Bitcoin  $103,554 miners have faced economic challenges as the “hashprice,” a key income indicator, remains stable despite an increase in mining difficulty. According to data from CoinWarz, the mining difficulty rose by approximately 1.4% on March 23, reaching 113.76 trillion. However, the hashprice, which reflects miners’ daily earnings, has remained steady at around $48 per petahash per second (PH/s). Experts indicate that a hashprice below $50 puts significant economic pressure on miners, particularly those using older equipment.

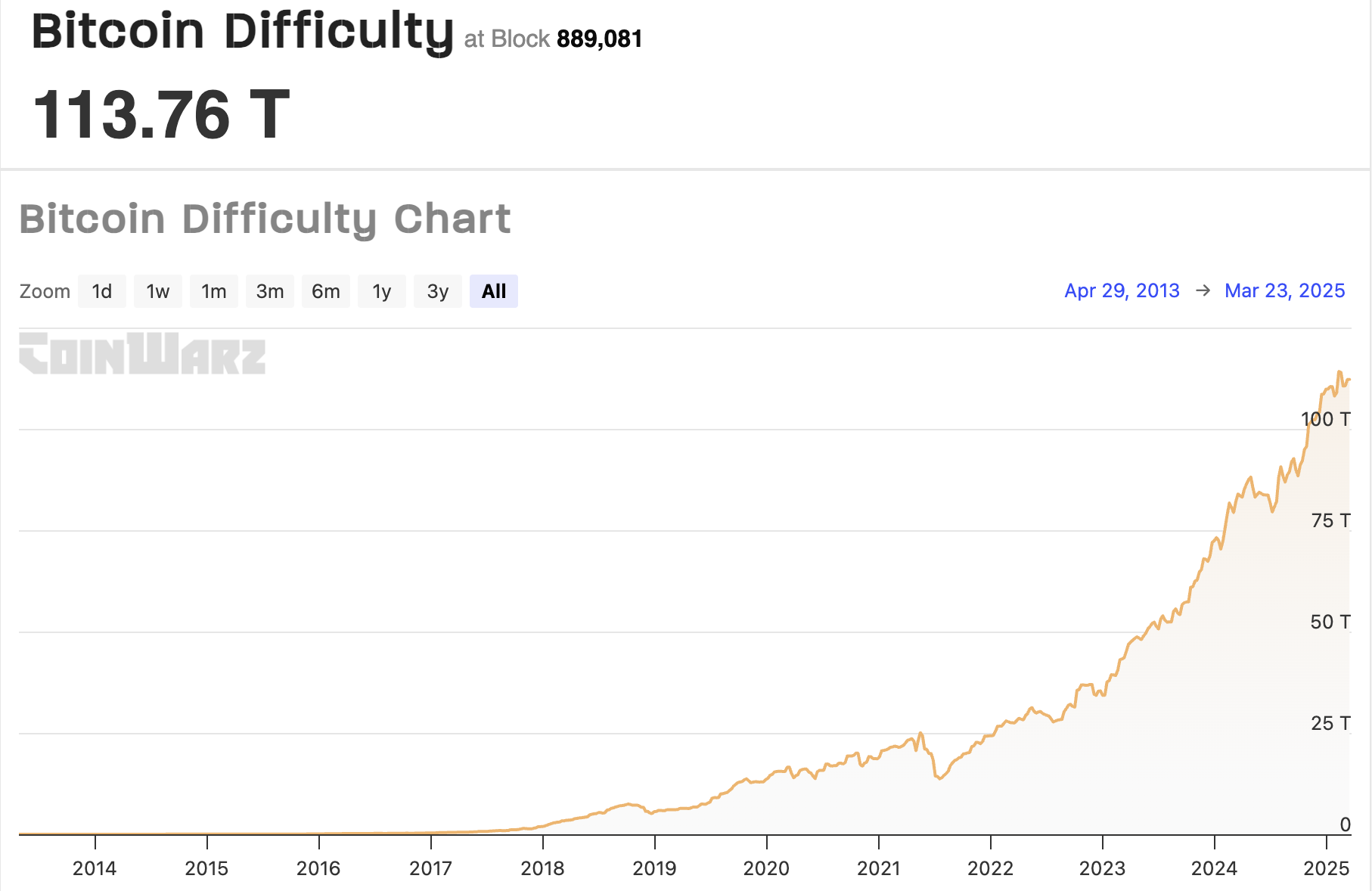

$103,554 miners have faced economic challenges as the “hashprice,” a key income indicator, remains stable despite an increase in mining difficulty. According to data from CoinWarz, the mining difficulty rose by approximately 1.4% on March 23, reaching 113.76 trillion. However, the hashprice, which reflects miners’ daily earnings, has remained steady at around $48 per petahash per second (PH/s). Experts indicate that a hashprice below $50 puts significant economic pressure on miners, particularly those using older equipment.

Older Equipment Poses Economic Risks

Cryptocurrency mining operations using older hardware like the Antminer S19 XP and S19 Pro face serious financial difficulties due to the low hashprice. The decline in network transaction fees and high energy costs have made it increasingly difficult for many miners to maintain operations. In such situations, miners are left with two options: either shut down their devices or invest in upgrading to next-generation ASIC hardware.

Following the Bitcoin halving event in April 2024, which reduced the block reward to 3.125 BTC, miners experienced a dramatic decrease in earnings. As the difficulty level of the Bitcoin network continues to rise, miners must expend more resources to remain competitive.

Mining Companies Under Financial Pressure

Publicly traded Bitcoin mining companies have faced significant economic challenges since the beginning of the year. According to a recent report from JPMorgan, these companies saw their market values drop by an average of 22% in February. In attempts to offset losses in cryptocurrency mining revenues, companies are turning to sectors like artificial intelligence and high-performance computing, yet they remain under economic stress.

A contributing factor to this pressure is the emergence of the DeepSeek R1, an open-source artificial intelligence model that provides comparable performance to proprietary products at much lower costs. The escalating trade war between the U.S. and Canada and potential new taxes on Canadian energy exports to the U.S. are also intensifying the economic strain on mining companies.

Türkçe

Türkçe Español

Español