Bitcoin price remains stuck below $43,000, with attempts at recovery being thwarted by sales in the resistance zone. At the time of writing, BTC stands at $42,900, and the outlook for altcoins is negative. Following the approval of a spot Bitcoin ETF, BTC appears to have entered a new phase, with miners playing a role in setting the stage for this change.

Bitcoin Miners

Bitfinex has released a recent report indicating that miners are decreasing their Bitcoin reserves. This could be due to actual sales or the use of their holdings for increased leverage. Shortly after the spot Bitcoin ETF approval, over 1 billion dollars worth of BTC was withdrawn from miner wallets.

BTC price reached its peak during the same period. According to the Bitfinex Alpha market report, which analyzes on-chain data, miners were aggressively emptying their wallets on the second trading day of Bitcoin ETFs, January 12th. Citing data from Glassnode, the report noted that over 1 billion dollars in Bitcoin was transferred from miner-associated wallets to exchanges on that day, marking the highest outflow in six months, coinciding with the ETF approval.

Will Bitcoin Price Drop?

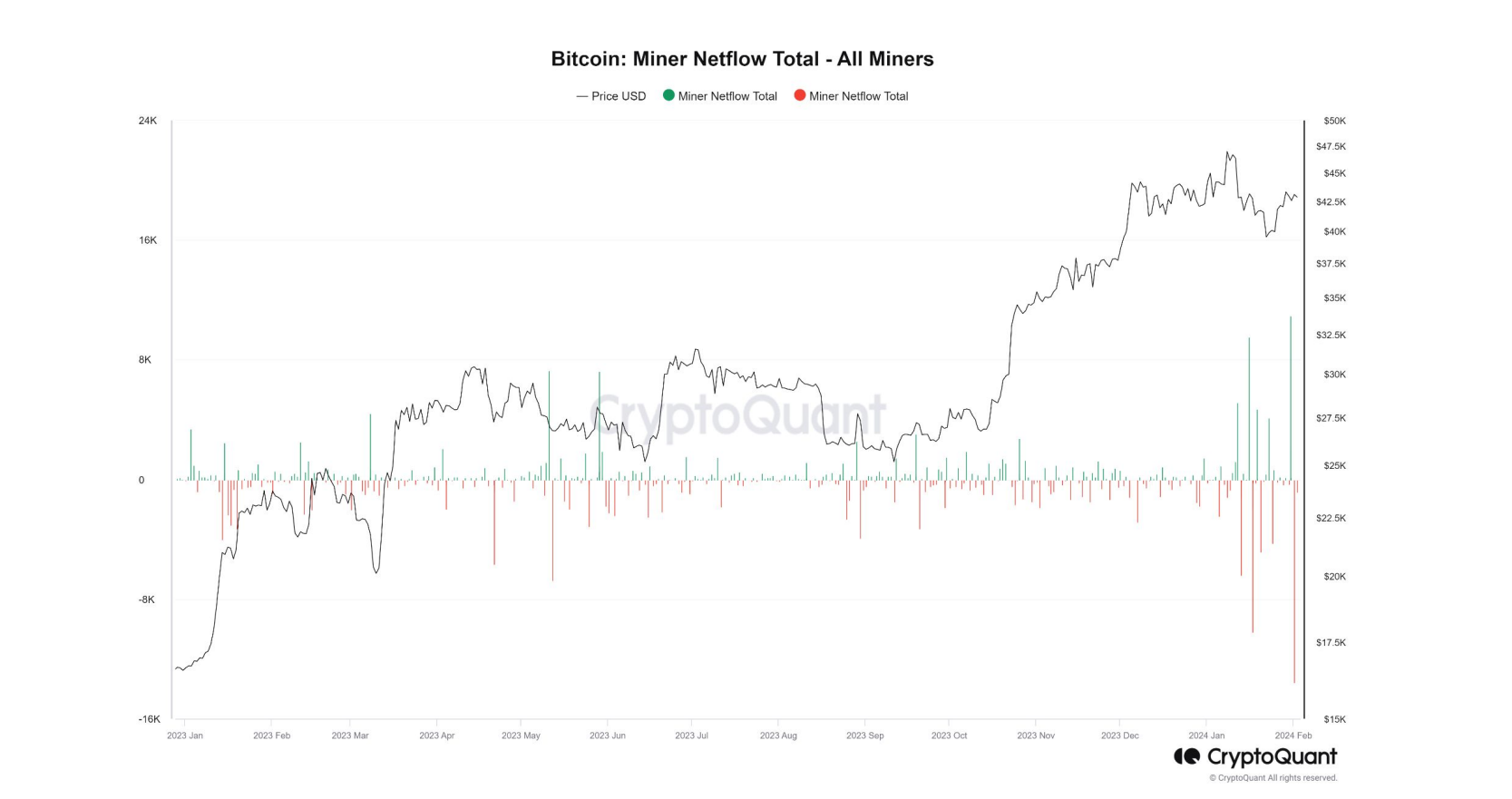

According to the report, net outflows from miner wallets have continued since the ETF approval. CryptoQuant data shows that net outflows from miners have reached approximately 10,200 BTC. Analysts believe miners have seized a good opportunity to benefit from market enthusiasm and have capitalized on it. With transaction fees increasing, the BTC price nearing $49,000 has enabled miners to sell at very attractive profit margins.

“This significant transfer of BTC from miners to exchanges reflects the miners’ response to market conditions and potentially their need to liquidate assets for operational expenses or risk management.”

There are also notable declines in the supply of BTC that has been inactive for a long time and is described as dormant. Experts directly associate these with outflows from Grayscale, as GBTC experienced billions of dollars in net sales, and reserves had to be distributed from Coinbase to other issuers.

Analysts remind that a significant majority of the Bitcoin supply continues to be tightly held and that the long-term trend remains bullish.

Türkçe

Türkçe Español

Español