During the last halving in May 2020, it took several months for the cryptocurrency to initiate a bull rally. Therefore, if history is to be believed, the next bull rally for BTC may not be imminent. However, in the short term, an increase in BTC price could be observed due to several market indicators showing bullish signs. For instance, both Bitcoin’s Relative Strength Index (RSI) and Money Flow Index (MFI) were in oversold territories, which could increase buying pressure. Additionally, the MACD showed a bullish trend probability, indicating a potential upward price movement in the coming days. As of the time of writing, BTC was trading at $25,957.73 with a market capitalization of over $505 billion.

Türkçe

Türkçe Español

Español