Despite the recent price correction, Bitcoin (BTC) continues its bull run according to various on-chain metrics. Earlier this month, Bitcoin approached an all-time high of $74,000 but faced strong selling pressure, leading to a 10% drop from its peak in June. On June 14, BTC’s price fell another 1.26%, dropping below $66,000.

Metrics Indicating Continued Bull Market in Bitcoin

Bitcoin performed poorly in the second quarter of 2024 with a 5% drop amid significant selling pressure. This decline followed the capitulation of Bitcoin miners triggered by the block reward halving in April 2024. Despite the recent price consolidation leading some investors to believe the bull run might be over, on-chain metrics suggest otherwise.

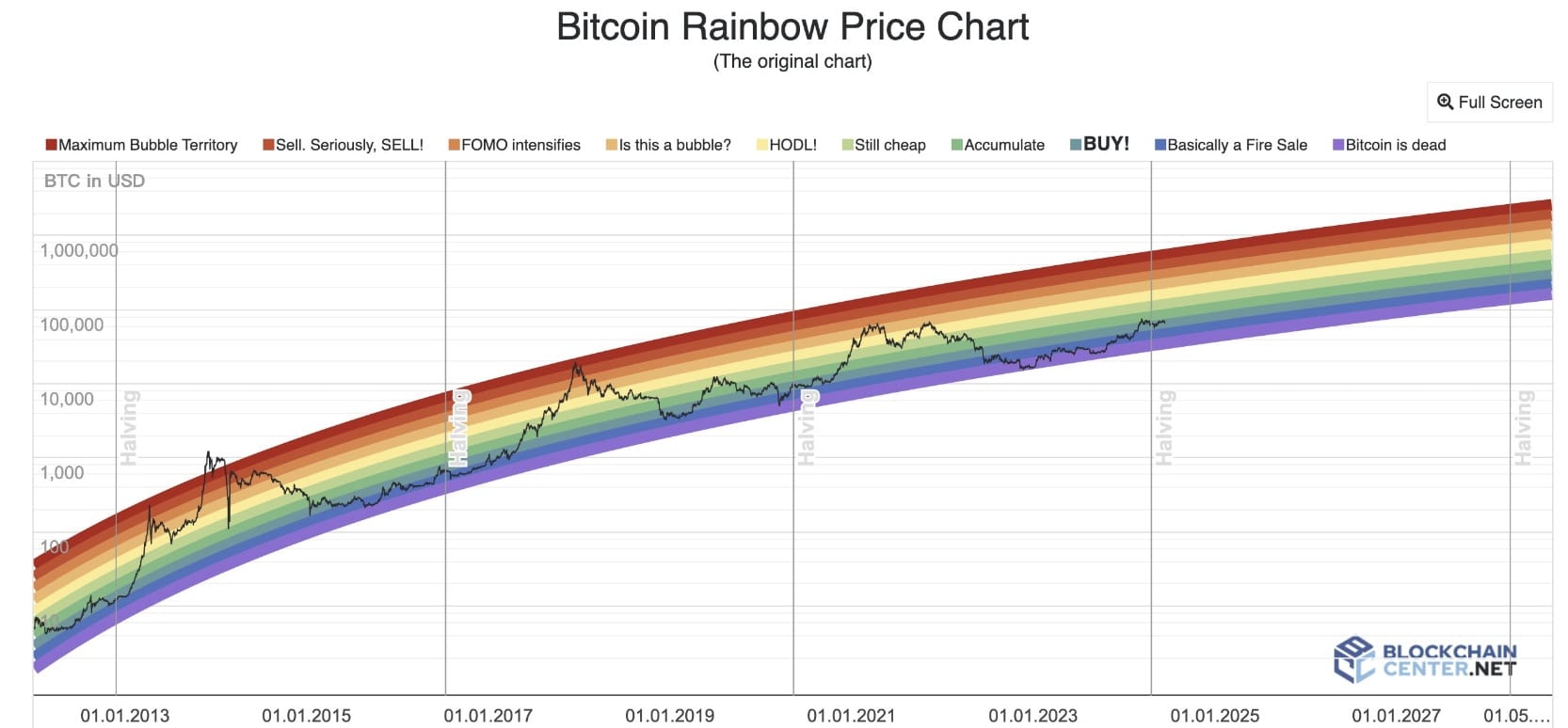

Firstly, the Bitcoin Price Rainbow Chart, a long-term valuation tool using a logarithmic growth curve, indicates that it is still a good time to buy BTC. This chart helps predict Bitcoin’s potential price direction and shows that the current value remains a valuable investment.

