Bitcoin is experiencing another day filled with record-breaking moments. The price of Bitcoin has shattered its previous record by reaching $73,650. Amidst this price surge, a new influx of investors has begun to enter the Bitcoin network. This situation serves as an answer to the question of what Bitcoin is. In my opinion, the answer to what Bitcoin is goes beyond technical definitions and is also reflected in its price.

Both Bitcoin Price and Wallet Numbers Increase

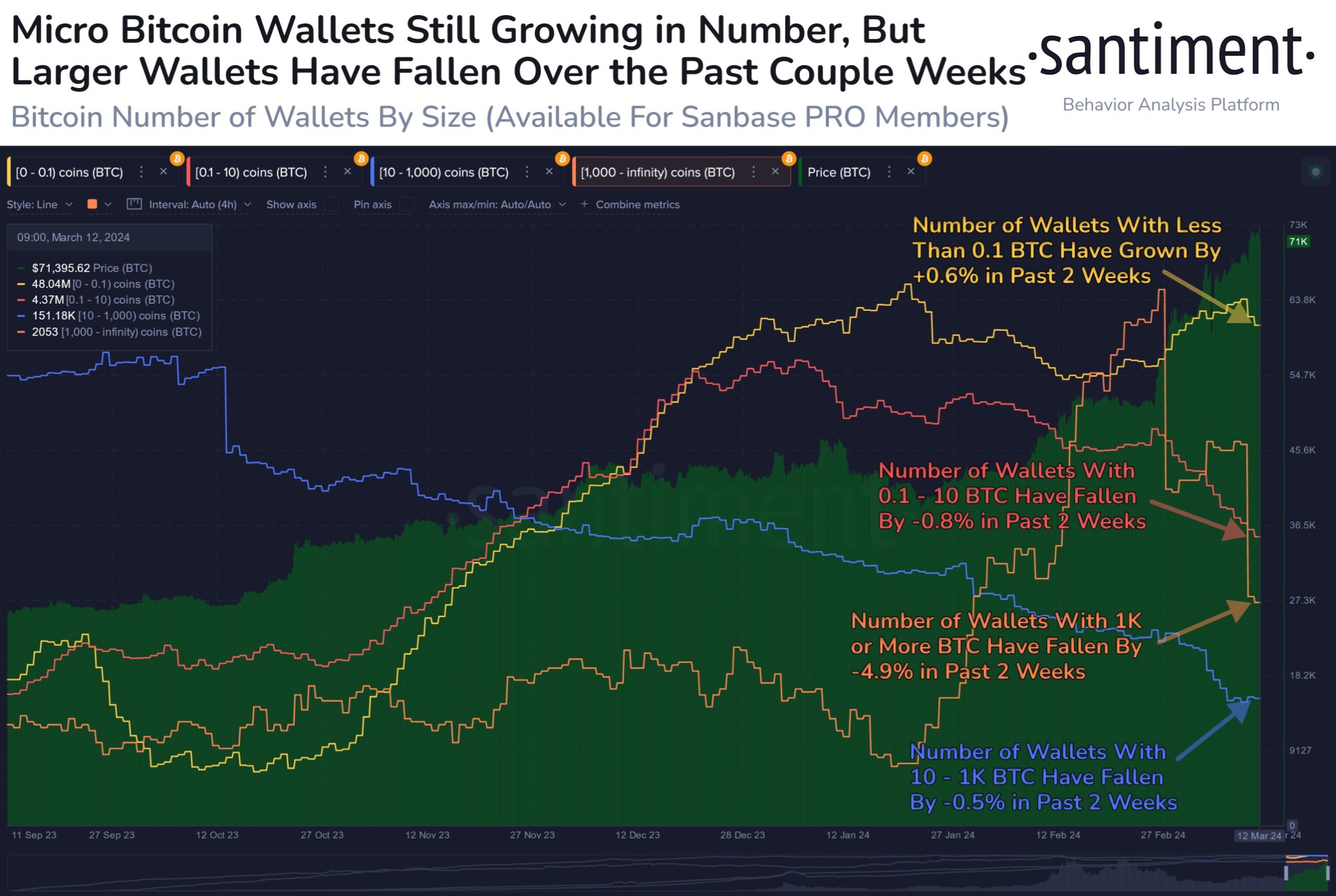

Today’s rally in Bitcoin has propelled the flagship cryptocurrency to a new all-time high (ATH) of $73,650, reinforcing the belief that the market is in an active price discovery phase. According to new data released by the crypto analysis platform Santiment, a notable trend during this rally is the increase in individual investors holding Bitcoin.

Santiment’s data indicates that over the past two weeks, the number of small wallets containing less than 0.1 BTC has continued to increase. Consequently, more than 277,000 new wallets have been added to the existing count. During the same period, the number of wallets holding at least 1,000 BTC decreased by 105, marking a 4.9% decline over the last two weeks.

Increase in Trading Volume and Greed

Considering that the Bitcoin market is currently exhibiting signs of extreme greed, encountering investors with a fear of missing out (FOMO) is not uncommon. The surge in individual investors has also contributed to an increase in Bitcoin’s trading volume, which has now risen by more than 10% to reach $63,131,961,279.

On the other hand, the number of wallets holding between 0.1 BTC and 10 BTC has decreased by 0.8% over the last 14 days. Santiment’s data pegs the total number of addresses holding between zero and 0.1 BTC, along with those holding more than 1,000 BTC, at 48.04 million.

More Individual Investors Could Enter the Market

Due to Bitcoin’s active price exploration, there’s a likelihood of more individual investors joining the market in the long term. As the price of Bitcoin reaches new peaks, owning an entire Bitcoin could become prohibitively expensive, making it sensible to purchase a fraction of Bitcoin for those wanting to hold it in their portfolios.

The emergence of spot Bitcoin ETFs has made it easier by providing an environment where investors can easily and under regulatory oversight acquire shares. Overall, the Bitcoin price could be the final trigger to encourage more general investment.

Türkçe

Türkçe Español

Español