The world’s largest cryptocurrency, Bitcoin (BTC), has been facing significant selling pressure since June 7. Previously finding support at $71,000, BTC’s price has dropped to $68,500. At the time of writing, Bitcoin is trading at $69,404 with a market value of $1.37 trillion.

Notable Increase in Bitcoin Hedge Fund Net Shorts

Analyst Zerohedge reported a dramatic increase in Bitcoin hedge fund net shorts, reaching a new record level. This increase indicates extreme bearish expectations among hedge funds and suggests potential market volatility if these positions are forced to unwind. The analyst compared this situation to historical short squeezes like Volkswagen and GameStop (GME), suggesting a similar dramatic shift could occur in the Bitcoin market.

The cryptocurrency market, including Bitcoin, has been affected by the end of the meme stock rally. On June 7, GameStop shares fell by 41% after Roaring Kitty appeared live, contributing to the overall market decline.

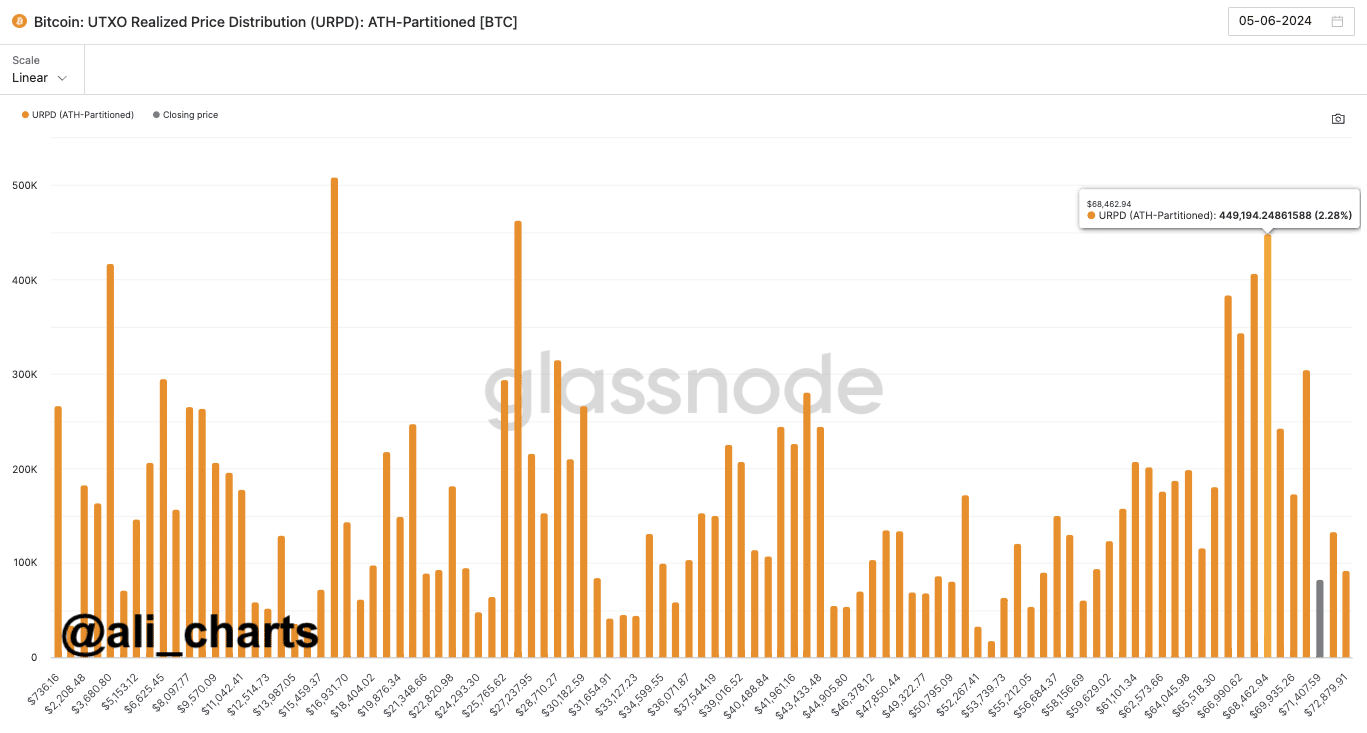

$68,500 Level is Critical

Meanwhile, crypto analyst Ali Martinez reported that $68,500 is a crucial support level for Bitcoin. Martinez emphasized that maintaining this support level is essential for Bitcoin’s upward movement to continue. According to him, if Bitcoin can stay above this level, it may potentially recover and see further gains.

Historical trends show that prolonged bullish phases often lead to significant downward corrections. Analyst Alan Santana predicted that a downward wave following a long bullish phase could occur much faster than the previous rally.

Santana warned that the market’s bullish trend might be losing strength, potentially exhausted, and in such cases, investors tend to exit quickly, resulting in rapid selling and sharp price drops.

Türkçe

Türkçe Español

Español