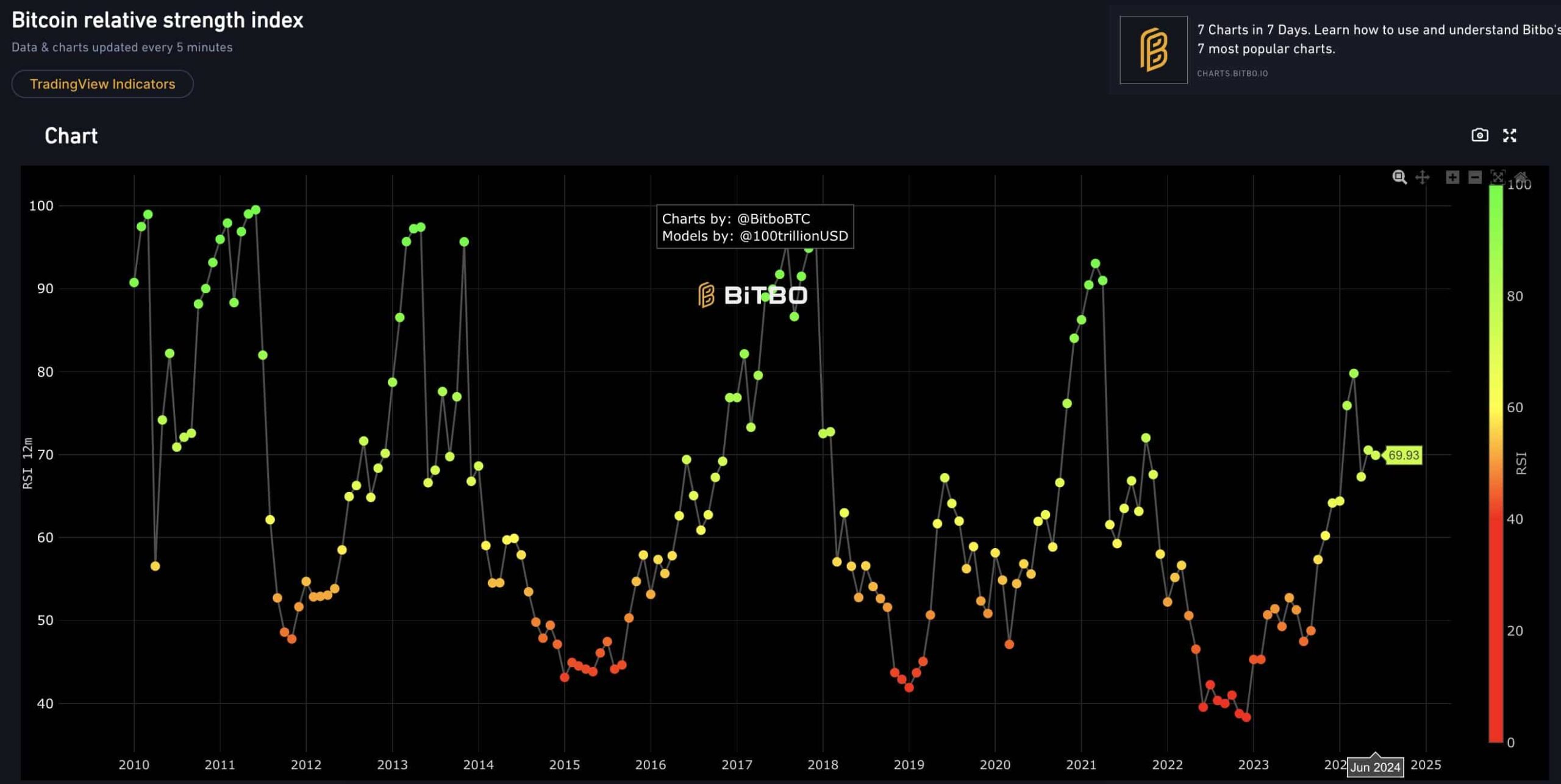

Secondly, the Relative Strength Index (RSI) for Bitcoin is currently at 69.9. An RSI value above 70 indicates an overvalued asset, while below 30 indicates undervaluation. The current RSI suggests that Bitcoin’s price has not yet peaked and has more potential to rise.

