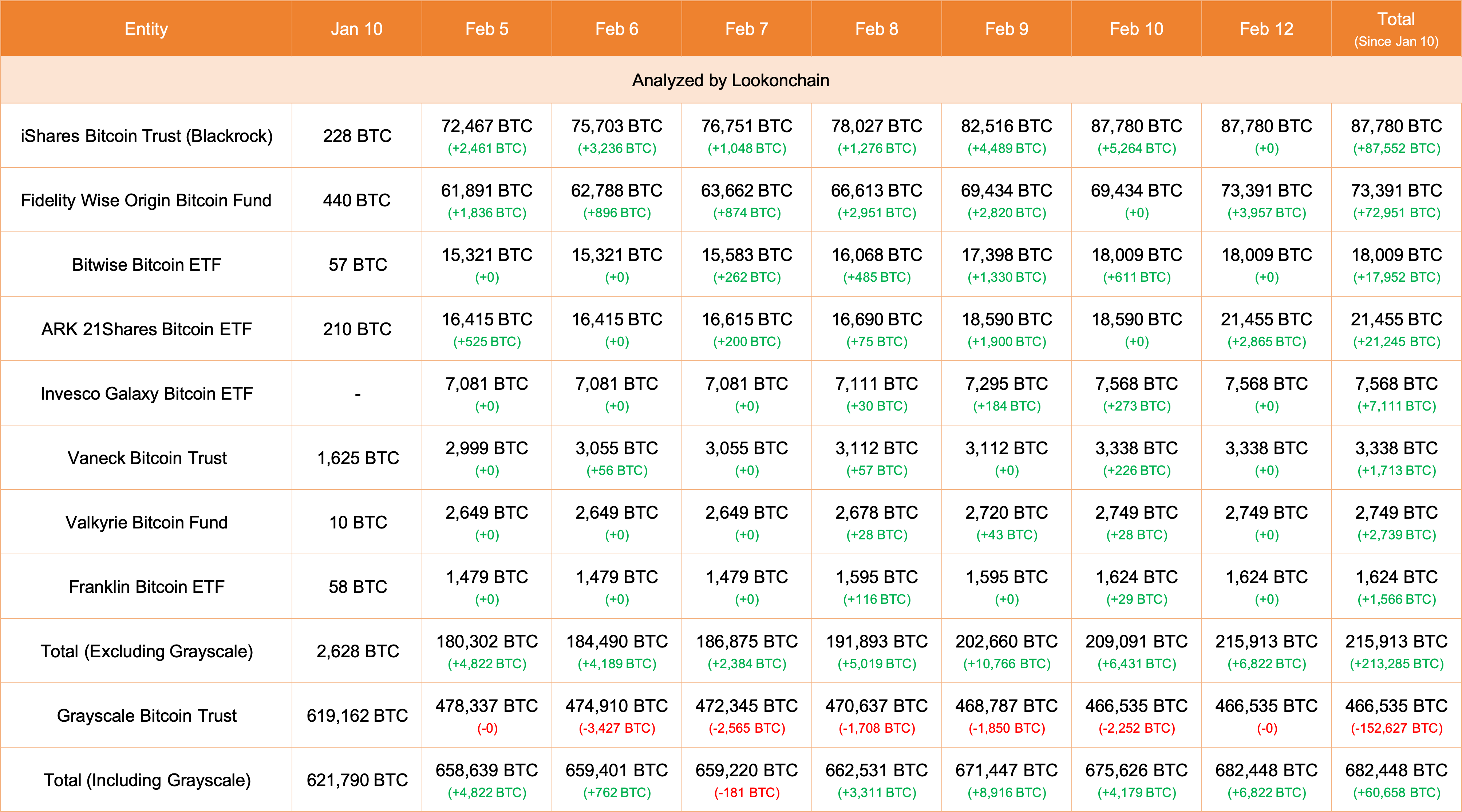

Today, we witnessed significant developments in spot Bitcoin ETFs, underscoring the increasing acceptance of cryptocurrencies in the traditional finance space. Fidelity made a bold move by purchasing 3,957 Bitcoins, while ARK 21Shares drew attention with an addition of 2,865 BTC. These maneuvers indicate the evolving legitimacy of Bitcoin as a valid asset class among institutional investors.

Shift in Institutional Investment Paradigm towards Bitcoin

Fidelity and ARK 21Shares’ accumulation of over 6,800 Bitcoins reflects a broader trend of institutional investors embracing cryptocurrencies as integral components of their investment strategies.

With the continuous evolution of the financial landscape, established institutions are diversifying their portfolios to include digital assets like Bitcoin, recognizing their potential as a hedge against traditional market volatility.

Implications of High Inflows into Spot Bitcoin ETFs

High inflows into spot Bitcoin ETFs indicate growing investor interest within the traditional financial system and an increased demand for Bitcoin. This demonstrates Bitcoin’s growing acceptance as a legitimate asset class among institutional investors and potentially signals wider adoption of cryptocurrencies in mainstream finance.

Additionally, high inflows into spot Bitcoin ETFs could contribute to increased liquidity in the Bitcoin market and create upward pressure on Bitcoin prices, reflecting a bullish trend among investors. Overall, high inflows into spot Bitcoin ETFs point to a positive outlook for Bitcoin’s role in the investment landscape and could attract more institutional participation in the cryptocurrency market.

As this article is being written, Bitcoin is making a significant push towards the $50,000 level, currently sitting at $49,560.

Türkçe

Türkçe Español

Español