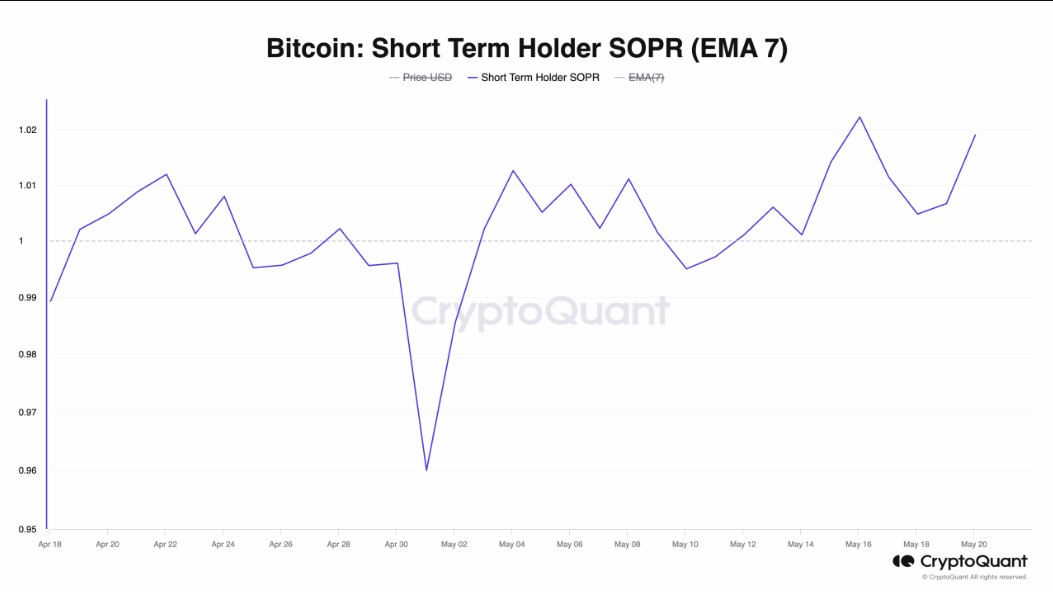

Bitcoin’s (BTC) short-term holders (STH) saw their Spent Output Profit Ratio (SOPR) rise above 1, signaling that this group of investors is now holding their cryptocurrencies at a profit. In a new report, CryptoQuant analyst Phi Deltalytics noted that the increase in this metric’s value above 1 indicates a bullish trend for the token in the market.

Critical Data on BTC

BTC’s STH-SOPR measures whether investors who have held the token for three to six months are selling at a profit or loss. When it returns a value above 1, it shows that short-term holders are selling their tokens at a profit on average. Conversely, if the STH-SOPR is below 1, it indicates that holders are selling at a loss.

CryptoQuant’s data indicates that BTC’s STH-SOPR was 1.019 at the time of writing. Deltalytics noted that this metric cratered to the 1 level before stabilizing but did not fall below this level. This situation led many investors to hold onto their cryptocurrencies rather than sell them.

Analyst’s Bitcoin Commentary

This situation could be a positive sign for the market and signal low selling pressure. The crypto analyst added that BTC’s STH-SOPR needs to stay above 1. If this scenario occurs, the market could reduce sellers’ profit-taking without significant price drops. Deltalytics foresaw that this could help sustain BTC’s current price increase:

This dynamic has the potential to push Bitcoin’s price higher due to the market not overheating.

The leading cryptocurrency Bitcoin benefited from the market’s rise in the last 24 hours. At the time of writing, BTC was trading at $71,212, and its price had increased by 6% during this period. This period was marked by a significant increase in BTC’s derivative market trading activities. According to Coinglass data, BTC’s derivative volume increased by 112% in the last 24 hours. At the time of writing, BTC’s open futures positions reached $35 billion, the highest level since March.