Thirdly, the 200-Week Moving Average heatmap shows that Bitcoin’s current price point is still in the blue zone. This indicates that the price has not yet peaked, making it a good time to hold and potentially buy more BTC.

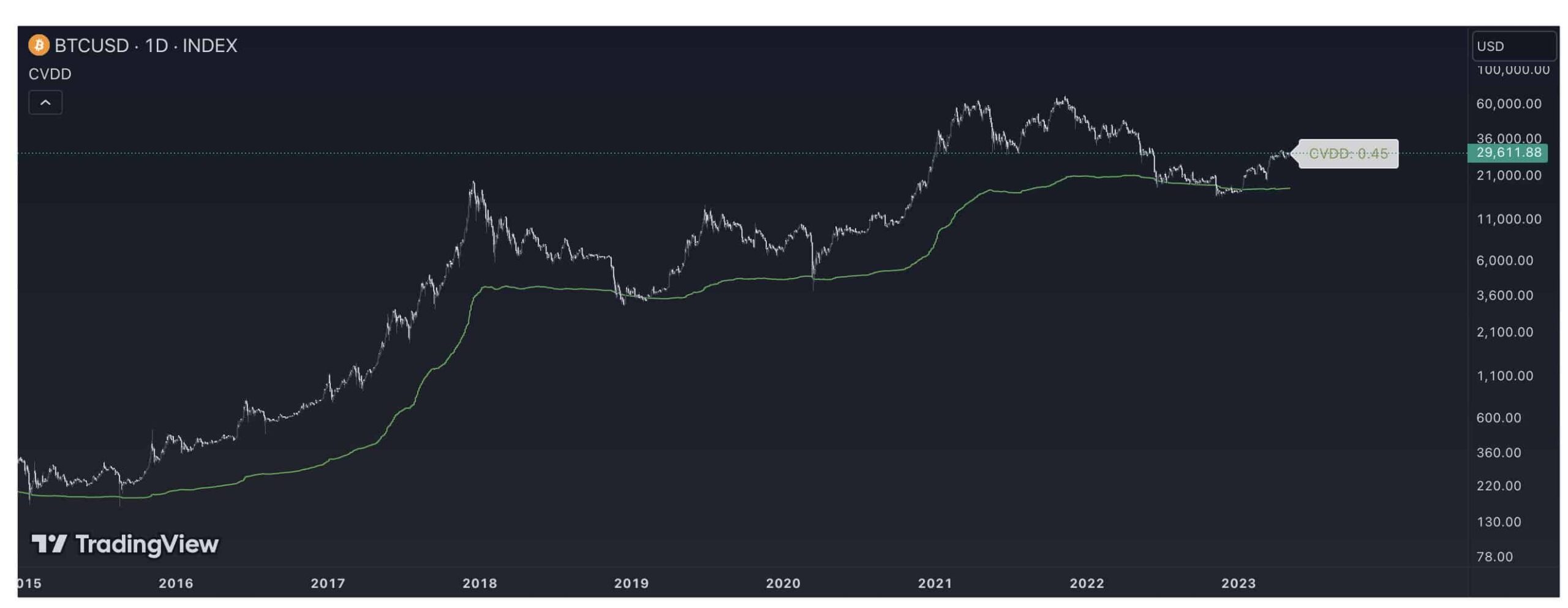

Fourthly, the Cumulative Value Days Destroyed (CVDD) indicator shows that when Bitcoin’s price reaches the green line, it represents an undervalued asset and a good buying opportunity. The current CVDD value indicates that BTC has not yet peaked.

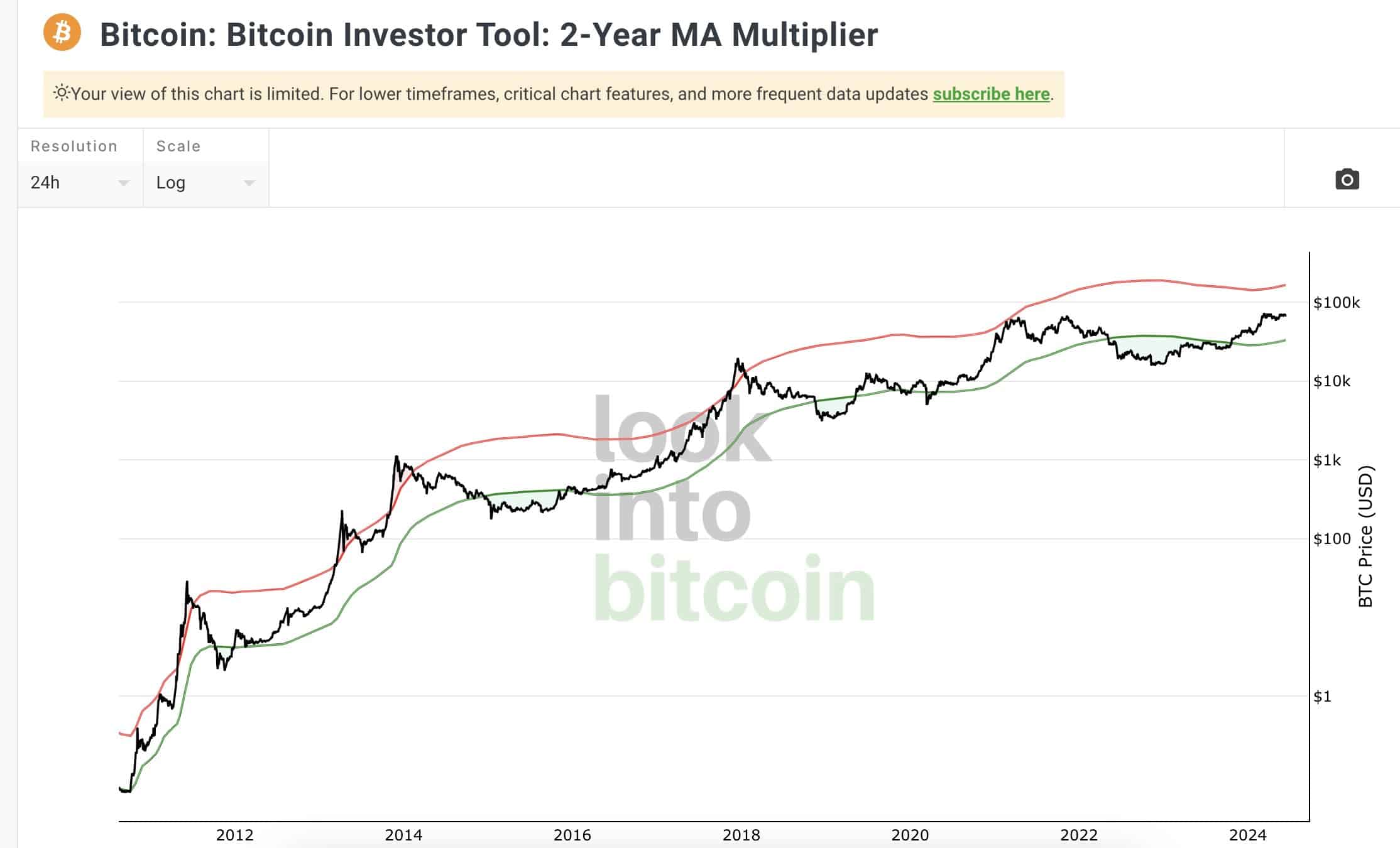

Lastly, the Bitcoin 2-Year Multiplier indicator shows that BTC is trading between the red and green lines. Until the price touches the red line, there is no confirmation that Bitcoin has peaked, indicating more room for growth.

Bitcoin Whales Sold 50,000 BTC

In the past 10 days, Bitcoin whales sold 50,000 BTC worth $3 billion. According to crypto analyst Ali Martinez, Bitcoin needs to rise above $66,254 soon, or it risks falling to $61,000.

CryptQuant CEO Ki Young Ju stated that the average entry price for Bitcoin investors is around $47,000. In a bull market, Bitcoin’s price usually stays above this level. This means that even with a 27% drop, the market is likely to continue its upward trend. Ju advised maintaining long-term optimism but warned against taking excessive risks.

Türkçe

Türkçe Español

Español